Fresh Cryptocurrency Prospect Priced at $0.04 for Investors Who Didn’t Capitalize on the SOL and AVAX Surge

“`html

Throughout 2021 and 2023, cutting-edge blockchain networks Solana (SOL) and Avalanche (AVAX) became prominent figures, offering scalable alternatives to Ethereum (ETH). These platforms saw their valuation soar into billions, yielding significant returns for digital asset investors who capitalized on this trend early.

As the technological landscape advances, fresh investment horizons emerge within the cryptocurrency realm, especially among currently undercapitalized but innovative networks.

Radix (XRD) emerges as a formidable player within the category of layer-1 blockchains, particularly focusing on decentralized finance (DeFi) and Web3 advancements. It stands out as part of the cohort utilizing sharding techniques to enhance network capacity while maintaining decentralization and robust security.

Comparable ‘sharded’ architectures include MultiversX (EGLD), Near (NEAR), Sui Network (SUI), and Toncoin (TON). Among these, XRD stands as the smallest in terms of market cap, not surpassing the $1 billion threshold.

Insightful Analysis of Radix (XRD)

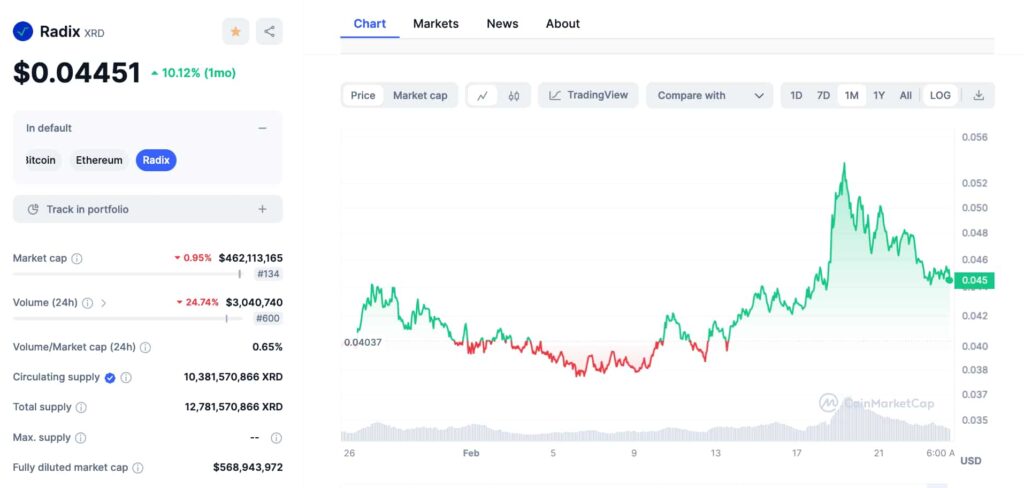

In the realm of fundamental analysis, Radix boasts a market valuation of $462 million with a trading price of $0.044. The DeFi-centric network has a circulating supply of 10.38 billion XRD, out of its max supply of 12.78 billion. With an approximate 2.5% annual inflation rate, the proof-of-stake protocol issues new tokens under a delegated staking mechanism.

Previously, we’ve seen phenomena like PEPE coin breaching the $1 billion market cap in mere days. Compared to such events, Radix could be seen as undervalued given its technology’s potential at less than half that market cap.

Highlighting its innovative tech stack, Radix boasts an asset-centric model that averts common wallet-draining attacks plaguing similar Ethereum Virtual Machine (EVM)-compatible projects.

Furthermore, with Radix’s Scrypto development language and Cerberus consensus algorithm, the network offers developer-friendly tooling and seamless atomic-composability across shard-based transactions.

Technical Perspective on Radix (XRD)

An analysis of the weekly chart highlights XRD as a potential gem for investors who missed the boat on SOL, AVAX, and their ilk.

A notable uptrend breach coupled with surpassing the 20-week exponential moving average (EMA)—similar to past performance where XRD ascended from $0.05 to above $0.15—could signal another upswing to $0.1 per token, yielding a near 125% profit. Such a movement might catapult Radix past the $1 billion valuation, an impressive leap but still a fraction of Solana’s and Avalanche’s caps, while addressing issues found in both platforms.

Notably, both SOL and AVAX suffered serious network interruptions in 2024.

To sum up, for those interested in taking part in the expanding DeFi space, Radix presents an appealing scenario. The platform harbors a vibrant ecosystem encompassing decentralized exchanges, lending services, gaming sectors, and support for a well-recognized memecoin known as HUG.

Nonetheless, with XRD being both a low-market-cap and low-liquidity cryptocurrency, it is paired with inherent speculative risks. As such, prudent consideration is advised prior to investing in these emerging sectors.

Disclaimer: The information provided here is not to be taken as financial advice. All investment strategies carry a degree of risk, and it is possible to lose your investment.

“`

Source link

#crypto #opportunity #investors #missed #SOL #AVAX #price #rally