NFT Prices Diverge Sharply as Ethereum ‘Merge’ Mania Intensifies

Prices of Ether and nonfungible tokens that always run on the Ethereum community have diverged sharply as traders snap up the second-largest cryptocurrency forward of the blockchain’s extremely anticipated software program improve.

Ether has soared 54% between June 13 to Aug. 15, in line with knowledge compiled by Bloomberg. NFTs, on common, have declined virtually 19% over the identical interval, in line with researcher NonFungible. Cryptocurrencies hit a low in mid-June, with Ether falling beneath $1,000 on June 18, after the collapse of the Terra blockchain and when its ripple results started to topple hedge fund Three Arrows Capital and lender Celsius Community.

“The usual path was, if Eth went up or down, if Eth goes sideway, then NFTs had room to move,” stated Sasha Fleyshman, portfolio supervisor at funding agency Arca. “Now it’s underperforming under any circumstances — up, down, sideways.”

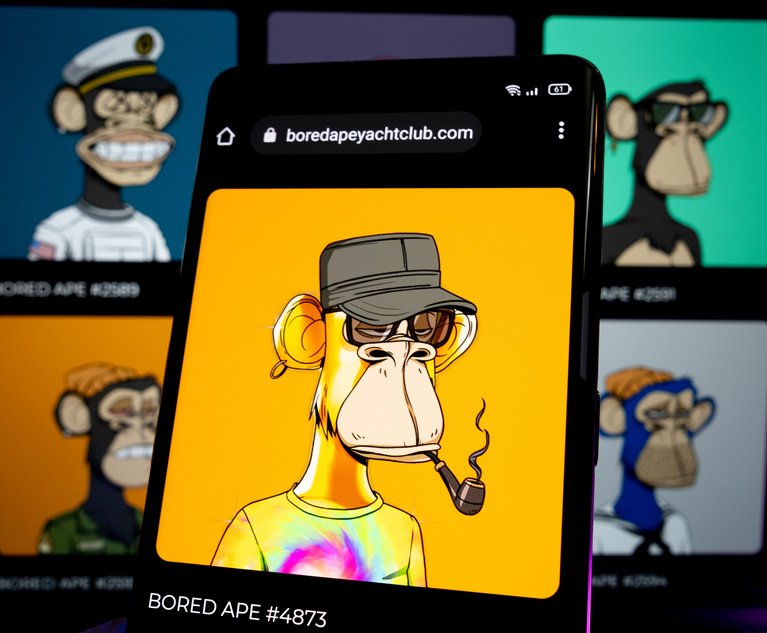

Because the most useful NFTs, equivalent to art work of bored apes and punky-looking characters, are offered for Ether, each usually have a tendency to maneuver in lockstep. Up to now, NFTs typically haven’t fallen as sharply as Ether and have, at instances, appreciated greater than the token, Fleyshman stated.

That has modified as traders have piled into Ether with hopes that it’ll proceed to understand forward of the software program improve often known as the Merge. The improve is predicted to happen in September after being kicked down the highway for a number of years. Ether holders are additionally desirous to get any extra cash that might outcome from offshoots from the primary Ethereum chain across the Merge.

However there’s no incentive to scoop up NFTs.

As an alternative, curiosity in NFTs has continued to wane and buying and selling volumes have dropped precipitously in latest months, in line with tracker DappRadar. The world’s largest NFT market OpenSea, is seeing its lowest month-to-month gross sales in a yr, in line with Dune Analytics.

Many blue-chip NFTs haven’t fared significantly better both. Bored Ape Yacht Membership’s ground value, the bottom value for an merchandise within the assortment, has climbed by lower than 15% over the previous month, in line with tracker NFT Value Flooring. One other common NFT, CryptoPunks, noticed its ground value improve by 13%, in line with the positioning.

Whether or not costs on current NFTs ever come again is unclear, Arca’s Fleyshman stated. The subsequent wave of NFTs whose costs rise may very well be tied to membership memberships, or entry to gyms or golf programs, he stated.

“I’d call this last cycle speculative,” Fleyshman stated. “My hope is that the next cycle would be value driven.”

Olga Kharif studies for Bloomberg Information.

Source link

#NFT #Prices #Diverge #Sharply #Ethereum #Merge #Mania #Intensifies