Trading Volumes on CEXs Dip in Challenging September

- Centralized exchanges experienced a dip in trade volumes by 19-22% during September 2024, showcasing the impacts of seasonal trends and economic factors.

- Amidst a general downturn, Crypto.com sees a surge in trades, whereas platforms like KuCoin, Coinbase, and BitMart witness significant reductions.

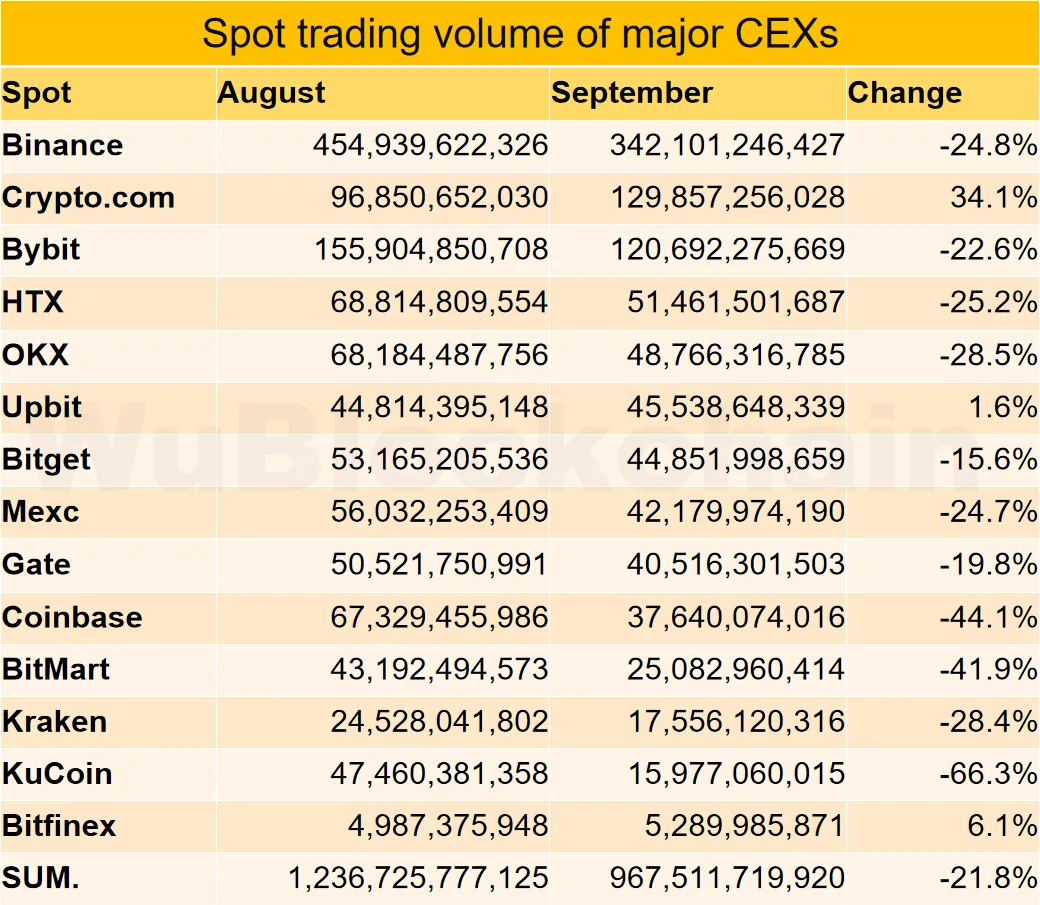

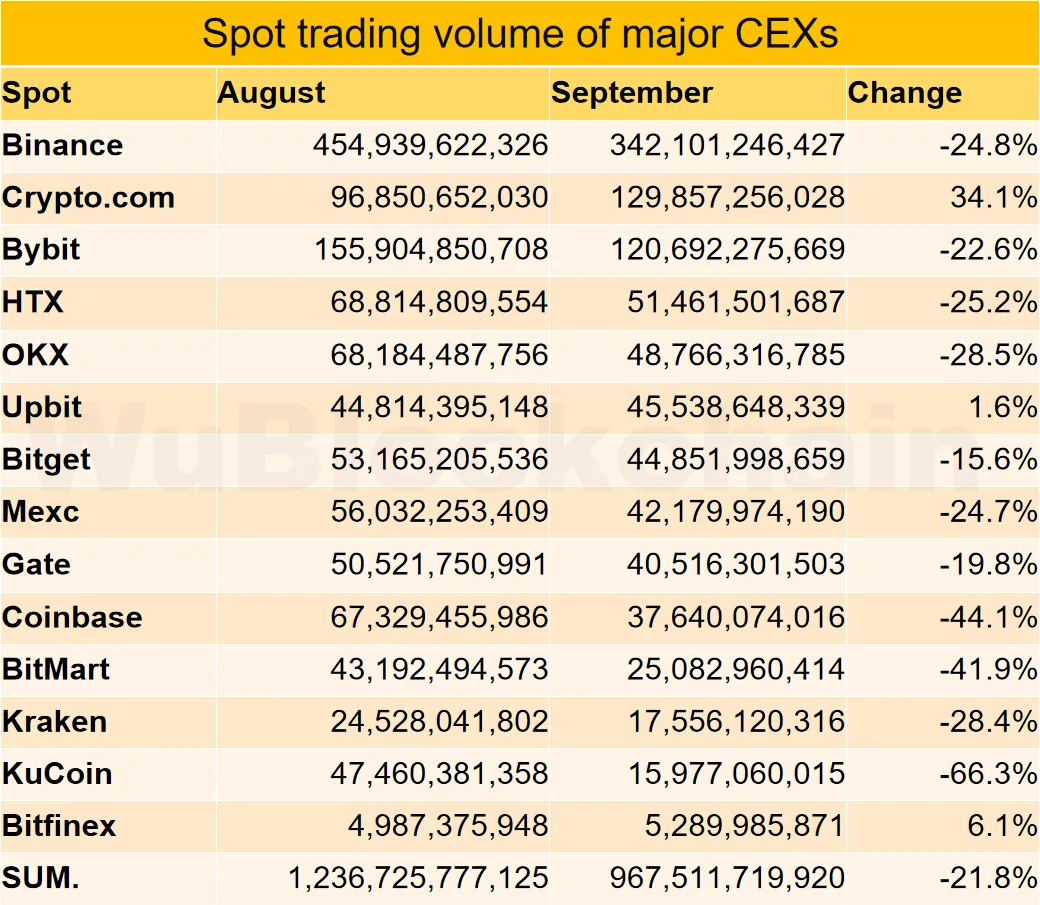

In September 2024, the landscape of centralized cryptocurrency exchanges (CEXs) encountered a noticeable decline, with a collective decrease in spot trading volumes by an approximate range of 19–22% in comparison to the preceding month. This downturn indicates the weakest trading activities since the latter part of 2023 and highlights the broader context of reduced engagement in the sector.

A portion of the market, including Binance, endured sizably reduced trading across both spot and futures. As recorded, Binance’s trading for spots plummeted to 22.9%, translating to a $344 billion loss, and its derivatives markets followed a comparable downtrend. The outcome pushed its market share to a nadir unseen since 2020, poignant of the hurdles faced by major incumbents in this arena.

Varied Outcomes Amid Economic Slowdown: Crypto.com Bucks the Trend

Despite the prevalent downturn, certain exchanges displayed resilience. For instance, Crypto.com’s striking uptick of 34% and 42.8% in spot and futures volume, respectively, stood in contrast to the common trend.

This notable performance uplifted Crypto.com to becoming the fourth biggest central exchange by volume. Its gained edge can be attributed to its targeted approach at acquiring new institutional clientele and tapping into the advanced retail trader segment.

Growth numbers of 6% and 2% for Bitfinex and Upbit, respectively, also register on the radar, adding layers to the prevailing market complexity.

In contrast, the narrative wasn’t as kind to some. KuCoin, Coinbase, and BitMart were amongst those most adversely affected, with volume contractions of 66%, 44%, and 42% respectively. These figures underscore the disparate impact of market forces on different trading entities.

Macro-economic volatility and typical seasonal behaviors contribute to the overall slump in trade participation. The trading adage “sell in May and go away” has been suggested as a contributing factor with the traditional reduction in market participation extending into September.

Tensions rising on the geopolitical stage, particularly in anticipation of the U.S. elections, contribute to investor hesitancy and a drained market sentiment.

Influence of Federal Policies and Decentralized Exchange Growth on Market Trends

The Federal Reserve’s monetary strategies have notably affected investor sentiment. The market aims for optimistic turns, such as awaited interest rate reductions, as investors take a more cautious stance.

As a result, centralized exchanges grapple with constrained liquidity and diminished trading volumes. Despite Bitcoin’s resilience, rising 8.4% in September, the overall slump remained as indicated by subdued trading volumes on major exchanges, signifying market participants were reticent about re-engaging extensively.

Derivatives markets too had not been spared, evidencing a 16.9% fall to a $3.07 trillion volume, contributing to the overarching decline in CEX operations. The combined decrease in spot and derivatives trades reduced the sector’s performance, causing skepticism on a market upturn around year’s end.

History suggests the final quarter usually witnesses an upswing in trading, especially if certain economic stimuli, such as interest rate alterations, come into play.

The advancement of decentralized exchanges (DEXs) adds another layer to CEXs’ challenges. These platforms have gained favor for their distributed frameworks and privacy features, accruing a steady rise in market share despite CEX volumetric contractions.

This shift partly mirrors a strategic pivot to decentralized substitutes due to inadequacies observed in centralized entities over recent years.

DEXs also benefit from facilitating access to a broader asset array, prompting a subset of traders to prefer these decentralized avenues, further straining CEX volumes.

Prospects of Recovery in Changing Economic Climate

Market pundits theorize a potential scenario shift as global financial policies evolve. The Federal Reserve’s interest rate decrease in mid-September 2024 could potentially rejuvenate market activity, spurring investments back into cryptocurrencies and other high-risk assets.

Traditionally, such reductions lead to greater liquidity, which could catalyze revived trading within the crypto space. Expectations are tilted towards a resurgence in trade volumes as we approach the year’s conclusion, with the wider economic conditions potentially aligning with a renewed appetite for risk.

Meanwhile, novel developments within the crypto industry may alter the dynamics amid exchanges. As previously pointed out, Binance is supporting Orion Protocol’s migration to the new Lumia blockchain between October 15 and October 18, 2024. ORN tokens will convert to LUMIA on a 1:1 basis, and existing trading pairs will be retired in this shift.

This marks Binance’s continual support for critical blockchain transitions amidst broader market challenges. Such progressive moves could sway market sentiment, possibly reshaping the competitive landscape as we advance into the year.

Source link

#CEXs #Faced #Tough #September #Trading #Volumes #Declining