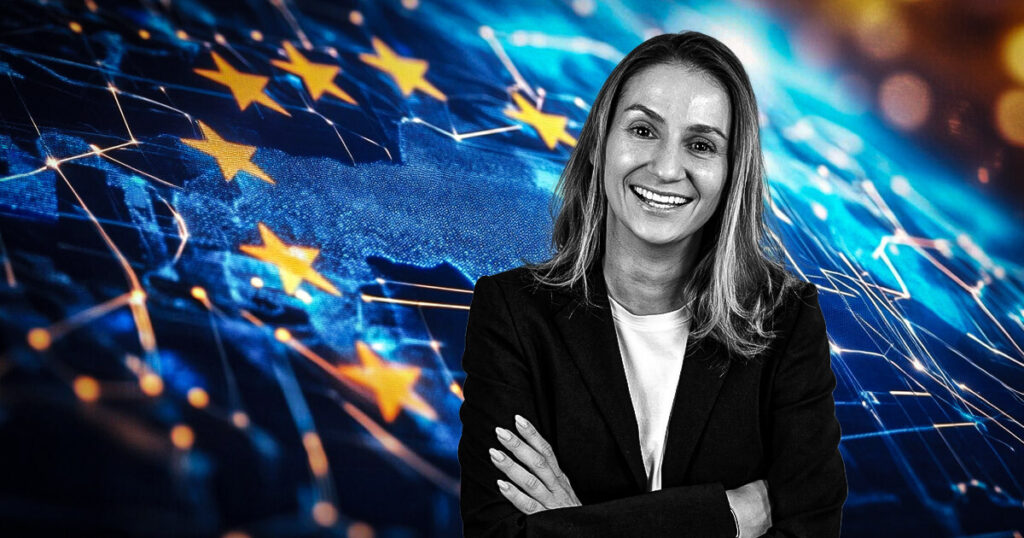

Anastasija Plotnikova Discusses the Future of Global Crypto Regulation in MiCA

In the ever-changing world of digital finance, MiCA (Markets in Crypto-Assets) is poised to revolutionize the regulatory landscape for digital assets. With the rise of stablecoins and increased adoption of cryptocurrencies, MiCA presents both challenges and opportunities for fintech companies, traditional banks, and stablecoin issuers.

In this exclusive interview, Anastasija Plotnikova explores the impact of MiCA on global policies, cross-border payments, and DeFi integration. She discusses how firms are adapting to stricter regulations and how traditional banks can thrive in this new environment.

Plotnikova also discusses the implications of MiCA for startups and innovation, emphasizing the importance of collaborations between fintech and traditional finance players. As digital assets and compliance technologies merge, this conversation provides insight into how MiCA will shape the future of finance.

How do you see MiCA influencing global regulatory policies for digital assets beyond the EU, and what implications does this have for international fintech companies?

In the past, there have been two main perspectives on the regulation of crypto assets. Some believe that crypto should remain untouched as a separate system from traditional finance, while others argue for clear regulations to protect individuals and businesses. With the increasing adoption of crypto, regulators worldwide are paying more attention to this evolving asset class. This heightened scrutiny is in response to the borderless nature of crypto trading and controversies surrounding initiatives like Diem. As regulations tighten, the impact on crypto firms is becoming apparent, with only well-funded and reputable companies likely to receive licenses.

The implementation of MiCA and similar regulations in other countries is increasing the legal and administrative burden on crypto firms. This may lead to unintended consequences, such as stifling innovation and causing smaller firms to shut down or be acquired by larger ones. M&A activity in the crypto industry is expected to rise in the coming quarters as a result.

With the introduction of MiCA, what challenges and opportunities do stablecoin issuers face, especially in terms of cross-border payments and DeFi integration?

To operate in the EU, stablecoin issuers must be registered as electronic money institutions or credit institutions. While this opens up the potential for regulated stablecoin issuance, it also comes with strict requirements outlined in MiCA. Stablecoins have become essential for global transactions, offering a cost-effective and efficient alternative to traditional banking methods. As stablecoin issuers become regulated, there may be a growing demand for domestic stablecoins within Europe, as well as increased usability for intercontinental trade.

When it comes to DeFi integration, regulated entities may be cautious due to compliance requirements. It is unlikely that regulated stablecoin issuers will engage significantly with DeFi in the near future, as there are uncertainties around client interactions with decentralized platforms. Collaboration between regulators and stablecoin issuers will be key to navigating this complex landscape.

How are traditional banks adapting their strategies to incorporate blockchain and digital assets while complying with MiCA regulations?

MiCA and related regulations put traditional banks in a favorable position, as they are already accustomed to strict regulatory regimes. Banks have the resources and infrastructure to comply with MiCA requirements, and there is growing demand for MiCA-compliant solutions from clients. Banks and brokerages are increasingly looking to implement blockchain and tech solutions to meet client demands and tap into the potential of digital assets.

What innovative collaborations between fintech startups and established banks do you foresee emerging under the new MiCA framework?

Collaborations in software as a service (SaaS) and compliance tools are likely to increase under the MiCA framework. TradFi companies may acquire ready-made solutions from fintech startups to meet regulatory requirements. Tools for transaction monitoring, auditing, and reconciliation will be in high demand in the post-MiCA era, expanding the market for crypto and fintech solutions.

As regulations become more stringent, what strategies should fintech companies employ to scale their operations while ensuring compliance?

Fintech companies will need to focus on compliance and user experience to scale their operations in a regulated environment. The era of rapid growth without regard to regulations is ending, and companies must invest in compliance, security, and user-friendly products to succeed in the post-MiCA landscape.

In your opinion, how will the intersection of digital assets, AI, and compliance technologies shape the future of fintech innovation?

The convergence of digital assets, AI, and compliance technologies is set to transform the financial industry in ways we have yet to fully comprehend. As digital assets become more mainstream, we can expect innovative solutions that blend blockchain technology with traditional finance systems. AI will play a crucial role in enhancing customer experiences and operational efficiency, while compliance technologies will be crucial in ensuring adherence to regulatory frameworks. These advancements will create a secure environment for digital asset trading and DeFi platforms, driving significant growth in the industry.

Given your experience in regulated industries like medical cannabis, what lessons can be applied to scaling blockchain solutions globally under diverse regulatory frameworks?

Experience in regulated industries highlights the importance of compliance and thorough testing when scaling blockchain solutions globally. Neglecting compliance requirements can have serious consequences, and companies must prioritize security and regulatory adherence to protect users. Compliance with AML regulations, in particular, is essential to prevent illicit activities in the crypto space.

How do you envision regulated digital payment ecosystems evolving to reduce friction in international transactions, especially for underbanked regions?

Regulated digital payment ecosystems may not directly address friction in underbanked regions, as stablecoins and crypto assets already offer efficient solutions for international transactions. The implementation of regulation may not significantly impact underbanked populations, as stablecoins have already addressed many payment challenges before regulations were introduced. Stablecoins provide a cost-effective and instant option for global transactions, serving as a valuable tool for individuals and businesses worldwide.

What role do you think embedded finance will play in shaping user experiences in Web3, and how might this impact the broader adoption of digital assets?

Embedded finance offers a transformative opportunity to integrate financial services seamlessly into everyday platforms in Web3. By simplifying financial interactions and making them more intuitive, embedded finance bridges traditional finance with decentralized technologies. This integration makes using digital assets more accessible and practical for users, potentially increasing the adoption of digital assets by making them a seamless part of everyday life.

Connect with Anastasija Plotnikova

Source link

#Navigating #MiCA #Anastasija #Plotnikova #future #global #crypto #regulation