Robinhood Achieves Record-Breaking Revenue and Profit in Q2 2024, Fueled by Interest Income and Cryptocurrency Transactions

For the second quarter of the year 2024, Robinhood Markets, Inc. (NASDAQ:HOOD), an American financial services company, unveiled a remarkable performance with ongoing elevations in Revenue and Profit for the second quarter straight. The flourishing brokerage landscape seems to be benefiting the company as it exhibits impressive operational efficiency.

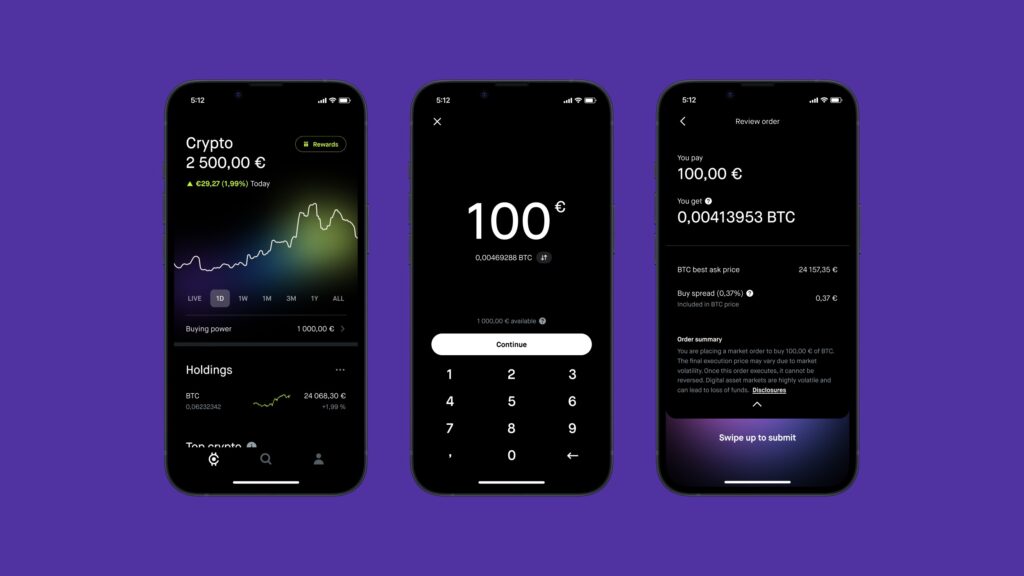

Robinhood experienced a significant 40% surge in total net Revenues compared to the previous year, reaching $682 million, which also reflects a 10% growth from the prior quarter’s high of $618 million. This leap can be partly credited to the first quarter’s performance. The company’s transaction-based Revenues, primarily from brokerage, jumped by 69% to $327 million, representing less than half of the company’s total Revenues. Options trading generated $182 million, up by 43%, Crypto activities contributed $81 million with a substantial 161% increase, and Equities added $40 million, a 60% rise.

Most notably, Robinhood’s top Revenue generator is now Interest income, boasting a 22% yearly increase to $285 million, largely due to upticks in interest-earning assets, the frequency of securities lending, and principally the higher short-term interest rates. Interest income now encapsulates a vast 42% of Robinhood’s entire top line Revenues.

Additional Revenues also saw a 19% year-over-year growth, arriving at $70 million, with Robinhood Gold subscriptions contributing significantly to this rise.

Shifting focus to net earnings, Robinhood’s Net Income soared to $188 million for Q2, translating to a diluted EPS of $0.21. This is a sharp climb from Q2 2023’s $25 million net earnings, or $0.03 diluted EPS.

Despite these hefty financials, the reaction of Robinhood’s shares in the aftermarket was muted post-results disclosure. At the time of this summary, the stock had seen an approximate 2.2% uptick to $17.50 from the closing figure of $17.12 on the prior Wednesday. However, in the last month, Robinhood’s stock has fallen nearly 30% from its 52-week zenith of $24.88 reached in mid-July.

CEO and Co-Founder Vlad Tenev commented on the Q2 achievements, saying,

CEO and Co-Founder Vlad Tenev commented on the Q2 achievements, saying,

“Our unwavering commitment to innovation and offering exceptional value to our customers has driven this quarter’s success. With now over two million Robinhood Gold subscribers, our growth strategy is clearly resonating with our client base.”

Robinhood’s CFO, Jason Warnick, stated,

“The strides we’ve made in the business are heartening. With records being set for revenues and EPS this quarter, our concentration on achieving sustained profitable expansion is evident.”

Q2 2024 financial details for Robinhood included:

- Year-over-year, adjusted EBITDA (non-GAAP) saw a near doubling, with a 99% uptick to $301 million.

- Hello

Source link

#Robinhood #sets #Revenue #Profit #records #driven #Interest #Crypto #Trading