Investors Turn to This Cryptocurrency Following the Collapse of China’s Stock Market

Amidst a downturn within China’s equities market, traders are pivoting towards an alternative avenue for their financial ventures. The rise in Bitcoin and various other digital currencies signifies a burgeoning investment trend, as these assets are increasingly viewed as stable options in times of economic flux.

Remarkably, this trend persists despite China’s rigorous prohibition of digital currency trading and mining activities, a testament to the tenacity and ingenuity of Chinese investors.

Circumventing China’s Cryptocurrency Restrictions

One emblematic case is Dylan Run, a finance expert from Shanghai. When economic instability emerged in early 2023, Run started to diversify his assets into cryptocurrencies, undeterred by the 2021-imposed ban on such transactions. Click here for more details.

Run tactically sidestepped the regulations by transacting through small, rural banks and participated in semi-legal trades. He limited his crypto purchases to $6,978 each to stay under the radar and has since amassed a digital currency portfolio valued at around $141,024, which represents half of his entire investment assets.

Where the domestic stock market stumbles, Run finds success in crypto, witnessing a significant 45% value increase and regards Bitcoin as “a haven just like gold.”

A pattern is seen as more investors, like Charlie Wong, an equity analyst, explore methods to incorporate digital currencies into their portfolios, considering them more predictable than the erratic Chinese stock and real estate markets.

Wong, among others, has pivoted to using services like Hashkey Exchange in Hong Kong to buy Bitcoin.

“It is challenging to locate promising prospects in conventional arenas. Chinese equities and other assets are experiencing a slump… The economy is weathering a pivotal transformation,” Wong elaborated.

This inclination reflects a broader sentiment among Chinese investors looking for alternatives in the face of faltering domestic markets.

While the Chinese mainland maintains its stance against cryptocurrencies, trading platforms such as OKX and Binance still serve Chinese customers through over-the-counter services and alternative channels. In addition, accessing overseas banking facilities and Hong Kong’s relatively warmer reception to digital currencies facilitate the circumvention of the prohibitive mainland controls.

The Sanctuary of Bitcoin

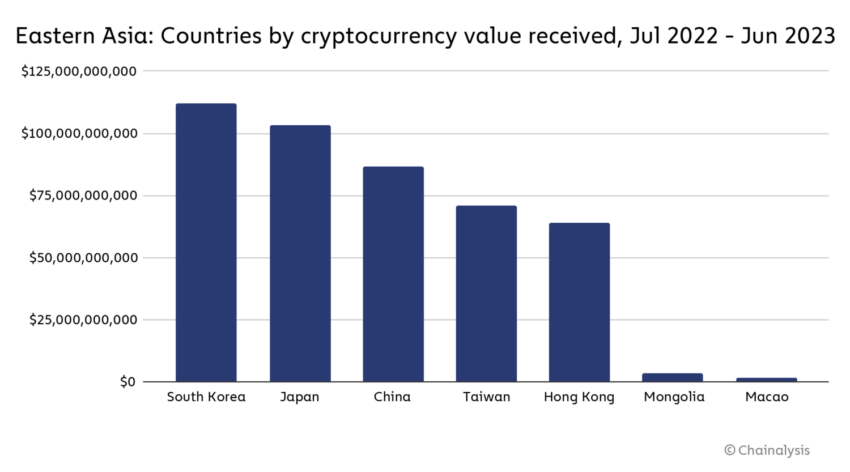

The Chinese underground cryptocurrency market is experiencing a boom despite existing in a legal grey zone. Chainalysis has reported a noticeable uptick in peer-to-peer digital currency exchange within China, elevating its global ranking significantly within one year’s span. Find out more here.

Between July 2022 and June 2023, irrespective of the official prohibition, $86.4 billion in cryptocurrency transactions were recorded in China.

“China and Hong Kong display unique trends in preferred crypto platform usage, although these statistics should be cautiously interpreted since a significant amount of the crypto activities in both locales is conjectured to occur via OTC services or unregulated peer-to-peer exchanges,” the analysis suggests.

The surge in cryptocurrency adoption coincides with the underperformance of China’s traditional investment vehicles. The intense regulatory crackdown on the housing sector and the broader economic shifts have made stock and property investments less attractive.

The state-dominated enterprise sector, lack of transparency in governance, regulatory volatility, and deficiencies in the credit rating framework present substantial economic hurdles.

“China’s economy progresses steadily and continues to inject robust momentum into the global economy. China’s role as a central engine in worldwide growth is undisputable,” Li Qiang, Premier of the State Council of the People’s Republic of China, stated.

Yet, the current scenario has precipitated a decline in the stock market and prompted worries about China’s economic fortitude. Concurrently, Bitcoin’s ascension by 50% since mid-October further accentuates its allure as an investment prospect. Amid the economic instability of China, cryptocurrencies stand out as a plausible refuge, promising stability and prospects for growth.

For further insight: Bitcoin Price Forecasts 2024/2025/2030

The upward trajectory of cryptocurrency commitments by Chinese traders is indicative of a pivotal strategic redirection in the wake of the evolving economic and regulatory climate.

Disclaimer

Adhering to the Trust Project principles, BeInCrypto maintains commitment to unbiased, forthright reporting. The purpose of this news piece is to deliver precise and timely content; however, readers should independently validate the accuracy of the information and seek professional counsel before making any investment decisions based on this article. Note that updates to our Terms and Conditions, Privacy Policy, and Disclaimers have been enacted.

Source link

#Traders #Buying #Crypto #Chinese #Stock #Market #Crash