With the 2024 Bitcoin halving event behind us, it's time to embrace the wealth of opportunities it presents! Bitcoin halving...

NodeMonkes surged to the top of the non-fungible token (NFT) market, recording over US$1.05 million in sales on Thursday, CryptoSlam...

Last updated: April 25, 2024 06:36 EDT | 2 min read The European Union (EU) has formally passed a new...

An enigmatic digital currency investor known as Cyclop has become the center of attention. This investor boasts an impressive financial...

Bitcoin's price reached above $66,000 for a brief period and even attempted to surpass $67,000 on multiple occasions without success....

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of...

Last updated: April 25, 2024 01:27 EDT | 9 min read The text below is a promotional article not affiliated...

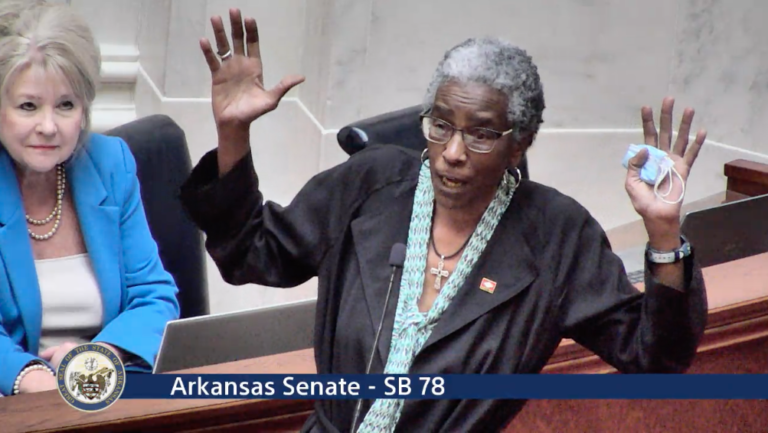

Two bills that would regulate cryptocurrency mining operations in Arkansas passed the state Senate Wednesday and will be considered by...

```html CoinW Exchange, a leading crypto exchange based in Dubai, marked its milestone anniversary with the debut of an innovative...

FC Barcelona is showcasing its first two NFTs, In a Way, Immortal (featuring Johan Cruyff) and Empowerment (dedicated to Alexia...