Game Developer Takes Legal Action Against Jump Trading over Allegations of Cryptocurrency Manipulation

Game developer FractureLabs has initiated legal proceedings against Jump Trading, alleging that the latter manipulated the value of the DIO token in the closing months of 2021.

Jump Trading, with a base of operations in the US, excels at algorithmic trading and is recognized for its prominent presence in the cryptocurrency sphere.

Allegations of Jump Trading Violating Market-Making Agreement

As per a Bloomberg article, FractureLabs aimed to obtain funding via an initial offering of their Decimated (DIO) tokens on the Huobi platform in 2021, appointing Jump Trading as their official market maker.

Discover more: The Top 5 ICOs to Keep an Eye On in 2024

FractureLabs contends in its lawsuit that Jump Trading pledged to keep the DIO token’s price within a defined bracket. Contrary to this commitment, the token’s value experienced an inflation to close to $1, before plummeting to a meager $0.006 over the ensuing twelve months. These events led FractureLabs to accuse Jump Trading of capitalizing on pump-and-dump strategies to profit from the manipulation of the DIO token price.

An examination of the DIO price graph indicates a consistent downtrend that commenced in early 2022 and has evidenced no signs of a rebound.

“The lawsuit asserts that Jump systematically divested its holdings of DIO, accruing millions in revenue.” the report reveals.

It has also come to light from FractureLabs that they loaned Jump Trading 10 million DIO tokens and transferred an additional 6 million tokens to Huobi exchange as per their alliance. Initially valued at $9.8 million, the tokens’ worth had significantly diminished to merely $53,000 upon their return by Jump Trading.

Gain insight: Understanding Rug Pulls: A Primer on the Web3 Scam

A concurrent investigation by the US Commodity Futures Trading Commission (CFTC) is also underway into Jump Trading’s cryptocurrency trading and investment engagements.

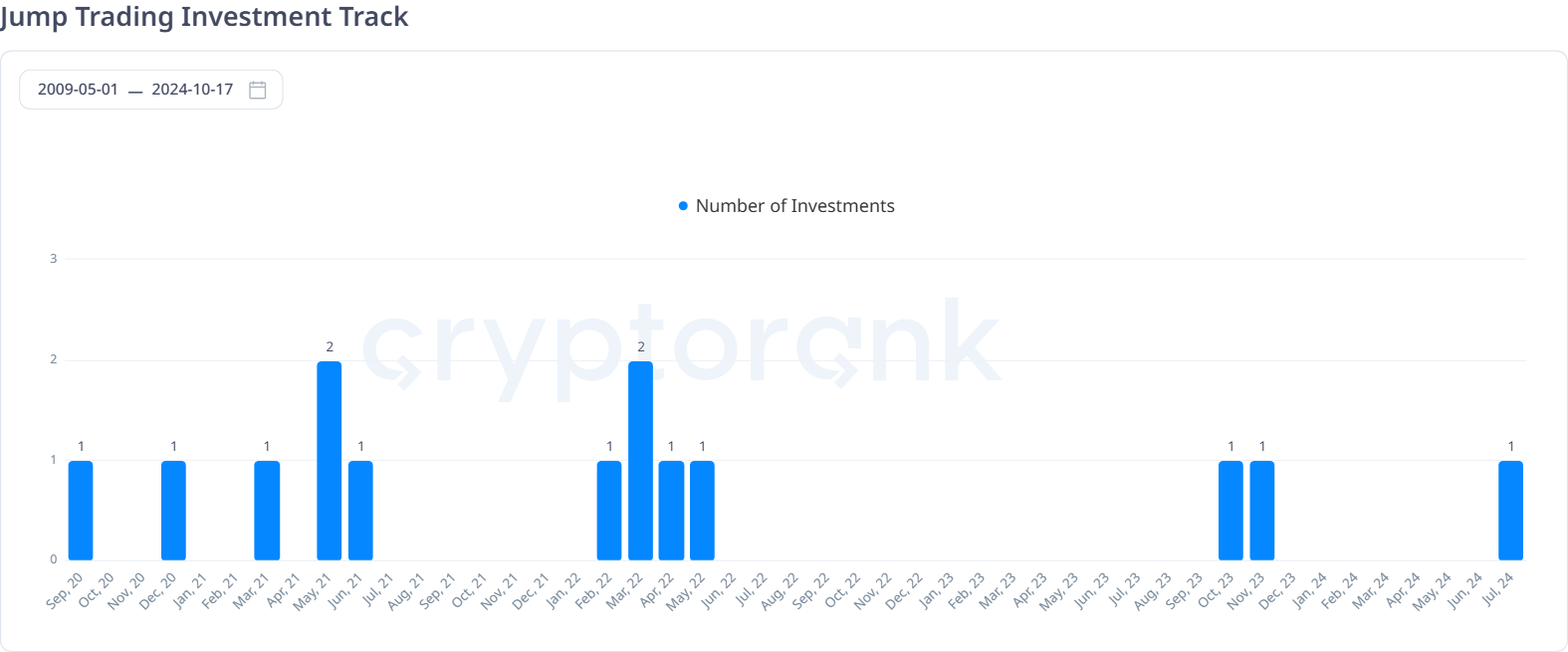

Subsidiary of Jump Trading, Jump Crypto, remains committed to crypto market investments. According to CryptoRank data, the firm’s investment actions seem to have been limited in the last couple of years.

Even though Jump Trading has previously seen prosperous ventures such as with Solana and Lido, they’ve encountered stumbling blocks, specifically with investments like TerraUSD and Wormhole.

Disclaimer

Heeding the principles of the Trust Project, BeInCrypto is dedicated to integrity and transparency in reporting. This article conveys information with precision and expediency, yet readers should independently verify facts and seek expert advice before making decisions based on this content. We bring to your attention that our Terms and Conditions, Privacy Policy, and Disclaimers are updated.

Source link

#Game #Developer #Sues #Jump #Trading #Crypto #Manipulation