Evaluating LISTA Crypto’s Recent Volatility: A 13% Surge Followed by a 30% Decline

- In the past day, LISTA’s valuation has plummeted by nearly a third

- Several vital technical predictors signal a likely continuation of the downtrend

The cryptocurrency of Lista DAO, LISTA, has seen an approximate 30% devaluation within the preceding day.

Yesterday, LISTA achieved a record peak price of $0.84 on June 21st following the announcement by cryptocurrency powerhouse Binance about LISTA’s integration on various platforms such as Binance Simple Earn, Buy Crypto, Convert, Margin, and Futures.

The integration sparked a 13% uplift in LISTA’s market price. However, as the current trading price hovers around $0.57, there’s been a 32% slump from the recent high, as reported by CoinMarketCap.

Intense sale activity pressures LISTA’s market price

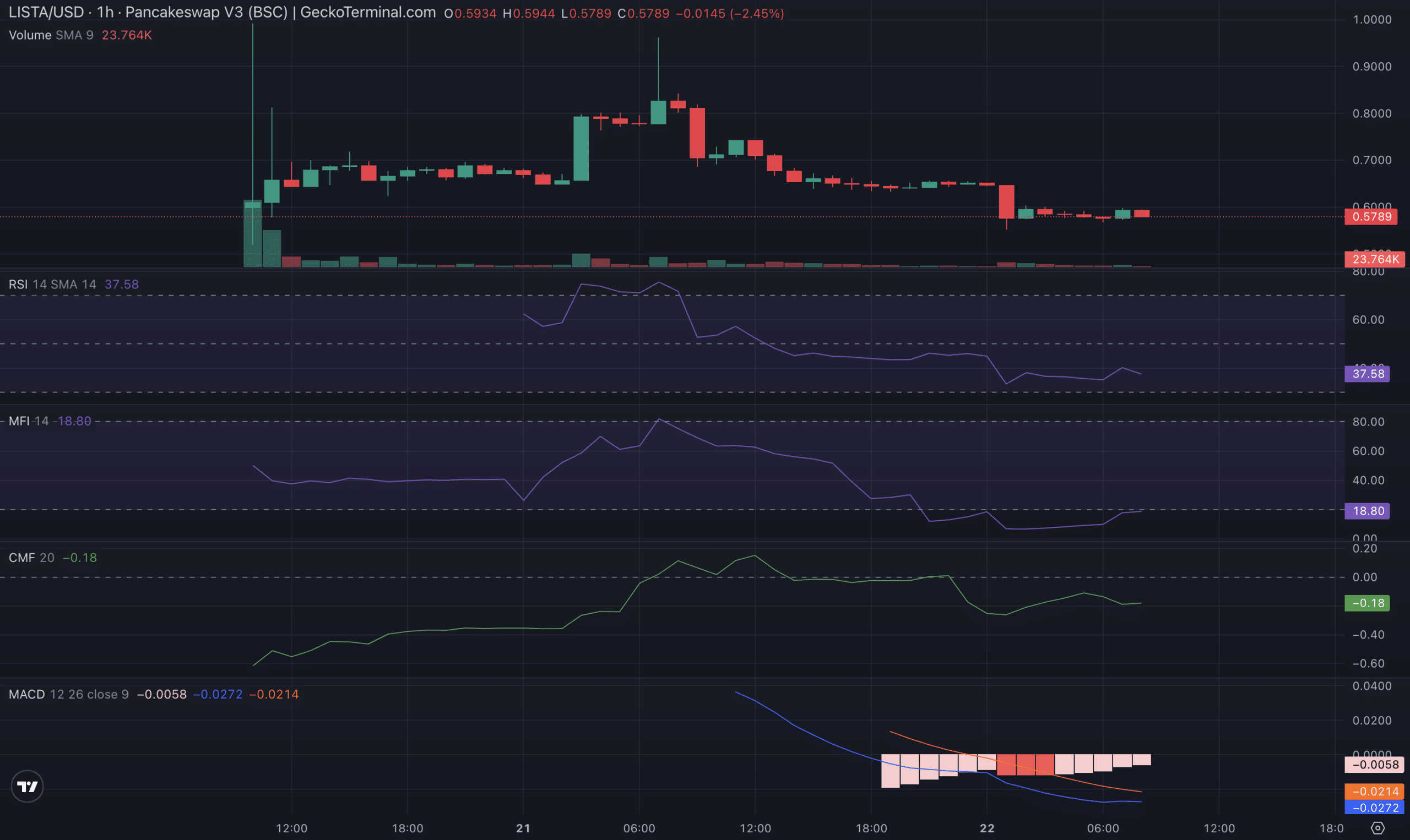

Chart analysis on an hourly basis for LISTA reveals a sharp decrease in demand. Key momentum indicators have dropped below their midlines as of the most recent checks.

For instance, LISTA’s Relative Strength Index (RSI) registers at 35.24 and the Money Flow Index (MFI) stands at 9.94.

These tools evaluate whether an asset is overbought or oversold, operating on a scale ranging from 0 to 100. Readings surpassing 70 suggest an overbought state, potentially leading to a price correction, whereas those under 30 indicate an oversold condition that could precede a rally.

At the time of reporting, the RSI and MFI levels for LISTA highlight a prevailing inclination towards distribution over accumulation, illustrating a dominant selloff compared to buying pressure.

Moreover, LISTA’s Chaikin Money Flow (CMF) is recorded at -0.22. The CMF evaluates the inflow and outflow of funds for a particular market.

A negative CMF value indicates a weakening market, which is interpreted as a bearish signal. It suggests an outflux of capital from the market, potentially indicating a further dip in price.

The moving average convergence divergence (MACD) for LISTA also corroborates the bearish trend, with the MACD line (blue) positioned below both the signal line (orange) and the zero line at this time.

As a frequently used trading metric, the MACD provides insights into potential entry and exit points. In its current state, it is suggesting unfavorable conditions, possibly advising traders to consider selling.

Source link

#Assessing #LISTA #Cryptos #days