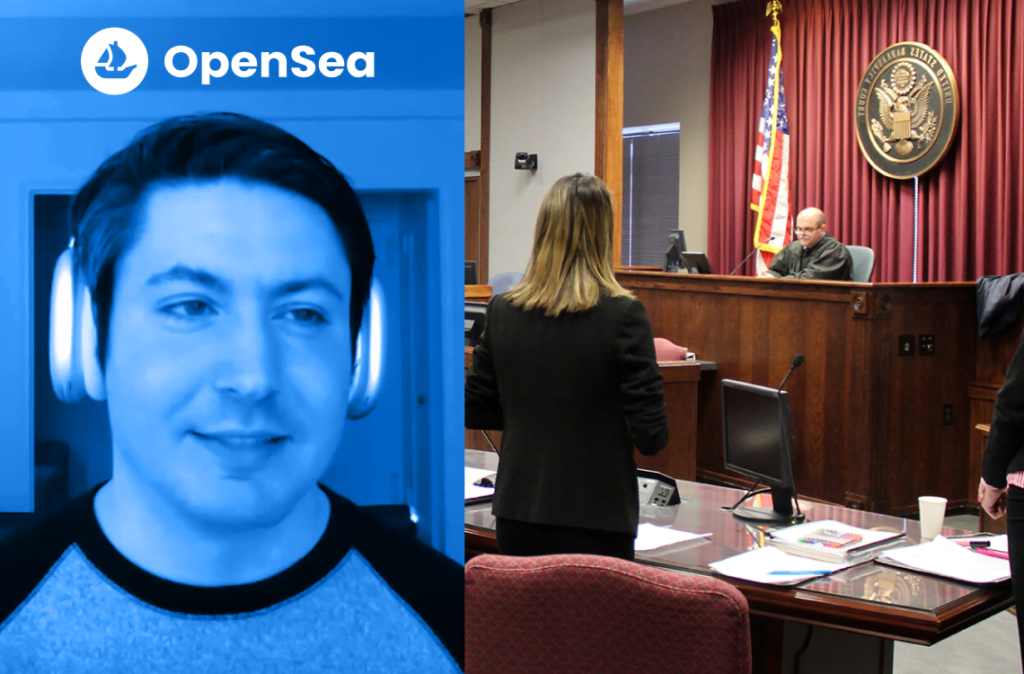

Former OpenSea exec’s NFT insider buying and selling trial has began – Cryptopolitan

The landmark trial of Nathaniel Chastain, a former OpenSea product supervisor accused of insider buying and selling within the burgeoning non-fungible token (NFT) market, has begun in Manhattan.

Prosecutors allege that Chastain took benefit of confidential info to revenue from NFT sales, marking the primary legal insider buying and selling case involving digital property.

The trial’s final result might have far-reaching implications for the broader regulation of digital property and the applying of insider buying and selling concept to new asset lessons.

Prosecutors accuse Chastain of abusing his place

The U.S. Lawyer’s workplace in Manhattan has charged Chastain with wire fraud and cash laundering, alleging that he secretly bought NFTs based mostly on confidential info that they or related tokens from the identical creators can be featured on OpenSea’s homepage.

Chastain was answerable for deciding on which NFTs to function on the platform, and he allegedly profited by promoting his tokens shortly after they have been highlighted.

Prosecutors keep that Chastain “abused that position of trust,” and the trial earlier than U.S. District Decide Jesse Furman is anticipated to final one to 2 weeks.

Protection argues towards classification as NFT insider buying and selling

Chastain’s authorized workforce has argued that his actions don’t represent insider buying and selling, as the knowledge he accessed was not OpenSea’s property and had no inherent worth to the corporate.

Lawyer David Miller, representing Chastain, emphasised that the case doesn’t contain securities buying and selling and expressed concern that referencing insider buying and selling might prejudice the jury.

The protection additionally identified that OpenSea didn’t implement a ban on staff shopping for or promoting featured collections or creators till Chastain’s final day of employment in September 2021, suggesting that the corporate didn’t take into account the knowledge in query to be confidential.

The trial’s final result might probably set a precedent for the way insider buying and selling concept is utilized to digital property that don’t match neatly into present laws.

Philip Moustakis, a former SEC enforcement lawyer and companion at Seward & Kissel LLP, questioned whether or not Chastain’s actions could possibly be labeled as insider buying and selling of any variety, noting that “if this case sticks, there is a precedent that insider trading theory can be applied to any asset class.”

As the primary legal insider buying and selling case involving digital property, the trial of the previous OpenSea government is a high-profile affair with probably wide-ranging penalties for the NFT market and digital asset regulation.

Chastain’s actions, whether or not deemed insider buying and selling or not, will possible immediate additional scrutiny of the burgeoning NFT area and will encourage the event of recent regulatory frameworks to control this quickly rising market.

Source link

#OpenSea #execs #NFT #insider #buying and selling #trial #began #Cryptopolitan