Meta’s $10B metaverse funding is ‘not enough’ in accordance with Animoca Brands’ Yat Siu • TechCrunch

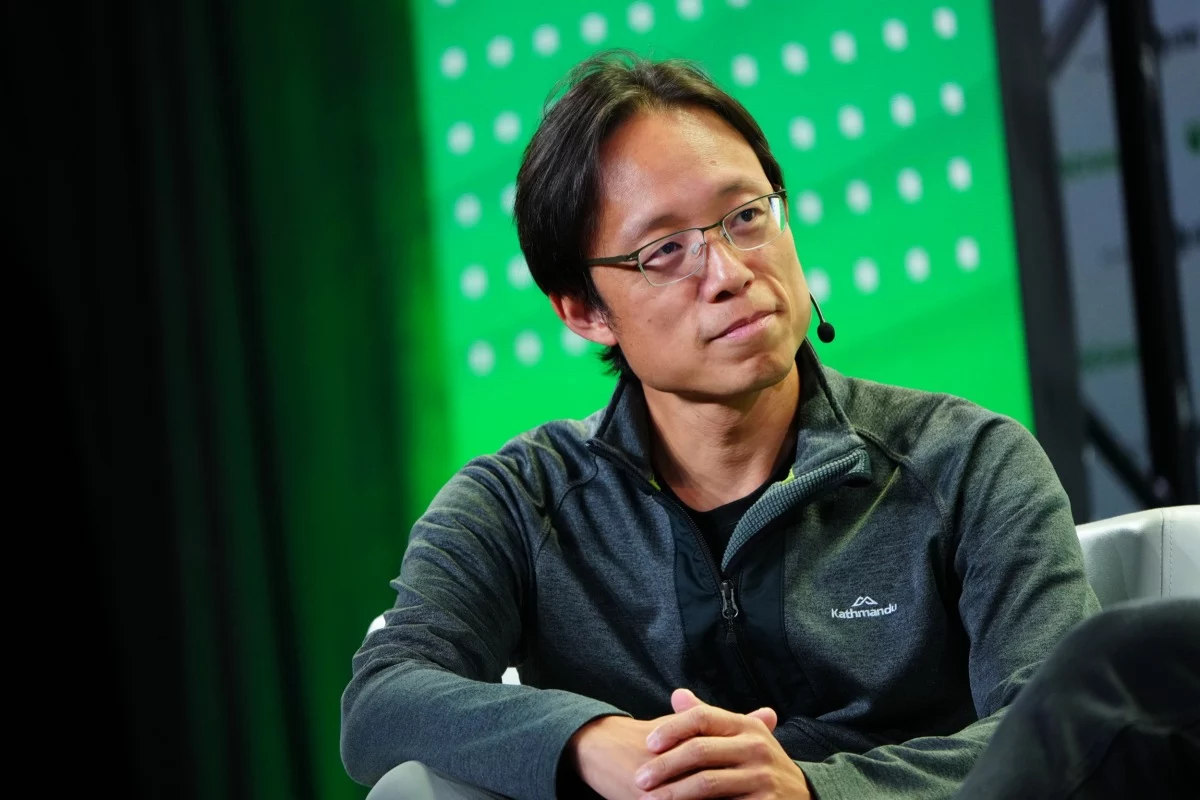

Yat Siu, the co-founder and govt chairman of Animoca Brands, has plenty of ideas in regards to the metaverse. That’s as a result of his firm owns The Sandbox and has investments in many various web3 firms, akin to OpenSea, Dapper Labs and Axie Infinity. At TechCrunch Disrupt, he shared his ideas about Meta’s tackle the metaverse.

They mentioned they’re going to spend $10 billion a yr to make the metaverse work. Nicely, right here’s the factor — we expect $10 billion will not be sufficient for Fb to succeed. Billions of {dollars} are transacted within the open metaverse area — really rather more when you think about fungible tokens. Many of the worth goes to the top consumer, so why would I transact on one thing like Meta — no matter its visuals — when I’ve to offer half of it to the platform?

Whereas if I take advantage of Sandbox, I get 95% of it. It simply doesn’t make any sense for me to try this, economically talking. And since billions of {dollars} of worth are already generated in an open approach, why would I give up that worth? So Fb would have to spend so much extra to incentivize folks to enter its platform.

However that doesn’t imply that Zuckerberg is the fallacious individual to go up this challenge. “I would say that certainly Zuckerberg did get it right in terms of construction. Remember, he tried to put out Libra, right?… So he understands blockchain,” Yat Siu mentioned.

However what’s the metaverse precisely? Lots of people are nonetheless arguing about that. Some folks assume it’s on-line universes, whereas others assume it includes digital actuality. In line with Yat Siu, the important thing factor that makes a metaverse a real metaverse is property rights.

“Just how George Washington said that you can’t have basically, freedom without property rights, we think the same is true with digital. You can’t have digital freedom without digital property rights. So our perspective on the open metaverse is that it has to start with a foundation of ownership. And that’s where The Sandbox stands out,” he mentioned.

Animoca Brands is far greater than The Sandbox. There are 380 firms within the group and portfolio. Thirty of them are subsidiaries. Animoca Brands is technically an Australian firm with a headquarters in Hong Kong and practically a thousand staff.

It’s fairly straightforward to sum up Animoca Brands’ technique. The corporate is investing within the web3 ecosystem as a result of there are some sturdy community results. It’s betting on a web3 rising tide that would carry all boats.

“The economy activity around the ownership of cars is much bigger than the sales of cars,” Yat Siu mentioned. He talked about Uber, Lyft and automotive washes as examples of companies that work with out promoting vehicles.

“For instance, when we made our first check in OpenSea, which had a very small valuation back in 2018–2019, it wasn’t because we hoped that OpenSea would be a decacorn,” he mentioned. “We did it because OpenSea had lots of NFT work and relatively good NFT volume. We would help push that and we would have our own NFT sales and every company we invest in could sell on OpenSea.”

In different phrases, if web3 turns into an enormous factor, it’s clear that Animoca Brands is effectively positioned to develop into a key participant within the area.

Source link

#Metas #10B #metaverse #funding #Animoca #Brands #Yat #Siu #TechCrunch