Skyrex’s Comprehensive Guide to Mastering Elliott Wave Analysis in Crypto Trading for BTCUSDT on Binance — TradingView

“`html

It’s not uncommon to encounter discussions about Elliott waves within financial circles, and yet many cryptocurrency traders shy away from this complex and subjective method. The incredibly nuanced landscape of crypto trading poses enough challenges for beginners, even without delving into the intricacies of Elliott waves. From our initial experiments incorporating it into our trading strategies, we faced disappointment and temporarily abandoned the concept, believing it to be ill-suited for both automated and manual trading protocols. Instead, we focused our efforts on creating a crypto trading algorithm grounded in the principles of linear programming.

While we were preoccupied with perfecting an automated trading bot using traditional indicators and understanding key levels of support and resistance, top-tier crypto traders were adeptly integrating Elliott wave analysis into their successful strategies. This observation propelled us to revisit and rigorously study the vast literature on Elliott waves. Our profound engagement with the subject led to a critical understanding: Elliott waves, if not corroborated by specific indicators, could potentially dismantle one’s trading outcomes. However, enriched by two years of practical experience and almost a year of application within our algorithmic trading model, we’re proud to share an unparalleled guide on Elliott waves. Drawing from our unique insights, this guide is designed to optimize your crypto trading strategies through adept application of Elliott wave theory.

Importance of Utilizing Elliott Waves

Why should we invoke map analogies when discussing Elliott waves? Just as a map is essential for navigation to a precise destination, the Elliott wave framework provides a “chartmap” for market price movements. One might argue that typical technical analysis, such as using indicators or identifying support and resistance, does not yield definitive directional predictions for price action. For instance, the commonplace strategy responding to a Stochastic Oscillator crossover or an RSI hitting an oversold area is to open a long position. This strategy operates akin to a “blind kitten”; it may yield results with sound risk and money management, yet it lacks the depth of insight provided by Elliott wave analysis. Incorporating Elliott waves into your trading can dramatically bolster profits, even when combined with standard strategies, primarily because Elliott waves reflect the intrinsic structure of the markets. With this knowledge, you’re empowered to deploy your signals judiciously and recognize when it’s more prudent to forego a trade.

A Deep Dive into Elliott Waves

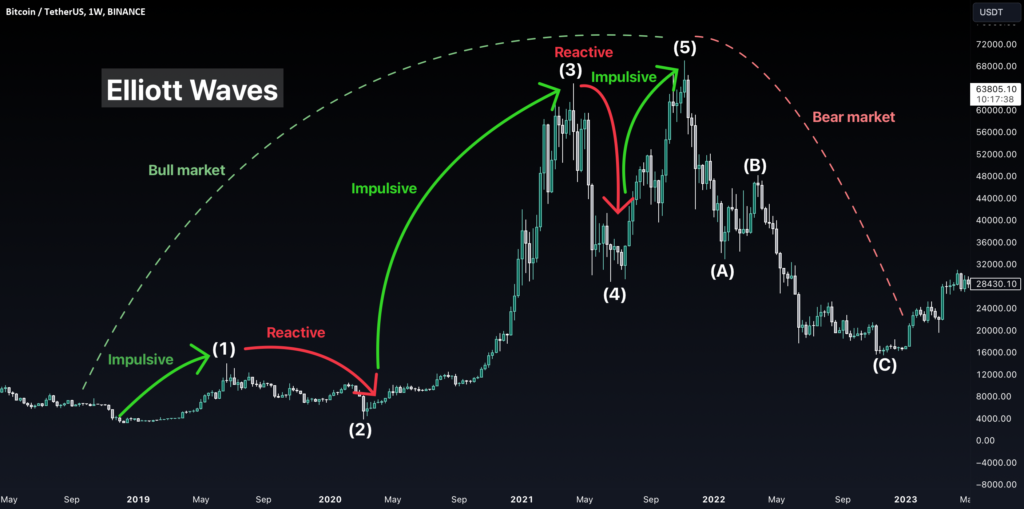

Elliott wave theory simplifies market movement patterns: markets typically trend upwards in a five-wave sequence before correcting through counter-trend waves. The concept separates waves into ‘impulsive’ waves, driving the market’s primary direction, and ‘corrective’ waves that counter this direction. Specifically, during a bullish phase, waves 1, 3, and 5 are impulsive and carry the trend forwards, whereas waves 2 and 4 are corrective and offer breathers in the upward propulsion. The bearish phase mirrors this as ‘A’ and ‘C’ take the role of impulsive waves, and ‘B’ serves as the corrective wave.

Key Signals Indicating the End of Waves

Identifying the culmination of each wave in the Elliott wave structure is critical. We employ a combination of tools, such as the Awesome Oscillator, Market Facilitation Index (MFI), Fibonacci retracement and extension, along with Fractals. These tools provide signals to determine the termination of waves:

- A divergence in the Awesome Oscillator indicates a potential end to the trend.

- Fractal formations at peaks or troughs provide confirmation.

- The MFI ‘squat bar’ signals the end of a wave with a high probability.

- A change in momentum, as evidenced by a shift in the AO histogram color.

- Fibonacci levels can suggest likely reversal areas.

With these foundational rules in place, we can dissect each wave in the context of the market’s behavior. What follows is the sequence of the waves—1, 2, 3, 4, and 5— each with its unique characteristics and potential for profit. Corrections after the initial five-wave trend vary in complexity and form, including Zigzag ABCs, Flats, Irregulars, and Triangles. Each offers distinct trading opportunities and challenges. Mastery of wave analysis encourages precise market entry and exit, dramatically affecting one’s trading efficacy.

What remains is to transfer this theoretical knowledge into practical execution within the markets. Your newfound comprehension coupled with experience will be the key to triumphant trading.

“`

Source link

#ultimate #guide #Elliott #waves #crypto #trading #BINANCEBTCUSDT #Skyrex #TradingView