According to OKX, two factors will prompt institutional investors to increase their crypto allocation to 7%

According to a new report from OKX, institutional investors are planning to increase their holdings of digital assets. The report highlights two major factors that will influence the amount they invest.

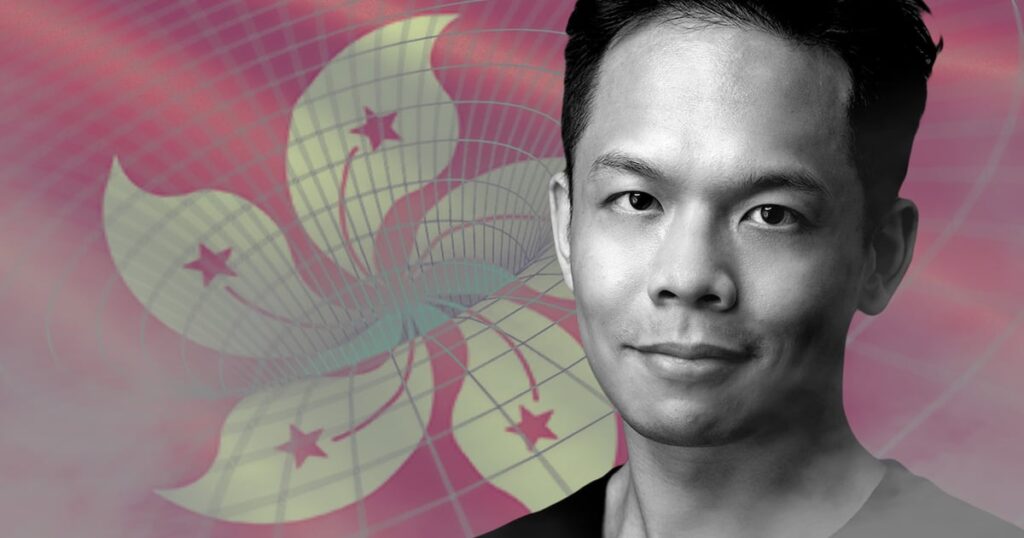

Mainstream institutional investment firms currently do not hold a significant amount of digital assets, but OKX believes this is soon to change. Lennix Lai, global chief commercial officer at the exchange, stated that “Crypto is still considered a frontier asset class” for these investors. However, the report indicates that more investors are looking to add crypto to their portfolios.

While most crypto trading has focused on Bitcoin and Ether, there are now additional options like spot exchange-traded funds, crypto derivatives, and stablecoins. The report notes that the average allocation to crypto in investment firms’ portfolios is around 1%, but some investors plan to increase this to 7% by 2027.

Two key factors will influence investors’ interest in digital assets: better custody solutions and regulatory standards. The emergence of new crypto custodians, with the ability to securely store assets while segregating trading activities, is attracting institutional investment. Additionally, regulatory standards are being expanded to cover digital assets, providing institutions with more confidence in their custodians.

Despite some pushback from industry giants like Coinbase, qualified custodians are becoming trusted partners for institutional investors. These custodians adhere to regulatory standards and provide a secure environment for holding digital assets.

In terms of market movement, Bitcoin and Ethereum are both down around 3.8% in the last 24 hours. Bitcoin is currently trading at $60,034, while Ethereum is at $2,528.

For more market insights, reach out to Joanna Wright, who writes about markets for DL News at joanna@dlnews.com.

Source link

#factors #drive #institutional #investors #crypto #allocation #OKX