U.S. State Regulators Ensure Investors in Lydian.World Metaverse Receive Refunds

Securities regulators from 12 U.S. states have come to an agreement to reimburse investors who suffered losses in a scam involving the Lydian.World metaverse, cryptocurrency, and tokenized ownership of a metaverse skyscraper.

The North American Securities Administrators Association (NASAA) disclosed that regulators have finalized a settlement with a consortium of German companies linked to Josip Heit, collectively known as the GSB Group.

As per the settlement terms, GSB Group will refund all funds and cryptocurrency deposited by U.S. investors. The settlement pertains to investors in Alabama, Arizona, Arkansas, California, Georgia, Kentucky, Mississippi, New Hampshire, Texas, Utah, Washington, and Wisconsin.

NASAA and the British Columbia Securities Commission in Canada initiated enforcement actions against GSB Group in November, branding the project as a multilevel marketing (MLM) scheme.

Bloomberg reported that GSB Group suspended investor withdrawals in October, impacting “hundreds of thousands” of investors in the U.S. and Canada.

Joe Rotunda, Texas State Securities Board enforcement director and NASAA vice chairman, remarked, “We have negotiated a settlement that will ensure that all clients in any state or province that join the settlement receive 100% of their deposits, less any withdrawals.”

Investors have 90 days to submit a claim to recover their funds. The German group, claiming to have more than 800,000 investors from over 170 countries, stated that transactions in the scheme were valued at nearly $1 billion.

Regulatory actions against GS Partners

California, Texas, and several other U.S. states pursued enforcement actions against GS Partners in November 2023, alleging the firm of deceiving cryptocurrency investors through schemes involving unregistered digital assets.

State regulators assert that GS Partners, alongside affiliated entities like GSB Gold Standard Bank Ltd., Swiss Valorem Bank Ltd., and GSB Gold Standard Corporation AG, broke securities laws by making false claims and withholding crucial information when marketing these assets.

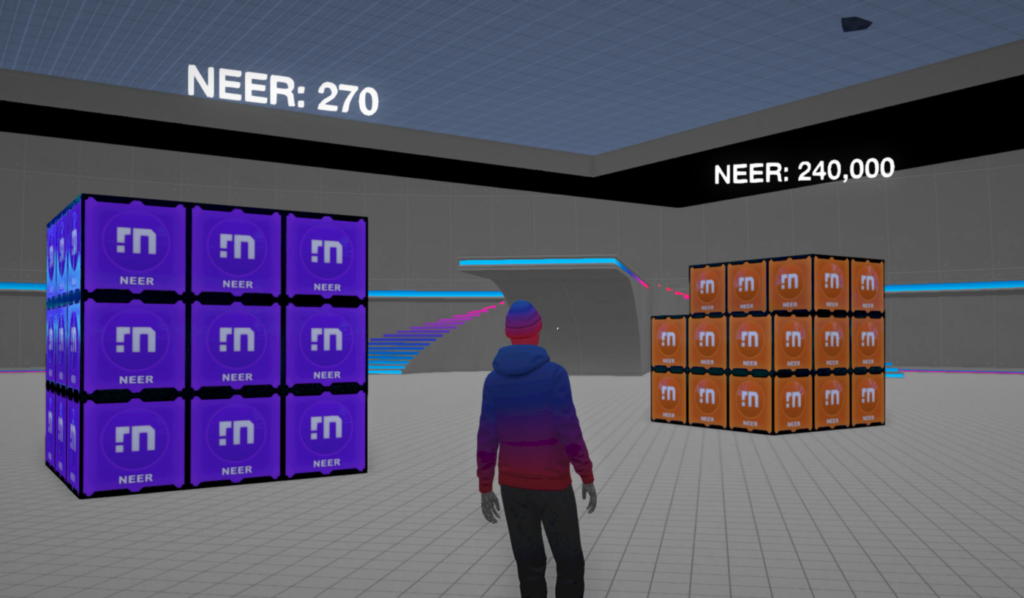

The accusations revolve around GS Partners’ promotion and sale of digital tokens associated with a Dubai skyscraper, metaverse real estate, liquidity pools, and other crypto assets promising high returns.

Authorities claim the company promoted investments in the “G999 Tower,” a 36-story building in Dubai, and in the digital tokens of the metaverse platform Lydian World. These ventures were pitched as exclusive opportunities for generating “lucrative profits” and “generational wealth” reportedly supported by blockchain technology and gold.

In addition, GS Partners allegedly operated a multi-level marketing (MLM) platform selling “MetaCertificates” to investors, which authorities allege were also part of the fraudulent offerings. Regulators accuse the entities, apparently controlled by Josip Dortmund Heit, of orchestrating a widespread crypto investment fraud that poses immediate harm to the public.

State regulators, including those in California and Texas, issued emergency orders for GS Partners to halt operations. Similar actions were taken by authorities in Alabama, Kentucky, New Jersey, and Wisconsin, who allege that the company engaged in deceptive practices by making false claims about the nature and profitability of its crypto investments.

The regulators highlight the use of celebrity endorsements from notable figures like boxer Floyd Mayweather Jr. and soccer player Roberto Carlos to entice investors into the schemes, which they argue had no real intrinsic value.

Source link

#U.S #State #Regulators #Secure #Refunds #Investors #Lydian.World #Metaverse