Prepare for Market Fluctuations as Half a Billion Dollars Transacts in Bitcoin Trading

The digital asset Bitcoin (BTC) remains a focal point in the financial landscape, remaining steady just over the $60,000 threshold. The crypto community watches intently for Bitcoin’s upcoming trends, noting a flurry of substantial buying orders and shifts in liquidity.

Observers can discern intriguing trends and potential for profit through these activities, providing insightful data for both the investing and trading spectrums.

Acclaimed trader Daan Crypto Trades observed noteworthy buying orders positioned beneath the current market rates, coupled with rising open interest. Remarkably, orders worth over $500 million have been identified under Bitcoin’s trading range, specifically within the $59,500 to $60,583 interval.

This accumulation of buy orders establishes a robust support region, acting as a buffer against substantial price decreases. Following its dip, Bitcoin regained its footing, climbing back past the $61,000 level. This rebound signals a sustained buying interest and presents low-risk entry points for investors.

Exploring Bid Volumes and Liquidity Movements

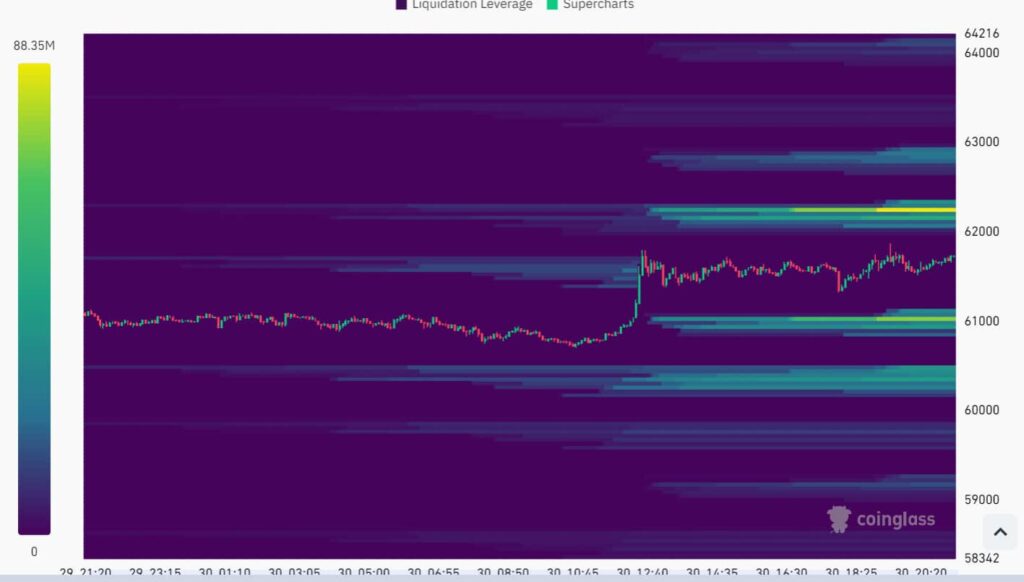

The trading heatmap shows dense buying orders at select price levels, especially near $59,500, signaling a key area of support. In contrast, as the valuation edges above $61,600, liquidity appears to transition upwards, indicating a preparedness for price elevation.

Heightened trade volumes and growing open interest illustrate increased market involvement, with traders actively creating and dissolving positions, providing insights into the locations of aggregated liquidity which, in turn, assist traders in forecasting price trajectories and tailoring their trading tactics.

Moreover, the surveillance tools from CoinGlass have pinpointed substantial liquidations between the $61,000 and $63,000 range, drawing attention to the areas with heightened liquidation leverage. Traders should be cognizant of these sectors that might lead to forced selling and contribute to price instability. Watching these segments is imperative for managing threats and seizing trading possibilities.

Assessing Market Sentiment and Past Trends

Despite Bitcoin’s latest 2.6% drop on a weekly comparison, the MNTrading CEO, Michaël van de Poppe, maintains a positive stance, drawing parallels between the

current market conditions and past trends where corrections did not necessitate a steep drop.

Even though Bitcoin’s second-quarter results have been relatively bleak with a 13.8% slump, the losses for June stand at 8.9%. Historically, Bitcoin has bounced back in July following a downtrend in June. Based on the observations of well-known analyst Ali Martinez, Bitcoin averages a return of 7.98% and a median of 9.61% in July.

Analysis of BTC Prices

At the time of this update, Bitcoin is valued at $61,576, marking an almost 1% gain over the past 24 hours.

Considering the establishment of firm support at reduced price points and experienced investors’ positive predictions, Bitcoin shows promise for ascending valuation trends.

Nonetheless, market volatility is expected to persist, given the dynamism in liquidity zones, escalation in open interest, and critical liquidation marks. It is vital for any investor, regardless of experience, to remain alert and stay informed about essential support and resistance areas when navigating through this unpredictable market.

Disclaimer: The material presented here is not to be interpreted as investment guidance. Trading involves speculation, and your capital may be at risk when investing.

Source link

#Brace #volatility #million #moves #Bitcoin #trading