Senate Votes to Repeal IRS DeFi Rule, Securing an Important Victory for the Crypto Sector – FinanceFeeds

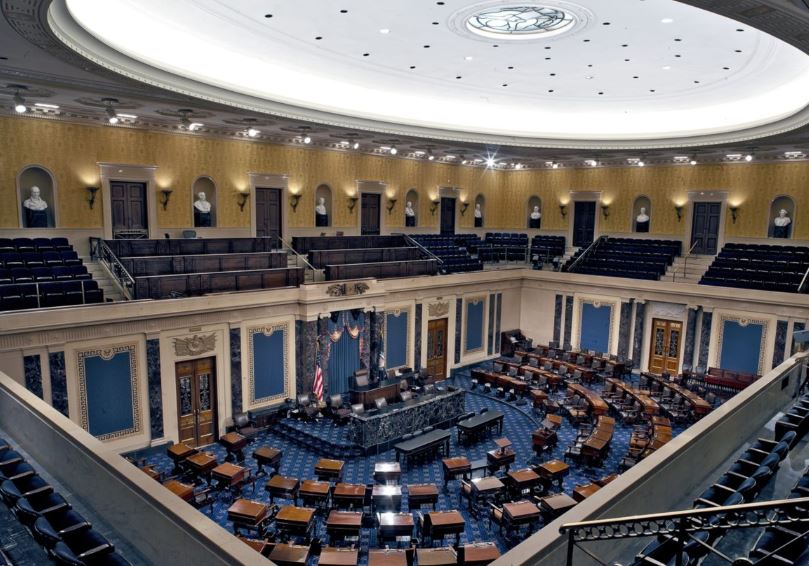

In a landmark decision for the cryptocurrency industry, the U.S. Senate has voted 70-28 to repeal an Internal Revenue Service (IRS) rule that sought to expand tax reporting obligations to decentralized finance (DeFi) platforms. The resolution, which previously passed in the House of Representatives, now awaits President Donald Trump’s signature. The White House has signaled support for the measure, making its enactment into law highly likely.

Background of the IRS Rule

The IRS rule in question was initially introduced under the Biden administration as part of efforts to tighten tax compliance within the digital asset sector. Specifically, the regulation aimed to classify DeFi platforms and blockchain validators as “brokers,” thereby requiring them to report customer transactions to the IRS, similar to centralized cryptocurrency exchanges. The rule was set to take effect in 2027 and was designed to curb tax evasion and increase transparency in digital asset transactions.

However, the measure faced sharp criticism from both the crypto industry and lawmakers across party lines. Opponents argued that applying traditional financial reporting standards to DeFi—a sector defined by its decentralized and pseudonymous nature—was not only impractical but also stifled innovation. Developers and operators of DeFi protocols claimed they lacked the ability to comply with the regulation, as these platforms often function without centralized oversight or user data collection.

In response to widespread industry opposition, Senator Ted Cruz (R-TX) and Representative Mike Carey (R-OH) spearheaded a repeal effort through the Congressional Review Act (CRA), a legislative tool that allows Congress to overturn recently enacted federal regulations. The Senate initially passed the repeal measure in early March with a 70-27 vote, but due to procedural requirements concerning budget-related measures, a second vote was necessary.

The House followed suit, approving the resolution with a decisive 292-132 vote before sending it back to the Senate for final confirmation. With bipartisan backing, the repeal gained momentum, culminating in the March 26 vote that effectively dismantled the IRS regulation.

Implications for the Crypto Sector

If signed into law, the repeal marks a significant victory for the cryptocurrency industry, which has long advocated for regulatory frameworks that recognize the unique nature of blockchain technology. The decision alleviates compliance burdens for DeFi platforms, ensuring that innovative financial tools remain accessible without excessive oversight. However, critics warn that without clear tax reporting requirements, the IRS may face greater challenges in tracking and taxing cryptocurrency transactions, potentially leading to increased tax evasion.

Regulators and lawmakers will likely continue discussions on how to effectively govern the growing digital asset economy without stifling its development. For now, the repeal signals a shift in Washington’s approach to crypto regulation—one that favors innovation over strict oversight.

As the bill moves to President Trump’s desk, all eyes are on the White House for the final step in cementing this legislative victory for the crypto industry.

Source link

#Senate #Repeals #IRS #DeFi #Rule #Delivering #Major #Win #Crypto #Industry #FinanceFeeds