Expert in Trading Charts Bitcoin’s Roadmap to Reaching $300,000

Following the disclosure of the United States Consumer Price Index, a significant downturn hit Bitcoin (BTC), though experts remain optimistic about its future, projecting sustained bullish trends.

Cryptocurrency trading authority Trading Shot penned a note on August 14 in TradingView post, suggesting that based on past price behavior and technical analyses, Bitcoin could soar to $300,000.

The forecast comes after a July 2024 closure in the green for Bitcoin, followed by a rapid recovery after a brief drop in early August, showcasing resilient investor interest.

Such resilience is evident at Bitcoin’s 0.786 Fibonacci retracement mark from its 2021 peak, highlighting a strong support zone.

The significance of the Moving Average Convergence Divergence (MACD) indicator’s bullish cross on the monthly chart is stressed by Trading Shot, a rare event that historically marks the onset of a bullish phase. Post the June 2023 bullish cross, Bitcoin experienced a notable rise, signaling the early stages of the current growth cycle.

These bullish MACD crosses, upon examination, have typically led up to major price surges for Bitcoin, as seen in the run-ups following November 2019 and December 2015, occurring roughly two years later. With the cross having emerged 19 months subsequent to the last height, predictions place the next peak around June 2025.

Prospective Upsurge in Bitcoin’s Value

Reflecting on past market cycles, current patterns are comparable to the consolidations in November 2020 and February 2017, both succeeded by bullish momentum post-stabilization above the 0.786 Fibonacci level. Thus,Trading Shot anticipates a potential surge to $200,000-$300,000, adhering to the long-established uptrend channel originating in 2014.

“By linking this high to the upward momentum commencing in 2014, we discern a pattern where cycle peaks often exceed it (signaled in red), suggesting the next climb could fall between 200k-300k,” the analyst proposed.

Even a modest forecast positions the peak of the symmetrical support at around $120,000, with $150,000 seen as an auspicious profit-taking juncture for investors.

The ‘HODL’ Approach Gains Favor Among Bitcoin Investors

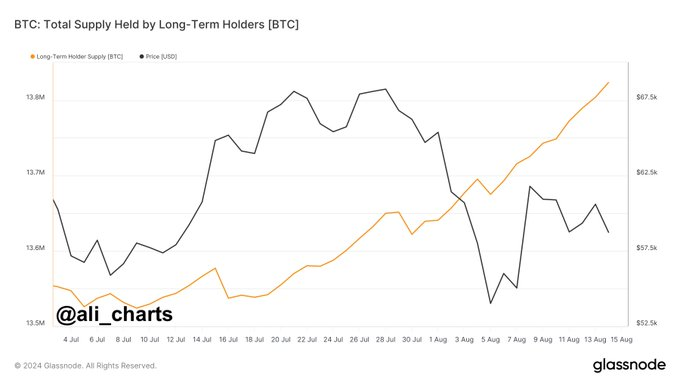

Meanwhile, Bitcoin stakeholders seem to prefer a long-haul investment approach, as indicated by data from analyst Ali Martinez in a recent report published on August 15, showing a noticeable shift from distribution to a ‘hold’ strategy.

Martinez referenced Glassnode statistics revealing three-month accruals nearing 300,000 BTC in long-term storage, underscoring the mounting belief in Bitcoin’s potential amidst prevailing price swings, with an evident uptick in the adoption of a “HODL” approach.

Analysis of Bitcoin’s Current Market Price

Bitcoin currently stands at $59,000, down by nearly 3% over the past day but has seen a weekly increase of more than 3%.

As Bitcoin presents a slight bearish signal, a decisive move past the $60,000 threshold is necessary to alleviate the negative pressure.

Disclaimer: The information presented here should not be deemed as financial advice. Investment activities are risky, and you risk losing your capital when you invest.

Source link

#Trading #expert #outlines #Bitcoins #path