Identifying False Breakouts in Cryptocurrency Markets: Analysis of OANDA’s EUR/USD Pair by Lingrid on TradingView

Ever experienced watching a critical level for a breakout, only to have the price break through and then reverse, threatening substantial losses to your portfolio? Let’s delve into the nature of a fake breakout, particularly within the cryptocurrency sphere.

Understanding Fake Breakouts

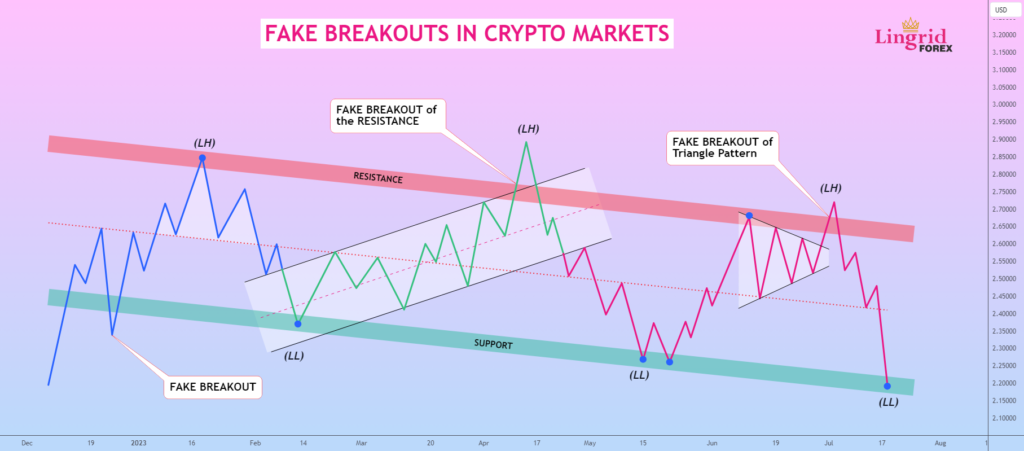

Fake breakouts occur when the price surpasses a key horizontal or angled threshold and soon reverses direction, defying the initial breakout trend. The candlestick breaching this threshold is termed as the breakout candle.

Often encountered fake breakouts in trading include:

- False breakouts from a trendline.

- False breakouts from support or resistance levels.

- False breakouts from the borders of a chart formation.

We’ve identified various breakout possibilities, so let’s scrutinize them further. Included in the breakout descriptions are principles to guide trading these patterns.

Countering Trendline Fakeouts

Analyzing the

ETHUSD

chart, I encountered a prime example of a bull run being disrupted by a fake trendline breakout. The phenomenon here was that post a substantial rally and subsequent trendline development, many traders entered long positions until abruptly the trend reversed, weeding out the buyers. Conversely, those cognizant of fake breakout tactics found a prime entry point.

Discerning a clear breakout trend, traders face a critical decision:

1. Enter the market aligned with the new downtrend.

2. Wait to confirm a rebound and reassessment above the trendline.

Rushing into a position right after a breakout isn’t generally advised due to frequent deceiving reversals. It’s recommended to anticipate a strong rebound for continuity in the breakout’s direction. If the price reverts above the trendline, follow these steps:

- Wait for the price to exceed the trendline again.

- Place a limit order at either edge of the breakout candlestick, depending on the trend.

- Allow the market to meet your order.

- Set a stop-loss beyond or below the trendline based on the trend’s course.

Navigating Support or Resistance Fake Breakouts

These are the most familiar, harboring a clever twist. Typically, the price suggests an intention to breach an important level, prompting traders to await the breakout which, when occurring, doesn’t yield anticipated gains. It’s a common scenario in cryptocurrency trading.

Entry strategies remain consistent with other scenarios, yet each breakout bears unique characteristics. Notably, many significant market movements are preceded by fake breakouts. This tactic effectively shakes out the skittish and those with very tight stops.

Technical Pattern Fakeouts Examined

These aren’t as frequent but do happen. When an anticipated technical formation implies a certain break direction and instead moves opposite, this is a pattern fakeout.

SOLUSDT

chart, there was a descending triangle that defied the norm by breaking upwards, catching many off guard.

Trade entry mechanics are the same as before, with an additional option: entering upon the pattern’s breach. Cryptocurrency markets often showcase this dynamic:

• An influential level is established.

• The price surpasses and steadies above or below this level.

• Following the breakout, a momentary pullback and minor reversal manifest (fake breakout).

• Price subsequently reconsolidates in this region.

• A genuine breakout follows.

Thus, the stops of both failed shorts and longs accumulate. Avoid such scenarios with tighter stop orders and tempering greed. A critical trading tenet: The more a level is tested, the more likely its eventual breach. Yet remember, levels are made to be broken.

In Summary, fake breakouts are frequent in trading, especially within the crypto markets. They manifest as false trend breakouts, false support/resistance breakouts, and false technical pattern breakouts. Knowledge and application of strategic approaches can allow traders to exploit such market phenomena effectively. Awareness and management of fake breakouts enhance the likelihood of trading success.

Traders, if this instructive post resonates with you, please amplify

Source link

#FAKE #BREAKOUTS #CRYPTO #MARKETS #OANDAEURUSD #Lingrid #TradingView