Bitcoin Price Prediction as $10 Billion Trading Volume Comes – Where is BTC Heading Now?

Essentially the most well-known cryptocurrencies, Bitcoin and Ethereum, are ending the week on a bearish be aware, with each cash persevering with to lose worth. Bitcoin not too long ago fell under $28,000, whereas Ethereum has fallen to $1,800.

Though Bitcoin reached $28,500 earlier this week, the rally was short-lived, as the worth rapidly fell. Equally, Ethereum failed to succeed in $1,800 on Sunday morning, inflicting buyers to be involved.

Nonetheless, the explanation for the newest decline might be traced again to the information that Binance, a number one crypto change, is dealing with crypto laws within the US and Dubai.

The Digital Property Regulatory Authority (VARA) in Dubai has informed Binance, which acquired an MVP license from the authority in September 2022, to offer extra details about the corporate’s possession construction, governance, and auditing procedures.

Moreover, the broad-based US greenback has been gaining traction on account of beforehand launched US job data displaying the US financial system is rising, growing the chance that the Federal Reserve must increase rates of interest subsequent month.

This was evidenced by market contributors, who now imagine there’s a 70% probability that rates of interest will rise, which is able to doubtless negatively impression Bitcoin costs.

Binance is Below Regulatory Scrutiny in Dubai and the US, Probably Impacting Bitcoin Prices

As beforehand acknowledged, Dubai’s Digital Property Regulatory Authority (VARA) has ordered the main cryptocurrency change, Binance, to submit extra particulars relating to the corporate’s possession construction, governance, and auditing procedures.

This measure is a part of the UAE metropolis’s try to satisfy the challenges of cryptocurrencies with powerful legal guidelines and guarantee compliance with the best regulatory necessities. Binance administration has stated they’ve offered all important solutions to VARA by means of their regulatory and fiduciary duties.

So, this rising laws limits Binance, which is already below strain from the US Commodity Futures Trading Fee. VARA’s investigation into Binance and different international crypto exchanges will doubtless affect the present Bitcoin value surge as buyers appear cautious because of the elevated regulatory scrutiny.

This might result in decreased demand for cryptocurrencies, finally affecting their costs.

Analyst Predicts Bitcoin Rally to $130K by Yr Finish Utilizing Elliott Wave Idea

In response to a preferred analyst who makes use of a technical evaluation methodology often called the Elliott Wave principle, the worth of Bitcoin may attain $130,000 by the tip of this 12 months. This principle means that when a coin is on a bullish development, it goes by means of 5 waves, with the primary, third, and fifth waves indicating rising costs.

Since this can be a good signal, buyers might purchase extra bitcoins in anticipation of accelerating worth, which might have an effect on the worth.

US Nuclear-Powered Bitcoin Mining Sees Spectacular Outcomes

TeraWulf, an organization in america that mines cryptocurrencies, simply opened the primary Bitcoin mining facility in Pennsylvania that runs on 100% nuclear energy.

Over 9,200 miners have already been turned on on the Nautilus facility, which has led to a 50% improve within the firm’s common working hash price since February.

Within the meantime, the corporate additionally runs a hydro- and nuclear-powered mining facility in New York, contributing to a mean manufacturing price of seven.5 BTC per day, or $208,973 per day at present Bitcoin costs.

This was seen as vital information that might positively impression the Bitcoin value. It reveals that persons are getting extra fascinated about and investing in mining operations, which reveals that persons are getting extra assured sooner or later worth of cryptocurrencies.

Bitcoin Price

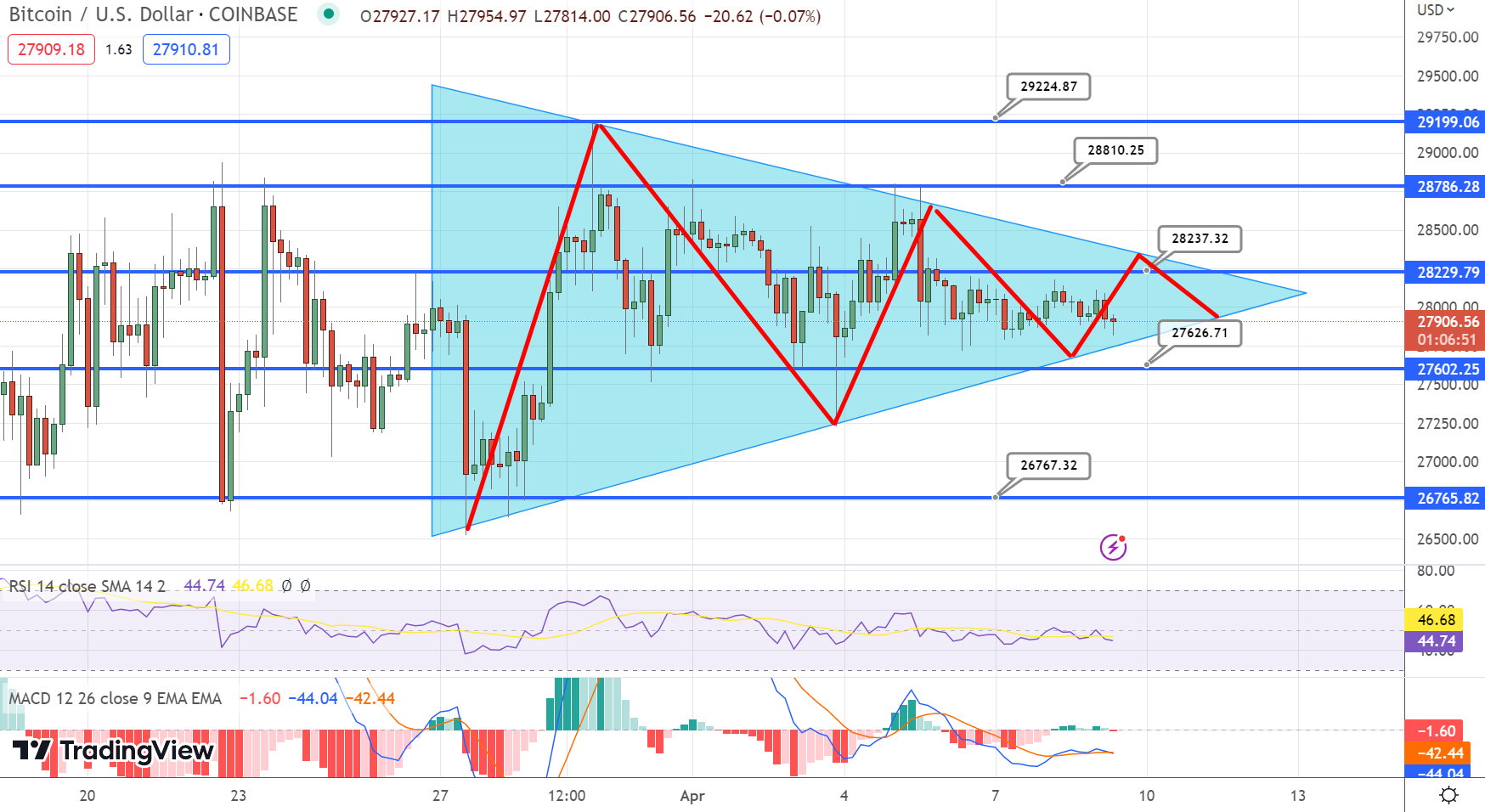

The continued battle between optimistic bulls and cautious bears persists as Bitcoin stays confined inside a decent buying and selling vary between $27,600 and $28,900.

Technical evaluation means that the BTC/USD pair shows a downward development. Nonetheless, it might face resistance close to the $28,250 degree.

Bitcoin Price Chart – Supply: Tradingview

Bitcoin Price Chart – Supply: Tradingview

If Bitcoin breaks by means of this resistance degree, its worth might rise to $28,900 and even $29,250. Conversely, if a downward development continues, substantial assist is anticipated across the $26,500 and $25,500 ranges.

Purchase BTC Now

Prime 15 Cryptocurrencies to Watch in 2023

To remain up-to-date with the newest ICO initiatives and altcoins, it’s advisable to commonly seek the advice of the expert-curated listing of the highest 15 cryptocurrencies to observe in 2023.

Doing so will allow you to stay well-informed about rising traits and alternatives inside the crypto market.

Disclaimer: The Trade Speak part options insights by crypto business gamers and isn’t part of the editorial content material of Cryptonews.com.

Discover The Finest Price to Purchase/Promote Cryptocurrency

![]() Cryptocurrency Price Tracker – Supply: Cryptonews

Cryptocurrency Price Tracker – Supply: Cryptonews

Source link

#Bitcoin #Price #Prediction #Billion #Trading #Volume #BTC #Heading