Market Share of USDC on Centralized Crypto Exchanges Surpasses 10% with a Two-Fold Increase

The stablecoin USD Coin (USDC), which ranks as the second-largest by market cap, has experienced a significant uptick in its dominance on centralized cryptocurrency exchanges in recent times.

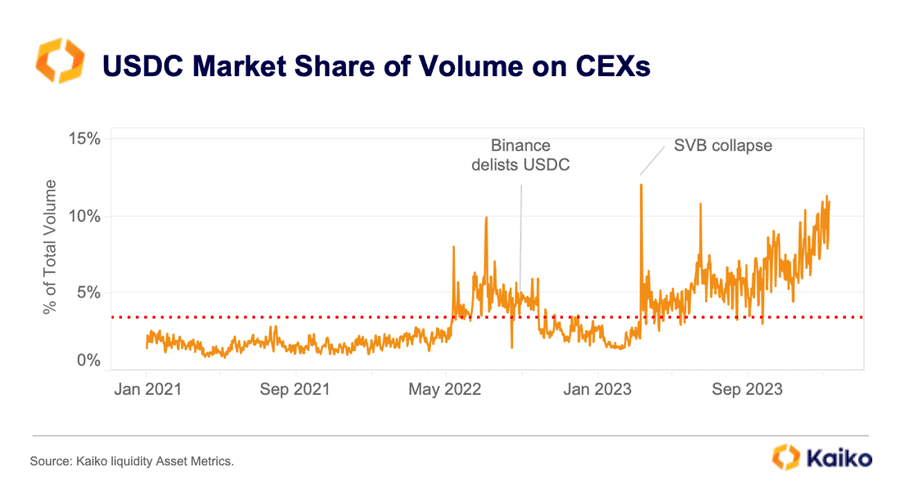

Insights from the Paris-headquartered crypto analytics firm Kaiko indicate that the market share of USDC surged from approximately 5% in September 2023 to over 10%, a notable increase which can be largely attributed to the amplification of trading activity on the Bybit platform.

The Expansion of USDC’s Market Presence

Bybit has taken the lead as the primary marketplace for USDC transactions, likely owing to the platform beginning to offer a commission-free trading model for pairs involving USDC in February of the preceding year.

The reinstatement of USDC on Binance, amidst legal complications faced by Binance USD (BUSD), is another factor that could have bolstered USDC’s expansion during this timeframe.

Moreover, Coinbase, a dominant cryptocurrency exchange in the United States, has progressively escalated the interest rates for USDC, beginning at 2% and steadily climbing to 6% over the previous year, providing users with added incentive to maintain holdings of the stablecoin.

In addition, the issuer Circle has forged strategic partnerships with leading financial bodies like Japan’s SBI Holdings and secured authorization in key markets such as Singapore, thereby enhancing the distribution and visibility of USDC.

USDC’s Circulating Supply

While these indicators of growth are promising, the current circulation of USDC still significantly lags behind its peak of $45 billion.

Circle has identified multiple causes for this downturn, such as “escalating interest rates, regulatory crackdowns, corporate bankruptcies, and instances of fraud.”

Moreover, USDC confronted major challenges last year when the collapse of its banking associate, Silicon Valley Bank, prompted a temporary deviation from its peg and sparked a substantial exodus from the cryptocurrency.

Circle also recently announced its renewed ambitions to enter the public market by submitting an IPO filing with the U.S. Securities and Exchange Commission.

Source link

#USDC #doubles #market #share #centralized #crypto #trading #platforms