This Week’s Bitcoin Trading Strategy Amid Anticipation of Interest Rate Reduction

Anticipation builds as the Federal Open Market Committee (FOMC) schedules a meeting on Wednesday, September 18, which may lead to the first interest rate reduction in quite some time. Such a move is expected to have a significant impact on financial markets, including influential assets such as Bitcoin (BTC), underscoring the importance of having a strategic approach for the week’s trading activities.

With this backdrop, CrypNuevo disclosed his strategy for trading Bitcoin this week, sharing his expectations for market movements. He anticipates BTC to oscillate near its current price level until the committee’s gathering.

“I surmise that the price will establish a range here, with potential false breakouts/traps preceding the event. Here’s why I foresee a possible upsurge to around $61.6k before a decline in the latter part of the week.”

– CrypNuevo

The expected price swings and a potential ascent to $61,600 preceding a substantial downturn are visualized next.

Bitcoin (BTC) Trading Plan and Price Assessment

The seasoned trader envisages a challenge of two key liquidity zones this week, potentially affecting both long and short Bitcoin traders. Presently, Bitcoin’s spot order books seem to indicate a stronger likelihood of an upward movement first.

CrypNuevo predicts a surge up to $61,600, which may heighten the risk of liquidations on the downside. At the time of this writing, the bearish objective stands at $56,600, just beneath a support level.

In essence, he anticipates a minor 25 basis point (bps) rate cut as the trigger for the initial price target. Post-announcement, he expects a cautious tone in Jerome Powell’s address may cause disappointment in the markets, leading to a reversal.

“Ideally, I’d like to see the price maintain its range with an upward thrust to that $61,350 – $61.6k zone before or during the FOMC announcement. Following a likely 25bps cut, if Powell adopts a somewhat hawkish stance in his communication, it could dampen market sentiment… prompting a price reversal.”

– CrypNuevo

FOMC’s Rate Cut Decision and Its Impact on Bitcoin

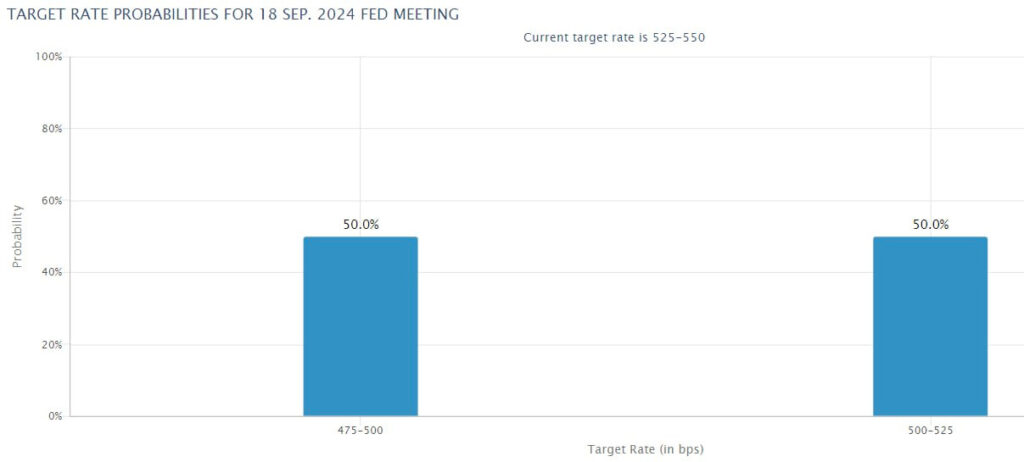

Notably, CrypNuevo points out an even split in probability between a 25 bps or a 50 bps decrease. A 50 bps cut could be perceived as a precursor to a recession, potentially having a bearish effect on the market.

However, it is often observed that lower interest rates tend to devalue the dollar and benefit risk-on assets like Bitcoin.

Other market analysts have indicated a bearish outlook contrary to the prevailing retail sentiment of a bullish week. Specifically, Credible Crypto and Alan Santana have projected that Bitcoin might experience further decline prior to reversing into an uptrend, as reported by Finbold.

Disclaimer: The information provided here is not investment advice. Investment activities are speculative and carry a risk of capital loss.

Source link

#Heres #Bitcoins #trading #plan #week #Interest #rate #cut #incoming

(@CrypNuevo)

(@CrypNuevo)