Revisiting the Metaverse: A Recap of Cryptocurrency Trends

The metaverse, once hailed as the future of digital by giants like Meta, now appears to have vanished. As investments shift heavily towards artificial intelligence, the question arises: is the metaverse still a project for the future, or have we already moved on from this vision of an immersive virtual world? We delve into this discussion in Crypto Analysis, following this week’s important news.

Block 1: Essential news

Will Tesla sell its bitcoin stocks?

Tesla has transferred all its BTC (around $760 million) to seven new addresses, marking the company’s first interaction with its bitcoins in two years. The reason for the transfer remains unknown, but it could be a security measure or a possible sale. Tesla, a fervent supporter of the crypto-asset with a $1.5 billion purchase in 2021, has since reduced its holdings from 43,000 BTC to less than 10,000. Tesla remains the 4th-largest listed company holding BTC, behind MicroStrategy, MARA (formerly Marathon Digital), and Riot Platforms.

Salvador: Bitcoin isn’t that useful?

In El Salvador, despite the adoption of bitcoin as the official currency in 2021, 92% of residents don’t use the cryptocurrency, according to a recent survey. Although President Nayib Bukele is popular and credits bitcoin with improving the national economy, the majority of Salvadorans don’t see cryptocurrency as essential to the country’s future. Only 1.3% of respondents believe that bitcoin should be a future priority, preferring improvements in education and industry. BTC serves primarily as a store of value rather than a retail currency in El Salvador.

Trump’s crypto project a Flop?

The launch of the WLFI cryptocurrency, backed by Donald Trump’s sons’ World Liberty Financial project, got off to a rocky start, with just 610 million tokens sold, or 3% of the 20 billion on offer. In one day, only $9.15 million was raised, well short of the $300 million target. The pre-sale was also marked by technical problems making access to the site difficult. To stimulate sales, a 1.5x multiplier was introduced for the final hours of the pre-sale. The project aims to distribute 63% of the tokens to the public.

MicroStrategy wants to become a “Bitcoin bank”.

MicroStrategy, headed by Michael Saylor, aims to become a “Bitcoin bank” valued at $1,000 billion. Its strategy is based on the accumulation of Bitcoins, with currently 252,200 BTC, and the creation of financial instruments linked to the cryptocurrency, such as stocks and bonds. Saylor expects the rise in the BTC price to play a central role in achieving this goal. MicroStrategy has already raised funds via several bond issues, which it is using to buy more BTC.

Block 2: Crypto Analysis of the week

The metaverse (already) no longer exists?

It all began in October 2021 when Facebook transformed itself into Meta, marking the company’s transformation towards its meta-verse vision. Mark Zuckerberg presented an ambitious vision of a vast virtual universe where people could work, socialize and, above all, consume. With Reality Labs, Meta’s subsidiary dedicated to the metaverse and augmented reality (AR), Meta has invested no less than $13.7 billion by 2022 – more than Mauritania’s annual GDP – to make this vision a reality. At the time, enthusiasm was contagious. Major brands like Gucci and Tiffany & Co. quickly jumped into this new space, seduced by the promise of new experiences and staggering profits. Gucci sold a virtual bag for $4,100, and Tiffany & Co. raised $12 million selling NFT virtual necklaces.

Luxury brands, often late adopters of new technologies, saw in the metaverse a unique opportunity to combine their exclusivity with Web3 values, attracting customers eager for unique and exclusive experiences. Sales of virtual goods took off. However, as quickly as the enthusiasm had built up, it dissipated. Horizon Worlds, Meta’s flagship platform, turned out to be a ghost town. By the end of 2022, Decentraland, another major player in the metaverse, had just 38 active users in a 24-hour period, despite a market valuation of $1.3 billion. More globally, by 2024, land values in the various “metaverse platforms” are in freefall, down 72% from their peaks in 2021.

Land prices on the main virtual platforms

CoinGecko

This also coincides with the downward trend in Google searches for the term “Metaverse”.

Search for “Metaverse” on Google

CoinGecko

The companies that had invested heavily in these virtual worlds soon realized that the audience was not there in the end. A similar mistake had already been made with Second Life in 2007, when companies such as IBM and Microsoft created virtual “islands” before quietly withdrawing in 2010, calling the experiment a costly mistake. This disappointment was repeated with the metaverse, where companies spent millions without understanding that their audience simply wasn’t there.

Faced with this reality, Meta and other tech giants began focusing their capital on artificial intelligence, following the rapid rise of ChatGPT in late 2022. S&P 500 company conference calls largely ignored the word “metaverse” in 2023, in favor of increased mention of AI.

Even the big brands that had bet on the metaverse have gradually shifted to artificial intelligence or augmented reality (AR). Meta, for example, launched its smart glasses in partnership with Ray-Ban, and Apple unveiled its Vision Pro, capable of switching between AR and virtual reality (VR). Snap continued to develop its AR glasses, and Google even teased new AR glasses. The concept of “phygital” also emerged, combining physical and digital experiences, in response to consumer expectations.

Some companies, like Coca-Cola, quickly pivoted to generative AI. Pratik Thakar, former head of metaverse at Coca-Cola, became global head of generative AI in 2023. Disney, after closing its metaverse division, launched an AI task force, marking a new turning point in the industry.

Zuckerberg seems to have finally understood that the majority of users don’t want to live inside a computer – or in 2.7kg virtual reality headsets. After the failure of virtual reality with the metaverse, Meta has subtly adjusted its approach, repositioning the metaverse concept as an experience accessible via augmented reality goggles.

A technology that Zuckerberg hopes to see become a mainstream success, unlike virtual reality, which is often deemed too immersive and cumbersome. At the recent Meta Connect conference, he claimed that augmented reality was now closer to Reality Labs’ “dream”, stressing that this was the company’s future direction. But with the colossal investments already made in VR, he has far too much invested to afford to say anything else.

Reality Labs posted an operating loss of $4.48 billion in the second quarter of 2024. Worse: since 2020, a total of over $50 billion has been swallowed up by this division. But as the company explains: “We continue to expect operating losses in 2024 to increase significantly year over year, due to our ongoing product development efforts and investments to further develop our ecosystem.

So is the dream of a fully immersive digital universe dead, or are we simply waiting for technology and user interest to catch up? The answer in a few years’ time (and a few tens of billions of dollars more invested).

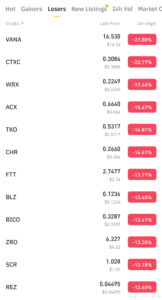

Block 3: Gainers & Losers

Cryptocurrency chart (Click to enlarge)

MarketScreener

Block 4: This week’s readings:

Trumpcoin’s launch goes smoothly (Wired)

What’s with all the pro-Trump venture capitalists (The Atlantic)

Source link

#Remember #metaverse #Crypto #Recap