Experience complimentary access to top ideas and insights — carefully curated by our editors. Caitlin Long originally aimed to be...

```html Apr 17, 3:36 am The Block South Korean Won Overtakes U.S. Dollar as Leading Currency in Crypto Transactions Kaiko,...

An Experience Centre (MEC) dedicated to the Metaverse has been established in Noida by Indian metaverse research and advisory firm...

PayPal announced that it will no longer offer buyer and seller protection for transactions involving NFTs from May 20, marking...

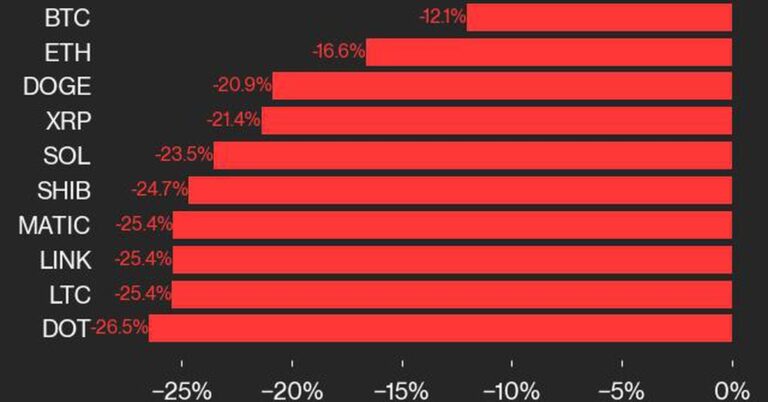

Bitcoin is currently trying to stay afloat amid geopolitical tensions that have triggered a sharp decline in the flagship crypto’s...

Certainly! Here's the rewritten content with the HTML tags preserved: ```html Chicago, USA, April 17th, 2024, Chainwire Liquid Mercury, an...

Exploring CryptoSlate Alpha Unlock exclusive content and enhance your web3 experience with CryptoSlate Alpha, provided via Access Protocol. Discover more...

Last updated: April 16, 2024 17:27 EDT | 2 min read Grant Martin, the former Chief Compliance and Ethics Officer...

```html Trading in cryptocurrencies has seen the South Korean won outpace the U.S. dollar as the primary currency globally. A...

The CoinDesk Indices (CDI) provides a bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk...