My 12-Month Cryptocurrency Trading Strategy for 2025

Mike Butler’s Strategy for Capitalizing on iShares Bitcoin Trust Option Premiums

- iShares Bitcoin Trust (IBIT) offers direct correlation with Bitcoin’s price fluctuations.

- The $55 entry point and high liquidity make it accessible for various account sizes to engage in multiple strategies.

- In a manner akin to his approach with DraftKings in 2024, Mike plans to maintain a short premium position in IBIT throughout 2025.

- Should the actual volatility be lower than the projected volatility by year-end, this could translate to a profitable trade with significant capital returns.

The iShares Bitcoin Trust (IBIT) is emerging as the new go-to crypto product for investors seeking a straightforward method for tracking Bitcoin’s market performance. With the recent opening of its options market and a price of about $55, it’s an attractive option for various investment strategies, whether bullish, neutral, or bearish towards Bitcoin’s value.

One of the hurdles in Bitcoin investment is acquiring coins for cold storage. IBIT addresses this challenge with its NASDAQ listing, offering unblemished Bitcoin exposure. Notably, IBIT has seen traded volumes surpass those of the S&P 500 ETF (SPY).

Assessing the IBIT Strangle: An Options Strategy

The essence of a long-term short premium strategy is to amass as much extrinsic value as achievable over time. This principle led to favorable outcomes with my DraftKings 2024 campaign, and I am optimistic that the same holds for IBIT until 2025’s conclusion.

When trading a strangle, the goal is to manage the spread, accumulating enough extrinsic value to expand the breakeven points beyond both the put and call strikes. My DraftKings venture began with a 35 strike and saw me pocketing upwards of $1,800 in extrinsic value throughout the year.

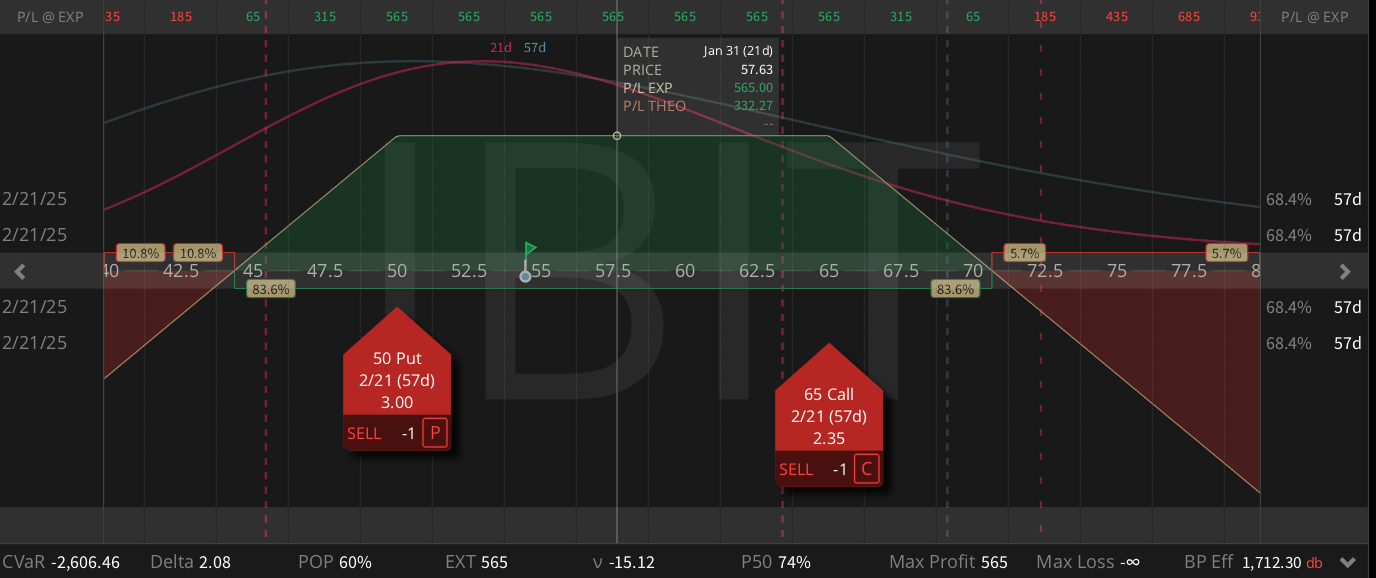

On December 23, 2024, I initiated a 50/65 strike strangle on IBIT, fetching a $5.65 premium with the stock priced near $53.

IBIT’s significant implied volatility offers a steady stream of extrinsic value, enabling better premium collection relative to the risks.

Optimal Outcome for an IBIT Strangle

A strangle strategy thrives best when the sold options expire out-of-the-money and worthless. My tactic involves monthly adjustments to maximize premium collection while maintaining a trade within the 50-65 strike zone.

Currently, with a projected range of $25.27 to $84.73 until January 2026, staying within this spectrum would indicate a victory for short premium strategies and imply an overestimation by implied volatility.

Navigating Adverse Outcomes for an IBIT Strangle

The worst-case scenario encompasses the stock breaching the projected range substantially. Moderate fluctuations are manageable; however, rapid one-directional moves are less so, potentiating intrinsic value losses.

Defensive Techniques for Managing Strangles

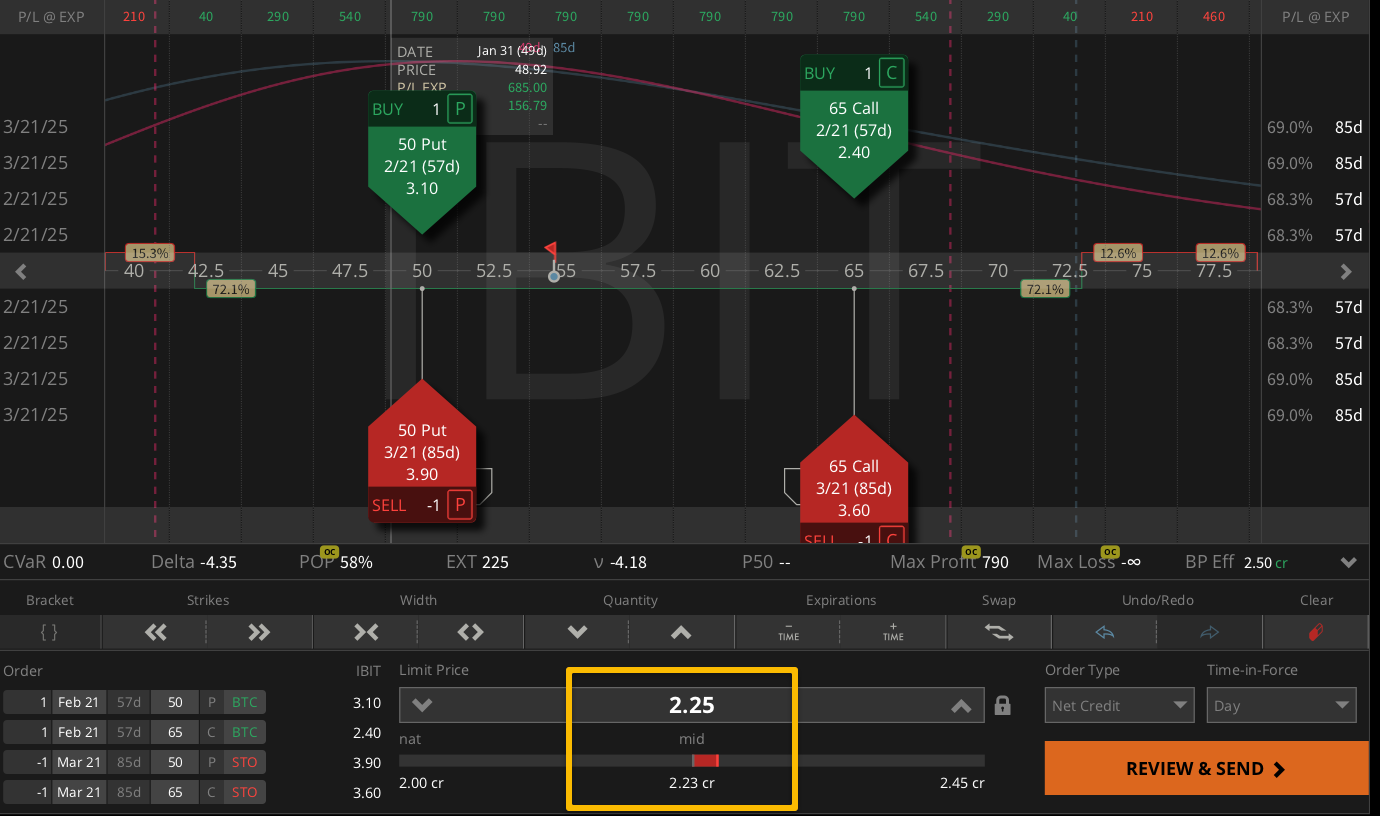

High-IV products offer flexibility with strangles. One can roll such positions forward in time, garnering significant credits which can be leveraged to adjust strikes. For instance, rolling from February to March might offer more favorable terms or strike adjustments.

Furthermore, tune into my updates on the IBIT year-long trade and catch live episodes of Options Trading Concepts Live on the stock market days.

Mike Butler, tastylive’s director of market intelligence, is an industry expert with a decade of trading experience. Watch him on Options Trading Concepts Live. Follow him at @tradermikeyb.

For more live programming and market insights, visit tastylive or our YouTube channels for options, stocks, futures, forex, and market trends.

Upgrade your trading experience, open a tastytrade account today. tastylive and tastytrade are separate yet affiliated entities.

Source link

#YearLong #Crypto #Trade