MicroStrategy Trades at a 91% Premium Over Its Bitcoin Holdings (NASDAQ:MSTR)

“`html

Note from the Editor: We are excited to announce Nick Jessop as the newest member of our contributor team. Joining Seeking Alpha as a contributor is straightforward, and it allows you to monetize your insightful investment perspectives. Contributors who are regularly active also enjoy complimentary access to SA Premium. Discover more by clicking here »

MicroStockHub

Introduction

MicroStrategy (NASDAQ:MSTR) is a company with a market valuation of $28.9 billion, whose business operations are valued at $2.5 billion at the upper end, while owning $15.1 billion in bitcoin assets. If these figures appear misaligned, it’s because they likely are. In this analysis, we’ll delve into the details of MSTR, examining its leadership, portfolio, business strategy, and an approach designed to capitalize on this perplexing market valuation.

Company Profile

The Business

According to its latest 10-K filing, MicroStrategy identifies itself as “the pioneer bitcoin adoption corporation”. More specifically, the firm utilizes bitcoin as its chief asset for treasury reserves. Although MSTR’s financial gains are tied to the rising prices of bitcoin, its actual revenue is derived from selling software. The software offerings are centered around business intelligence and analytics, enhanced by AI. The prime objective of the company’s software sales is to grow its bitcoin reserves, stating “For over three decades, our software enterprise has been our main operational pursuit, generating cash flow that facilitates our bitcoin strategy.” An overview of this strategy is outlined below.

SEC EDGAR

An extract from page 7 of the corporate 2023 10k, the onset of the business section, highlights this point. However, it is not until page 12 that the company’s software segment receives a direct mention. It becomes evident that MSTR prioritizes bitcoin over its analytics software ventures.

Technology

Although the focal point of this document is not MSTR’s technical offerings, it’s useful to briefly touch upon their market positioning. For example, reviews on respected enterprise software platforms such as Gartner Peer Insights give the MicroStrategy platform a 4.6 out of 5 rating, yet it ranks 9th amongst its rivals in business intelligence tools on PeerSpot. This competitive landscape includes Microsoft Power BI, Oracle OBIEE, and IBM Cognos. Without delving too deep and without claiming expertise in the field, we can infer two things: the industry is highly competitive, and MicroStrategy is not leading the pack.

Strategy

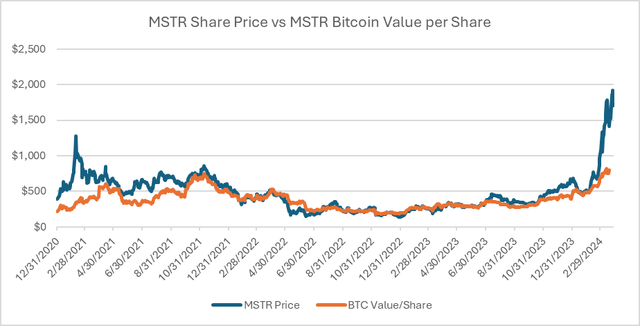

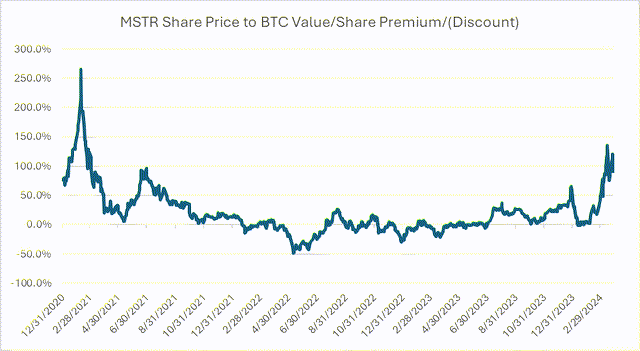

MicroStrategy seems to operate more as a bitcoin investment vehicle than a conventional software enterprise. While the organization does sell software, its leadership includes individuals focused on bitcoin, and investor materials suggest that their influence is strong. Equity markets tend to share this perspective. MSTR initiated bitcoin acquisitions in 2020 and since the end of the fiscal year 2020, its stock has been trading on average at an 11% surplus compared to its bitcoin holdings per share. In February 2024, following a bitcoin surge, the stock now sees an enormous 91% surplus over its bitcoin value. As a result, investors are essentially paying $1.91 for every $1 worth of bitcoin coupled with ownership in a company whose EBITDA hasn’t exceeded $100 million since 2016. Admittedly difficult to comprehend, yet historically inconsistent. By banking on mean reversion, an investor could short MSTR, while simultaneously maintaining a long position proportionate to the bitcoin value held per MSTR share.

Bloomberg, personal analysis

Bloomberg, my analysis

Considerations

Imperfect Hedge: The following analysis outlines how a perfect hedge against bitcoin’s volatility is not attainable (unless proven otherwise). For instance, if an investor short sells a stock at $120/share, which includes $100 of bitcoin, and goes long on bitcoin with $100, they anticipate benefiting from the 20% surplus value at convergence. If the bitcoin value escalates by 20%, the long position would yield a 20% profit. Conversely, if the stock’s bitcoin value climbs to $120 and the surplus holds, the stock would trade at $144, resulting in a net $4 loss for the investor. In this scenario, like that with MSTR, a flawless hedge exists only if the bitcoin premium drops to zero.

Margin Calls and Valuation Fluctuations: While it’s believed that MSTR’s bitcoin premium will eventually decline, this may not occur in the immediate future. The proposed trade provides certain safeguards, but there still remains the potential for significant short-term losses and possible margin calls. To illustrate, MSTR’s stock at one time reached a 266% premium over its bitcoin assets early in 2021. Should such a spike recur, even transiently, MSTR’s share value could soar by more than 100%.

Social Media Influence Risk: It is widely acknowledged that an unpredictable surge, dubbed the “meme effect,” can affect any stock’s performance. This risk is characterized by sudden and often inexplicable market behavior, such as a surge prompted by social media momentum. Given the close association between the company and bitcoin, this is particularly relevant.

Short Interest Cost: The outlined analysis and proposed fiscal strategies do not account for the costs of borrowing to short the stock, nor the transaction fees involved in trading either security. As of March 28th, 2024, borrowing rates for MSTR shares are slightly below 5%.

Bitcoin ETF Correlation: Although the Bitcoin ETF (IBIT) is designed to mirror the Bitcoin spot prices, it is relatively new, having been listed in January of 2024, and therefore lacks extensive historical data. Despite this, its correlation coefficient thus far is 0.936 in relation to Bitcoin spot prices, indicating a strong correlation.

Financial Analysis

Current Market Premium on Bitcoin: As of the close on 3/28/2024, MSTR’s share price is $1,705, equating to a market cap of $28.9 billion. This reflects a 91% premium to the per-share bitcoin holdings of $892. When applying an average NASDAQ price/sales ratio of 5x to the most recent trailing twelve-month revenues (a generous metric), it translates to a business operation market cap of $2.5 billion, narrowing the premium to 75%. To reassert, the company has historically traded at an average premium of 11% above its bitcoin assets over a three-year span.

Investment Proposition: The suggested investment move entails shorting MSTR shares and going long on the equivalent bitcoin value per share held by MSTR. By shorting one share of MSTR at $892 in bitcoin assets and taking a correspondingly long position in 22 shares of the Bitcoin ETF IBIT (priced at $40/share), an investor can safeguard against a drop in MSTR’s bitcoin premium to 60%, ensuring no net loss, provided bitcoin’s price remains within 50% of its present value in any direction.

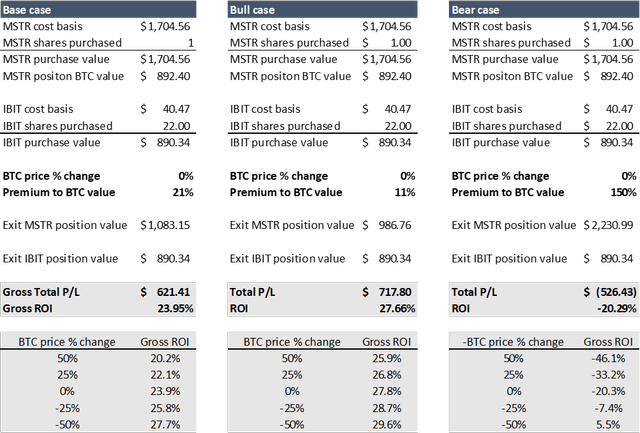

Potential Returns: Assuming MSTR’s premium over its bitcoin holdings reverts to the prior quarter’s median of 21%, an investor could realize a gross return on investment of 24% without any movement in bitcoin’s value. Given bitcoin’s volatility, its price fluctuations will undoubtedly affect returns, as demonstrated in the accompanying visual. In an optimistic scenario, where MSTR’s premium declines to a three-year median of 10%, the return could be 29%, absent any bitcoin price change. On the downside, if MSTR’s premium were to extend to 150%, an investor might see a 20% loss, assuming bitcoin’s price remains static.

Final Remarks: While this investment strategy is not a guaranteed arbitrage, nor is it entirely insulated from fluctuations in bitcoin’s pricing, the prevailing premium of MSTR above its bitcoin assets is unlikely to be enduring. Investors can reasonably speculate that over time, MSTR will behave like a cache of bitcoin with an ancillary software business. If these assumptions hold water, investors could achieve returns that outperform the market, with limited exposure to long-term risks.

Bloomberg, personal Excel analysis

“`

Source link

#MicroStrategy #Box #Bitcoin #Trading #NASDAQMSTR