The Commodity Futures Trading Commission Investigates Jump Crypto

The regulatory body, Commodity Futures Trading Commission (CFTC), is presently conducting an inquiry into the operations of the trading enterprise Jump, stationed in Chicago, which extends into the realm of cryptocurrency. This covers a review of their investment initiatives and trading activities, as noted by an individual acquainted with the investigation.

Even though the investigation itself does not presuppose any misconduct, it occurs amidst a period of significant upheaval over the past three years for Jump. Renowned for its proficiency in algorithmic trading, Jump has lately been recognized as a dominant player in market-making and investing within the crypto sector. Yet, the firm has encountered several hacking incidents and setbacks, leading to a reduction in its cryptocurrency endeavors. This includes the divestiture of two prominent projects and withdrawing from the Bitcoin ETF market.

Both the CFTC and Jump have refrained from issuing any comments on the matter.

Challenges in Trading

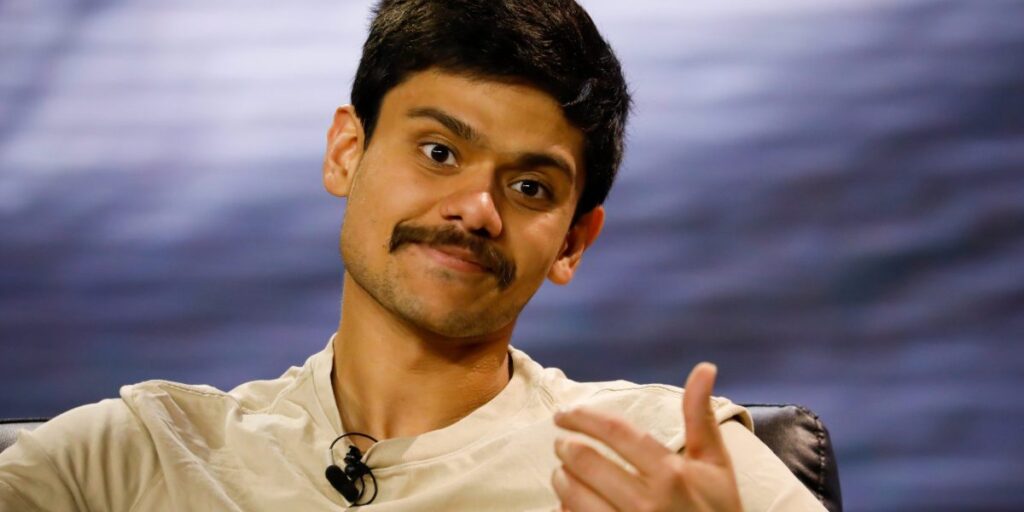

Historically recognized as a powerhouse in high-frequency trading, Jump gained significant media attention when it announced its cryptocurrency division, Jump Crypto, in September 2021 through a public release, although it had been active in the sector for a while. Kanav Kariya, who was appointed president, rose prominently within the industry as a result.

Contributing significantly to the emerging crypto market, Jump has served as a principal market maker on various exchanges and collaborated with crypto projects to inject liquidity into newly issued tokens. Its investments also positioned the firm as a leading venture capitalist in the market, with efforts extending to incubation and development of significant initiatives like Wormhole, Pyth, and Firedancer.

Nevertheless, Jump’s robust operations started showing vulnerabilities, highlighted by events such as the $325 million Wormhole platform hack. Jump’s substantial financial foundation allowed for a swift resolution to this breach. The firm’s tie to FTX, serving as its major market maker, led to a reported loss of nearly $300 million after FTX’s downfall, chronicling the event.

Further dilemmas surfaced with the SEC’s February 2023 legal action against Terraform Labs and its founder Do Kwon over the TerraUSD stablecoin debacle. Through media investigations and court documents, it was disclosed that Jump was implicated in supporting the coin’s stability. The SEC in its lawsuit accused Terraform and Kwon of fraud, however, Jump did not face any formal accusations.

Within the context of Justice Department’s criminal charges against Kwon, Jump appeared mentioned yet again as a prominent trading entity that helped sustain Terra’s peg. Similar to the SEC case, Jump was not accused of any legal violations.

The CFTC’s examination into Jump’s dealings in cryptocurrency could be seen as the most recent of federal inquisitions; whether any indictments will emerge against the firm remains unclear. With the regulatory scope of the CFTC covering derivatives and commodities in addition to the SEC’s oversight of securities, CFTC Chair Rostin Behnam has indicated a forthcoming wave of strict regulatory enforcement within the cryptocurrency domain.

As part of standard procedure, regulatory authorities often conduct investigative diligence on entities under their oversight. For instance, Fortune reported that the SEC had been issuing subpoenas to crypto firms concerning their interactions with the Ethereum Foundation without having filed any charges to date.

Source link

#CFTC #probing #Jump #Crypto