Over the Past Year, Binance Experiences Milestones in User Growth and Trading Volume Despite Regulatory Challenges

Binance, the world’s largest cryptocurrency exchange by trading volume, says that it now has over 250 million registered users, marking a 47% increase from 2023, according to its 2024 year-end report, published Thursday.

Cumulative trading volumes across all its products surpassed $100 trillion, underscoring Binance’s dominance in the crypto sector. The platform reported $160 billion in user assets under custody and $30 billion in net annual inflows, significantly outpacing competitors in the industry.

By comparison, Coinbase, the largest U.S.-based exchange, reported $137 billion in assets under custody as of its latest quarterly filing in September.

Binance stated it achieved regulatory authorizations in 21 jurisdictions during 2024, more than any other global crypto exchange. Its compliance team expanded to 650 experts, which it credited with strengthening its ability to respond to nearly 65,000 law enforcement requests globally.

However, Binance’s dominance was marred by legal and regulatory actions across multiple regions.

Institutional Growth and Broader Adoption

The report noted substantial growth in institutional participation, with the number of Binance’s VIP users doubling during the year. This segment of its user base benefitted from new features such as Binance Wealth and upgraded triparty banking services, which aim to bridge traditional finance and cryptocurrency markets.

Binance attributed its growth to rising mainstream adoption of digital assets. The approval of multiple spot Bitcoin exchange-traded funds (ETFs) in early 2024, followed by Ether ETFs later in the year, contributed to a market rally. The bull market drove Bitcoin to record six-figure prices and spurred higher trading activity across exchanges, including Binance.

“2024 marked a pivotal chapter for the crypto industry,” Binance stated in the report. “Characterized by massive strides in mainstream adoption and unprecedented levels of institutional participation.”

APAC’s Digital Asset Adoption Nearly Three Times Global Average

A new report highlights Thailand, the UAE, India, and the Philippines as regional leaders, driven by favorable regulations, increasing institutional interest, and a belief in the future potential of digital currencies.

Trading Activity and Platform Enhancements

Trading volumes across Binance’s Spot, Futures, and Margin platforms also surged. The platform processed a record 4.44 million requests per second, reflecting improvements in its scalability and infrastructure.

New features introduced during the year included Spot Copy Trading and BFUSD, a reward-bearing margin asset. The exchange also expanded its fiat-to-crypto offerings, bringing these services to 20 new countries, and launched new decentralized finance (DeFi) products through Binance Earn, which saw a 144% increase in total value locked.

Binance enters 2025 with what it described as “vigorous momentum,” aiming to expand its ecosystem and maintain its market position. However, the exchange also highlighted the growing challenges in compliance, security, and competition as regulators and market participants closely monitor the exchange’s dominance.

Legal, Regulatory Challenges

Binance enters 2025 with what it described as “vigorous momentum,” aiming to expand its ecosystem and maintain its market position. However, the exchange also highlighted the growing challenges in compliance, security, and competition as regulators and market participants closely monitor the exchange’s dominance.

Binance faced mounting legal and regulatory scrutiny throughout 2024. In Australia, ASIC sued Binance Australia Derivatives for misclassifying over 500 retail clients as wholesale, resulting in $13 million in compensation payouts. Canada, where Binance also faces a class action lawsuit in Ontario for unlawfully facilitating derivatives trades, fined the exchange C$6 million ($4.38 million) for violating money laundering and terrorist financing laws, while the Philippine SEC blocked Binance operations due to licensing violations and instructed Google and Apple to remove its app from their platforms.

In India, Binance was fined $2.2 million for anti-money laundering breaches but was conditionally allowed back into the market. In the U.S., Binance settled with the Department of Justice for $4.3 billion, leading to founder Changpeng Zhao stepping down as CEO receiving a lifetime ban from leading the company and serving a four-month prison sentence.

Other challenges included Cambodia blocking Binance’s website amid a crackdown on illicit crypto activity and legal troubles in Nigeria, where a Binance executive was held for months in detention.

Binance’s New Era: A Focus on Compliance, Global Expansion

Teng, who replaced founder Changpeng “CZ” Zhao in November, is steering the company towards a more transparent and regulated future.

Elsewhere

Renewed Investor Confidence Sparks Funding Boom in Crypto Sector

A wave of fresh capital is flooding into the crypto industry, with high-profile fundraises by Movement Labs and SoSoValue alongside an ambitious (and contested) acquisition bid for FTX EU, signaling a resurgence of investor confidence in the volatile asset class.

Gary Gensler Takes Potentially Final Swing at Crypto as SEC Exit Looms

Gary Gensler slams crypto as “rife with bad actors” in final SEC stint, citing noncompliance and shaky fundamentals ahead of stepping down Jan 20

Do Kwon’s Fraud Trial Set For 2026 in New York

Terraform Labs cofounder Do Kwon’s US trial for fraud charges is set for 26 Jan 2026, lasting 4–8 weeks

South Korea Looks to Allow Institutional Crypto Trading This Year

South Korea plans to lift its institutional crypto trading ban, aligning with global rules, tightening meme coin standards, and revising regulations

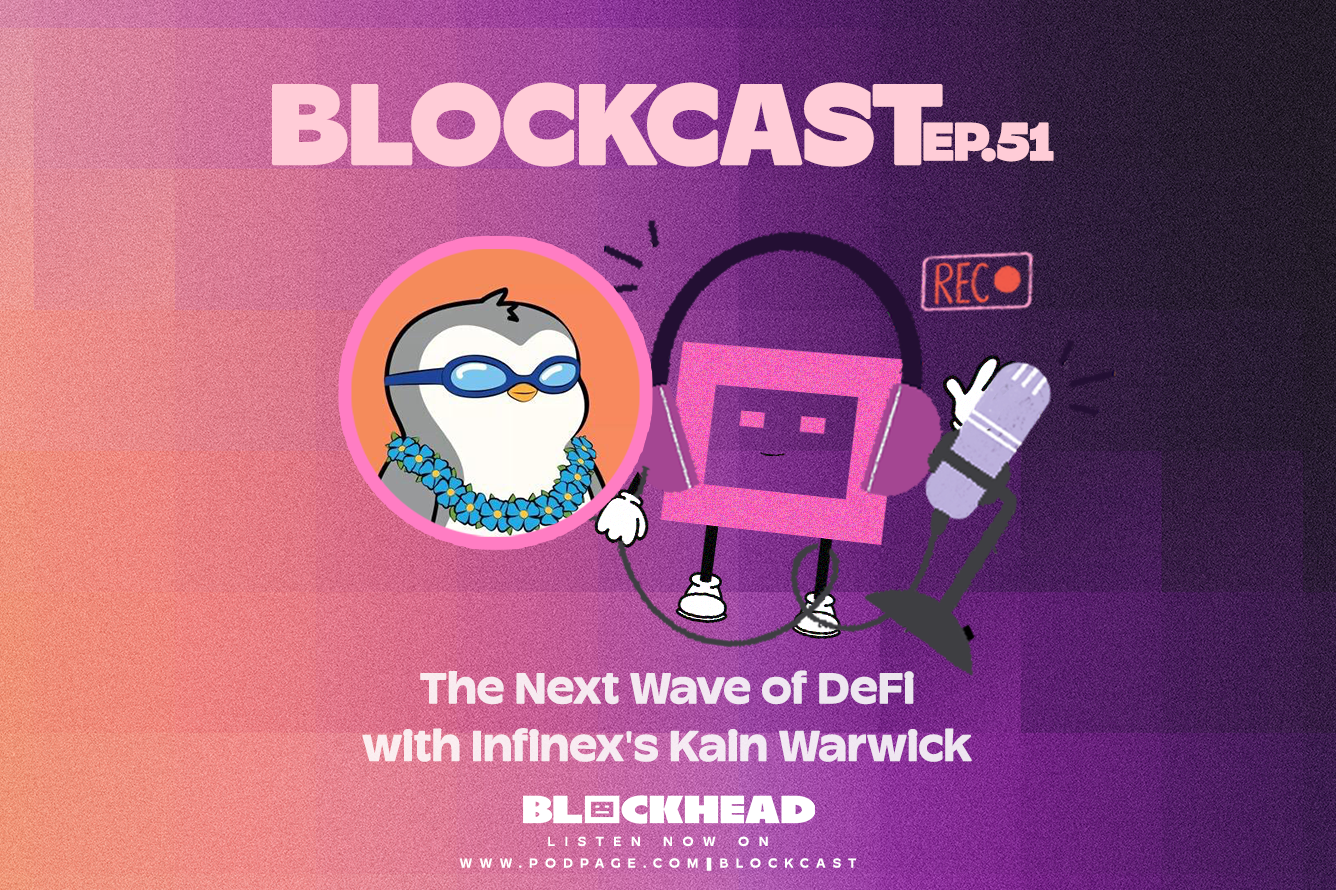

Blockcast

In this episode, host Takatoshi Shibayama speaks to Kain Warwick, founder of Infinex, and a renowned figure in the DeFi space, known for his work on the Synthetix protocol.

Warwick argues that the current crypto landscape, dominated by centralized exchanges, is unsustainable and hinders innovation. He outlines Infinex’s vision to create a decentralized platform that rivals the convenience and accessibility of centralized exchanges while offering superior functionality and empowering users with true self-custody.

Blockcast 51 | The Next Wave of DeFi with Infinex’s Kain Warwick

Kain Warwick, Infinex’s founder and core working group lead, and founder of Synthetix protocol discusses the incoming “post-CEX” era in the industry.

Previous episodes of Blockcast can be found on Podpage, with guests like Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It’s All Happening on LinkedIn

Did you know you can now receive Blockhead’s juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry’s hottest events, exclusively for subscribers!

Source link

#Binances #Sees #Milestones #User #Growth #Trading #Volume #Regulatory #Hurdles #Define #Year