Reasons Behind the Texas Cryptocurrency Firm’s Legal Action Against the SEC

Lejilex, a cryptocurrency company headquartered in Texas, has teamed up with the Crypto Freedom Alliance of Texas (CFAT) to initiate a legal battle against the US Securities and Exchange Commission (SEC). Their contention lies in the SEC’s classification of certain cryptocurrencies as securities, a move they believe exceeds the Commission’s jurisdiction.

The lawsuit surfaces in a climate of heightened regulatory complexities, with the SEC facing disapproval for its methods of digital asset regulation.

The Motivation Behind Lejilex’s Legal Action Against the SEC

Lejilex aspires to introduce Legit.Exchange, a new venue for cryptocurrency transactions. However, the regulatory perspective of the SEC places their ambitions under uncertainty, as it has recognized various tokens intended for listing on the exchange as securities.

This perspective takes cues from existing legal confrontations with prominent platforms such as Coinbase and Binance, fueling a broader conversation in the crypto space about cryptocurrency regulation and identity.

Both Lejilex and CFAT refute that cryptocurrencies fulfill the qualifications for “investment contracts,” thereby warranting regulation under securities law. They posit that such interpretations are legally murky and create unwarranted regulatory hurdles. They’re placing their bets on the “major questions” doctrine.

This approach argues that important regulatory changes must be clearly authorized by Congressional legislation. However, this line of reasoning has seen limited endorsement in recent cases concerning cryptocurrency firms.

“Rather than focusing on launching our enterprise, we find ourselves having to pursue legal action,” stated Lejilex co-founder Mike Wawszczak, in an expression of frustration detailed here.

The deliberate selection of Fort Worth for filing the lawsuit is tactical, as it falls under the jurisdiction of the 5th US Circuit Court of Appeals, which is known for its conservative stance. This move highlights the strategic thinking of the cryptocurrency company in seeking a judicial atmosphere more likely to be receptive to their cause, illustrating the broader pattern of the crypto industry’s legal challenges to SEC authority.

The Legal Tug-of-War: SEC’s Crypto Enforcement Efforts

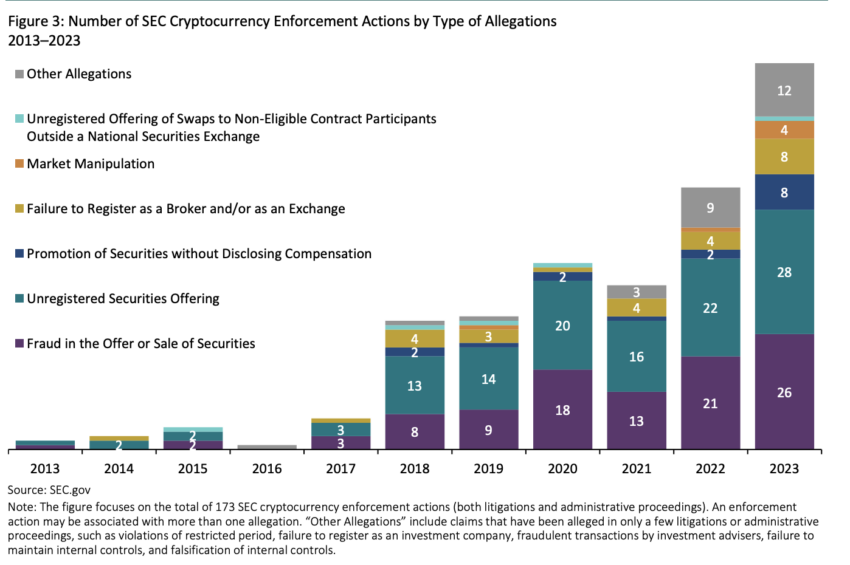

Throughout the past year, the SEC’s enforcement efforts against the crypto sector have surged under Chairman Gary Gensler, leading to an unprecedented wave of regulatory measures. This intensified focus has resulted in discomfort throughout the crypto landscape.

Discover more: Learn About Gary Gensler: The Man at the Helm of the SEC

The rising importance of Texas in the cryptocurrency sphere, particularly due to its bitcoin mining activities, is coupled with the state’s own struggles over environmental and noise disturbances linked to the industry.

These additional issues introduce yet more complexity to the intricate relationship between crypto enterprises and regulators.

Disclaimer

Following the Trust Project principles, BeInCrypto remains dedicated to neutrality and transparency in our reporting. This article aims to deliver precise, current information, though readers should independently validate facts and seek professional counsel before making decisions based on this material. Note that we have made updates to our Terms and Conditions, Privacy Policy, and Disclaimers.

Source link

#Texas #Crypto #Company #Suing #SEC