Financial Institutions Mandated to Report High-Risk Transactions

New regulations from the Chinese foreign exchange authority now mandate banks to report transactions considered high-risk, such as those involving cryptocurrencies.

The latest directive from the State Administration of Foreign Exchange (SAFE) requires financial institutions to identify, monitor, and inform authorities about suspicious foreign exchange transactions, including but not limited to virtual currency dealings.

Obligation on Chinese Banks for Cryptocurrency Transaction Reporting

A recent publication states that these new rules are set to tighten the noose on the trading of digital currencies like Bitcoin by Chinese traders. Banks are now tasked with oversight on forex operations that involve unofficial banking, cross-border betting, and illegal cryptocurrency transactions.

The regulations will affect all financial institutions within China, compelling them to scrutinize transaction patterns, including the frequency of trades, the origins of capital, and the identities of parties involved in the trades.

Reflecting China’s consistent, stringent cryptocurrency regulation strategy, this regulatory development affirms the nation’s view of cryptocurrencies as a potential risk to its financial security.

Commentary on the newly announced regulations was provided by Liu Zhengyao, a Shanghai-based lawyer at ZhiHeng law firm on WeChat, as reported by the South China Morning Post.

“These new regulations offer an additional legislative framework for punishing cryptocurrency trading. It is anticipated that the stance of mainland China on cryptocurrency regulation will continue to tighten going forward,” remarked Liu.

Liu further elaborated that conversions of yuan to cryptocurrencies followed by trades for foreign fiat currencies could be deemed as “cross-border financial transactions involving cryptocurrencies,” especially when these transactions surpass the legal limit.

The Stance Against Cryptocurrencies in China

Since the year 2017, China has implemented constraints on cryptocurrency trading and disallowed financial firms and payment providers from engaging with digital currencies. Following a May 2021 declaration by the People’s Bank of China (PBOC), all dealings with Bitcoin and other cryptocurrencies were deemed illegal.

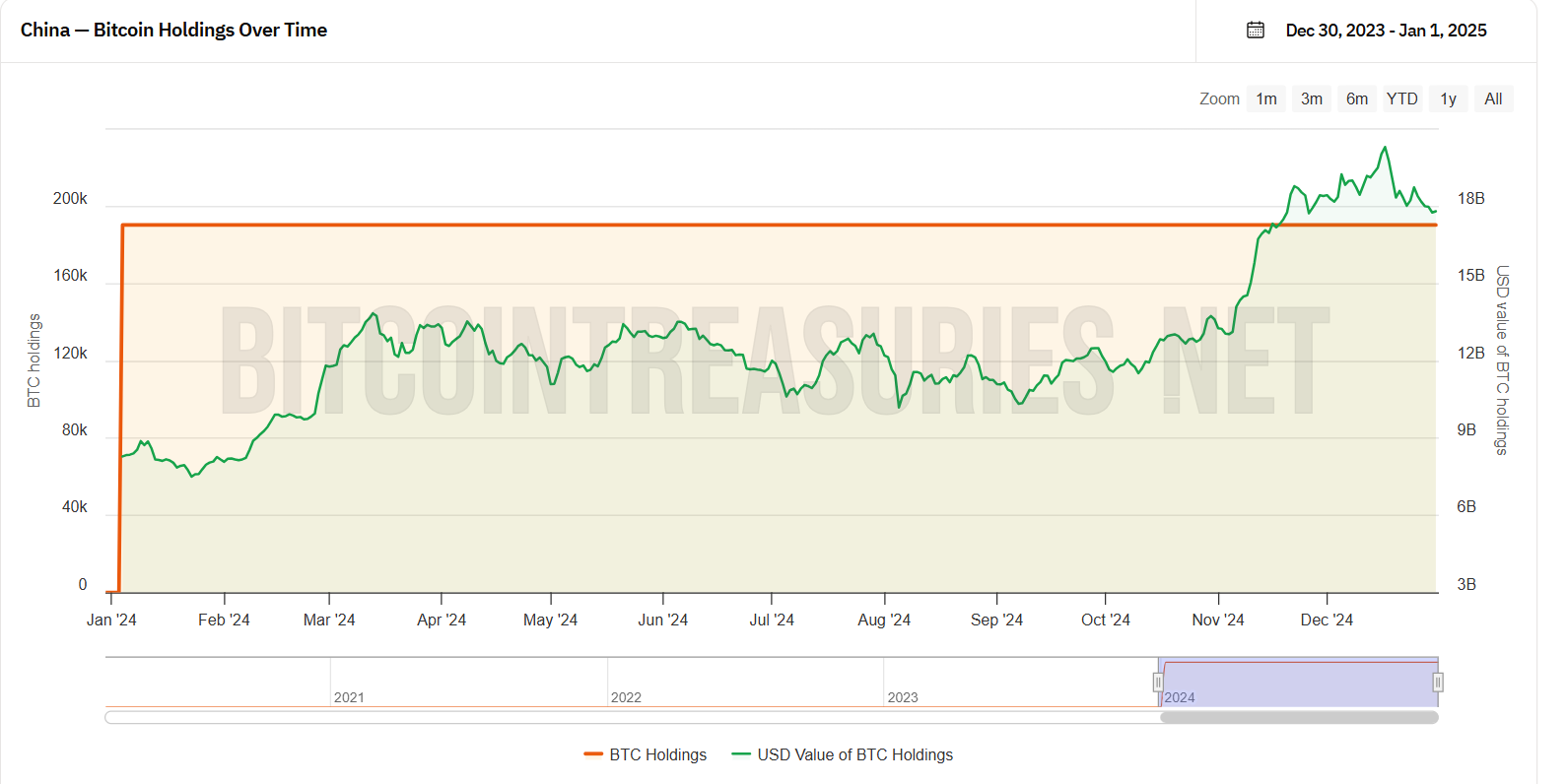

Despite its opposition to cryptocurrencies, China currently possesses upwards of 190,000 BTC, positioning it as the world’s second-largest governmental holder of Bitcoin, next to the US. These assets have been acquired through enforcement actions against unlawful trading activities.

The founder of Tron blockchain, Justin Sun, in July 2024, advocated for a more progressive stance from China regarding cryptocurrency policies.

“It is in China’s interest to advance in this field. The dynamic between China and the US on Bitcoin policies serves as a catalyst for progress across the entire industry,” Sun suggested.

In one of the more recent developments, a Chinese court ruled that cryptocurrencies have properties akin to assets and are not prohibited by Chinese legislation, although this recognition is limited to their status as commodities rather than currencies or financial instruments.

Disclaimer

Committed to the standards of the Trust Project, BeInCrypto values factual, transparent journalism. The purpose of this article is to deliver accurate information in a timely manner, although readers should verify the information independently and seek professional consultation before making any investment decisions. It should also be noted that our updated Terms and Conditions, Privacy Policy, and Disclaimers have been revised.

Source link

#Banks #Ordered #Flag #Risky #Trades