2023 could also be a do-or-die yr for cryptos. Are traders ready?

After witnessing exponential development in 2020-21, the worldwide crypto market got here to a standstill in 2022 with many occasions bringing consideration to the trade’s flaws.

Indian crypto traders are on the sidelines ready for indicators of a revival in costs of the digital property. They’re possible headed for a troublesome journey, a minimum of within the first half of 2023.

The digital asset market will want extra time to get better from a collection of setbacks, together with bankruptcies, frauds and crash of asset costs amid elevated surveillances by governments around the globe, together with India’s.

After witnessing exponential development in 2020-21, the worldwide crypto market got here to a standstill in 2022 with many occasions bringing consideration to the trade’s flaws.

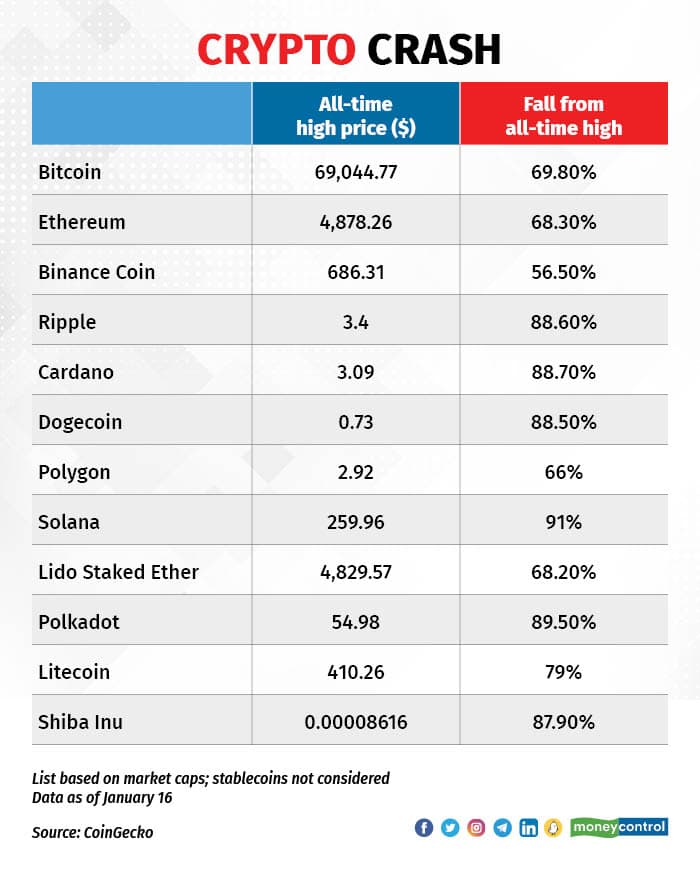

Crypto market capitalisation began reversing from the ultimate weeks of 2021 after reaching an all-time excessive of $3 trillion on November 10, 2021. On November 21, 2022, the market capitalization of cryptocurrencies fell to a 2022 low of $727.58 billion.

“In 2021, a lot of serious investors, such as high net-worth individuals (HNIs) and institutional players, were planning to enter crypto. That process has slowed down, not just because of the bear market, but also because of the catastrophes that we experienced during the last eight months or so starting from Luna, Celsius, Alameda Research, FTX and Genesis to Gemini,” mentioned Anurag Dixit, founding father of Kunji, a crypto asset administration platform that gives predefined funding methods which are actively managed.

The yr that was

Knowledge reveals that 2022 was the second-worst single-year efficiency for Bitcoin since 2011 when it comes to each year-on-year (-64%) and decline from an all-time excessive (-74%).

Also read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemes

Crypto property have been a sufferer of worries over inflation and rates of interest after the Ukraine-Russia battle broke out. The issues aggravated with the downfall of Terra Luna in Could.

Based on Kunji, whereas the preliminary impression of Terra Luna’s collapse was immense, the downfalls and bankruptcies of crypto entities that adopted it have been catastrophic, and the fallout from the latest FTX-Alameda collapse was nearly unexpected.

“It wasn’t just a downfall but an enormous breach of ecosystem-wide trust,” it mentioned in a latest report.

The downward spiral in cryptos started in November 2021 as expectations of the US Federal Reserve specializing in rate of interest hikes, inflation and tapering asset buy triggered a risk-off on international property.

Many crypto lenders together with BlockFi, Three Arrows Capital, Voyager and Celsius Community have been a part of the collateral harm to the crypto market crash in 2022.

Cryptocurrencies suffered some sizable losses. Cardano (ADA) fell by 85 p.c and Solana (SOL) by 94%. Each dropped out of the highest ten cryptocurrency rankings. The unique altcoin (an alternate digital foreign money to Bitcoin), Ethereum (ETH), misplaced 68% of its worth year-on-year.

Crypto laws: Impending risk or unavoidable actuality?

In India, the central authorities has been sharpening its gaze over cryptocurrencies, thanks partially to the fear financing that the crypto world confronts. Pending the Cryptocurrency Invoice that the federal government wished to introduce across the finish of 2021, however didn’t, it taxed digital digital property (in different phrases, cryptocurrencies, non-fungible tokens and so forth) in Funds 2022. That added to the distress of crypto traders.

To make sure, Reserve Financial institution of India (RBI) Governor Shaktikanta Das has additionally repeatedly warned in opposition to the ill-effects of elevated use of cryptocurrencies.

Within the 2022-23 union funds, the federal government had mentioned that good points arising out of crypto property could be taxed at 30 p.c no matter the person’s earnings tax slab fee.

Additional, the losses from one crypto can’t be adjusted in opposition to good points from one other and no carry-forward of losses to future years is allowed.

As well as, a 1 p.c Tax Deducted at Supply (TDS) was made relevant on every switch of such property.

“After the taxation came from April 1 last year, interest in crypto has died down, volumes have died and then this crash also happened in prices. There is a sense of bottom-fishing happening, but it’s not a very confident one,” mentioned Amit Kumar Gupta, founder and CIO, FinTrekk Capital.

All eyes on Funds 2023

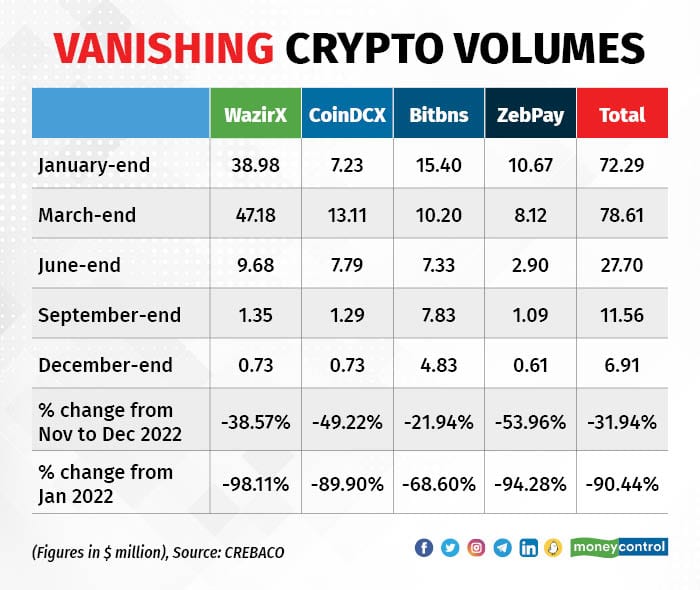

The crypto trade in India got here down crashing in 2022 with buying and selling volumes plummeting round 90 p.c on home exchanges on the again of as much as an 90 p.c drop in asset costs and the brand new taxation coverage for crypto property.

Consultants say that the excessive fee of TDS, which was launched to trace crypto property’ motion, has pushed transactions offshore.

Based on latest analysis by Esya Centre, a Delhi-based know-how coverage assume tank, Indian traders shifted over $3.8 billion in buying and selling quantity from native to worldwide crypto exchanges after the brand new taxation coverage was unveiled.

Now, traders are hoping that Funds 2023-24 supplies them some reduction.

Meyyappan Nagappan, partner-tax, at Trilegal, a regulation agency, believes that decreasing of the TDS is a much-needed step and there’s a chance that we may even see some clarifications on the therapy of cryptos.

“Since the government sees value in blockchain technology and with India well positioned to be the global Web3 hub, it is hoped that the right signal is sent to the market by rationalizing the tax regime for crypto and digital assets. Narrowing and clarifying the scope of virtual digital assets along with ensuring digital assets are treated on par with tangible assets would go a long way in giving confidence to investors and developers,” mentioned Nagappan.

Some consultants don’t see any change in crypto taxation within the upcoming Funds.

“We don’t see much relief in the Budget this year as the impact of the announcements of the last Budget would be visible this year only,” mentioned Sidharth Sogani, founder and CEO of CREBACO, a crypto analysis agency.

2023 forecast for cryptocurrencies

Consultants say that traders who entered cryptos in 2021 are sitting on losses. They don’t wish to e-book the losses and likewise appear hesitant in including to their positions.

A research carried out by the Basel, Switzerland-based Financial institution of Worldwide Settlements, between 2015 and 2022, estimated that 73-81 p.c of traders misplaced cash on their investments in crypto property.

Nevertheless, the crypto market has begun the yr on a promising notice with the value of Bitcoin topping the $21,000 level for the primary time since November 2022.

BlackRock, the world’s largest asset supervisor, getting into the crypto enviornment is seen as a serious increase to the sector. The asset supervisor including Bitcoin as an eligible funding in its funds might speed up the token’s institutional entry into the worldwide market.

Kunji’s Dixit believes that proper now in India there are principally retail gamers. “We expect institutional players to come in when there’s probably more clarity from a market stability and regulatory uncertainty point of view,” he mentioned.

In India, the Web3 trade has set an bold objective of changing into a world hub for Web3, blockchain, and crypto innovation over the following 5 years, with the potential to contribute over $1 trillion to assist India in reaching its objective of changing into a $5 trillion economic system.

Eye on the Fed

“Notably, the trend of crypto adoption and institutionalization has grown and we anticipate that the movement towards DeFi and self-custody will accelerate in 2023 as users look to secure their assets,” mentioned Sumit Gupta, Cofounder and CEO, CoinDCX, a crypto trade.

DeFi is brief for decentralised finance.

One main signal of reversal of the crypto outlook could possibly be the US Federal Reserve stopping rate of interest hikes.

“What has happened is that bonds are giving good money. Till the risk appetite comes back, I don’t think crypto will see any major buying, at least not in the first half of 2023,” mentioned FinTrekk Capital’s Amit Kumar Gupta.

When it comes to costs, Bitcoin may have broken the $21,000 level recently, however sustaining above this zone shall be key for the crypto bulls.

Wall of worries

“The market is expected to remain sideways till second half of the year. At most on the upper side, BTC is likely to hit $21,000-23,000 and on the lower side it could be $12,000-13,000 levels. For the next six months, I don’t see either of these levels breaking,” mentioned CREBACO’s Sogani.

After a number of landmine occasions in 2022, the crypto market continues to climb a wall of worries. Contemporary insolvencies, accelerating inflation and Covid-19’s comeback (a minimum of in China thus far) have the potential to trigger appreciable strikes to the draw back.

Whereas 2021 was a breakout yr for crypto, 2022 examined the resolve of traders. Consultants really feel that 2023 will possible be a make or break yr for cryptos.

Source link

#doordie #yr #cryptos #traders #ready