The Intricate Balance of Regulation, Ethics, and Financial Risks in Trump’s Crypto Empire

This article will delve into the operational strategies of the family’s crypto business, shed light on how it thrives in a regulatory vacuum, and delve into the institutional risks posed by this “crypto empire expansion.”

By Molly White

Compiled by: Daisy, ChainCatcher

With Trump back in power, the cryptocurrency industry is witnessing an unprecedented relaxation of regulations. Seizing this opportunity, the Trump family swiftly ventured into related industries and established a crypto empire with a market value reaching billions of dollars. This empire encompasses platform development, token issuance, infrastructure management, and even market manipulation, showcasing a tight intertwining of power and capital.

This progression not only yields substantial profits but also gives rise to significant conflicts of interest and misuse of power. From holding platforms to intervening in policies, from speculation in meme currencies to potential insider trading, the Trump family is molding the national regulatory framework to serve their personal gains.

This article will outline the operational path of the family’s crypto business, elaborate on how it capitalizes on regulatory gaps, and examine the institutional risks stemming from this “crypto empire expansion.”

Financial backers inject capital while regulations loosen: How does crypto capitalize on the intersection of government and business?

Following Trump’s return to power, he promptly received political donations exceeding $20 million from crypto industry financiers, including $5 million contributions from Ripple and Andreessen Horowitz each, along with substantial support from major players like Coinbase, Gemini, Kraken, and Circle.

These financiers were reciprocated with favorable policies: at least eight U.S. Securities and Exchange Commission (SEC) enforcement cases against crypto companies were either withdrawn or put on hold. Many companies were also included in crafting new regulations, enabling them to tailor market rules to suit their needs in an environment lacking supervision, low compliance requirements, and weak consumer protection.

The relaxations in regulations not only facilitated hefty profits for the donating companies but also cleared the institutional obstacles for Trump family’s crypto expansion, setting the stage for the entire spectrum of business activities.

Source: Follow the Crypto

World Liberty Financial: The cornerstone of Trump’s crypto empire

In August 2024, Trump and his associates established the crypto company World Liberty Financial. Steven Witkov, the father of project co-founder Zach Witkov, boasts a longstanding alliance with Trump and currently serves as the special envoy for the Middle East. Recent reports also appoint him as Putin’s personal envoy and a key facilitator for the project.

Although the platform’s branding and positioning predominantly revolve around Trump himself, with his son being labeled a “DeFi visionary” and “Web3 ambassador” on the official website, and pledging 75% of the protocol revenue to him, the family initially tried to maintain a sense of distance. It wasn’t until Trump reassumed office and officially acquired a 60% stake, becoming the de facto controller.

Source: World Liberty Financial website homepage

Although no trading platform has been launched, World Liberty has successfully raised up to $550 million. Based on the ownership structure, Trump anticipates a personal profit nearing $400 million. The company purports to develop a “financial democratization” platform and issue a stablecoin USD1, a stark contrast to Trump’s earlier denouncement of stablecoins as “government-controlled financial instruments.”

It is noteworthy that $75 million in project funding originated from Justin Sun, a foreign crypto entrepreneur entangled in SEC and Department of Justice investigations for alleged fraud, making it impossible for him to directly donate to Trump. Subsequently, Sun was appointed as an advisor to World Liberty, and the SEC lawsuit against him was shelved post-Trump’s return to office.

$WLFI, issued by World Liberty, is labeled as a “governance token” that theoretically confers voting rights to holders. Nonetheless, the platform team unilaterally executed major decisions, including stablecoin issuance, without any voting procedure. The token features several regulatory circumvention clauses, is exclusively available to non-U.S. citizens or “qualified investors,” and is presently non-negotiable. Speculators anticipate that once SEC regulations are further eased, the imposed restrictions will be lifted, enabling the token to hit the secondary market and yield returns.

Simultaneously, the project faced significant scrutiny concerning suspected insider trading. Reports unveiled that World Liberty procured tokens from Movement Labs for approximately $2 million at a time marked by rumors about the latter exploring blockchain engagements with Musk’s “Government Efficiency Department.” Although both entities refuted the claims, the market reacted vehemently.

On April 8, 2025, a memo issued by Deputy Attorney General Todd Branch confirmed the Department of Justice’s formal dissolution of the cryptocurrency investigative team, discontinuing all associated law enforcement actions pursuant to an executive order endorsed by Trump. This maneuver virtually severed the federal investigation pathway into Trump family’s crypto operations.

The timing of USD1’s release also triggered scrutiny: on March 25, World Liberty proclaimed the stablecoin issuance. Just ten days later, the SEC declared that “certain types” of stablecoins fell beyond its regulatory domain and companies could issue them sans registration. Concurrently, pro-Trump factions in Congress are championing legislation to ease regulatory restrictions on stablecoins. Furthermore, this effort is underpinned by the crypto industry’s investment exceeding $130 million in lobbying funds during the previous election cycle.

Additionally, World Liberty is in talks with Binance for USD1 listing on its platform. If secured, the project would integrate with the user base of the world’s largest crypto exchange, harboring immense profit prospects. At present, Binance is negotiating with the U.S. Treasury Department regarding compliance concerns, endeavoring to nullify the earlier established regulatory agreement necessitated by anti-money laundering breaches, which led to a $4 billion fine settlement.

Truth Social and Truth.Fi: Pivoting social platforms towards crypto investment

Trump Media & Technology Group (TMTG), the parent firm of Truth Social, has recently ventured into the crypto sphere. The public-listed company, valued at approximately $2 billion, has Trump controlling around 53% of shares. Furthermore, TMTG sought authorization to authorize a trust fund spearheaded by Donald Trump Jr. to divest its shares.

In January 2024, TMTG unveiled plans to enter the fintech sector under the “Truth.Fi” brand, launching “America First” investment products. On March 24, the company declared a collaboration with Singapore Exchange Crypto.com. Notably, the platform was previously under SEC investigation and received a “Wells Notice” in August of the same year, signaling forthcoming enforcement actions. Nevertheless, just three days post the announcement, Crypto.com publicized the termination of SEC’s scrutiny.

Simultaneously, TMTG disclosed intentions to allocate up to $250 million from its reserves to invest in crypto assets, including Bitcoin. Through this move, the company, essentially Trump himself, stands to benefit directly from his statements and actions driving market upsurges. His proposals to establish a Bitcoin strategic reserve and advocate for government Bitcoin acquisitions could significantly influence market dynamics.

Blockchain gaming aspirations and lax regulations: Transitioning from Monopoly to real-world arbitrage

Per Fortune magazine, Trump is preparing to roll out a blockchain game centered around real estate, akin to Monopoly but devised atop a cryptocurrency framework. Emphasizing “Play-to-Earn,” the game entices players to secure tangible rewards through gameplay.

Such games have been subject to repeated censure, with concerns primarily revolving around economic imbalance and moral perils. Wealthy players can ‘win through spending,” while economically challenged individuals struggle to enter the market. The system heavily hinges on fresh player influx to sustain token value, risking a collapse once growth rates decelerate.

The 2021 sensation Axie Infinity engendered a “digital farming” model whereby affluent individuals leased game assets to players in low-income nations pledging superior earnings than local wages through gameplay. This practice engendered ethical controversies, entangling minors in gambling mechanisms and decimating players’ invested real money. In March 2022, the game succumbed to North Korean hacker attacks, losing approximately $625 million, with token prices yet to recover.

Of late, U.S. regulators have intensified scrutiny on such projects. The SEC’s litigation against Coinbase and Binance levels allegations of listing unregistered securities encompassing $AXS from Axie Infinity, $SAND from The Sandbox, and $MANA from Decentraland. Simultaneously, the Consumer Financial Protection Bureau (CFPB) voiced apprehensions regarding exploitative conduct in cashing out game currencies, particularly involving underage players.

Nonetheless, these regulatory barricades swiftly dissolved post-Trump’s reinstatement. He spearheaded the push to relax constraints on crypto enterprises, including deregistration, compliance, accountability, and gambling mechanism oversight. The SEC expedited the termination of enforcement actions directed at Binance, Coinbase, and associated game tokens, asserting the exclusion of most crypto assets from regulatory jurisdiction and inviting industry executives to craft novel regulatory frameworks.

The Trump administration also advocated for CFPB’s discontinuation, a recommendation openly backed by senior crypto executives. Congress is also in accord, with the House of Representatives and Senate sanctioning a bill aimed at annulling CFPB’s regulatory directives tied to crypto games, initially designed to fortify protections for underage users and non-gaming crypto asset investors.

The bill is enmeshed in partisan discord: unanimous opposition from Democrats and independents encounters resolute support from all Republicans barring one senator symbolically opposing it. Currently awaiting Trump’s endorsement, the bill, upon ratification, will not only obliterate the regulatory barriers to related transactions but will yield direct benefits to him and his affiliated crypto ventures.

Trump family’s foray into Bitcoin mining sparks suspicions of profit transfer

In late March 2025, Trump’s sons, Eric Trump and Donald Trump Jr., disclosed their investment in the Bitcoin mining entity American Bitcoin, with Eric assuming the role of chief strategy officer.

The firm was established with assistance from mining company Hut8, which transferred “almost all” of its mining gear to this new entity, triggering industry skepticism. VanEck analyst Matthew Sigel remarked: “It’s perplexing why they exchanged merely 80% of the remaining shares from the previously wholly-owned subsidiary for 61,000 mining machines.” Many observers perceive this as a mere “political stock swap,” implicating Hut8 relinquishing 20% of its shares to the Trump family in return for policy convenience and prospective returns.

Eric Trump disclosed plans for the company’s future public listing, a collaboration with World Liberty Financial. He also hinted at retaining some mined bitcoins, betting on Bitcoin prices to soar anew under Trump’s stewardship, consequently bolstering asset appreciation.

Trump family’s multimillion-dollar profits from launching memecoin unveil cash-out maneuvers

Prior to Trump’s presidential re-ascension, he rolled out a meme coin dubbed $TRUMP, a move that caught many crypto advocates off guard. In candid terms, some industry insiders lambasted his actions as “flagrant money-making,” branding them as “ludicrous and plumbing new depths of ignorance.”

Subsequently, the family introduced the $MELANIA meme coin, further enkindling fervent debates. Financial Times approximates that by early March, the Trump team had cashed out at least $350 million through these two tokens. On April 15, a wallet address controlled by Trump allegedly cashed out $4.6 million once more.

Suspicion arose over the $MELANIA team selling tokens worth approximately $4.5 million from late March to early April. On April 7, Bubblemaps, an on-chain analytics platform, unearthed allegations of project insiders shifting around $30 million worth of tokens from a wallet identified as “community distribution,” subsequently offloading them on an extensive scale. Particularly alarming was the team’s earlier implications in manipulating $LIBRA tokens tied to Argentine President Mile and engaging in insider trading of multiple Solana-based meme coins.

During the initial $TRUMP token distribution, Trump and his affiliates wielded up to 80% of control under a three-year linear unlocking mechanism. The inaugural unlock phase is near initiation, enabling Trump to vend up to 40 million tokens valued around $310 million at the contemporaneous price point. Concomitantly, a plethora of early investors faced severe setbacks, with the coin price plummeting from a pinnacle of $75 to below $5.

Whilst these transactions are under suspicion of market manipulation or insider trading, oversight is nearly nonexistent. On February 27, the SEC explicitly outlined that memecoins lie beyond its regulatory jurisdiction. Typically, potential unlawful activities of this nature should trigger Department of Justice intervention; however, the department prioritized resource allocation in areas like “immigration and government procurement fraud,” holding off investigations into the crypto market.

Put differently, the Trump family leverages regulatory voids to engage in low-risk maneuvers yielding high returns in the memecoin sector.

NFT operations surge further: From acquiring “obscure artworks” to vending “dubious cards”

Besides cryptocurrencies and meme coins, the Trump family is actively participating in the NFT (non-fungible token) arena. As early as December 2021, Melania Trump unveiled her inaugural NFT series, met with lukewarm market reception. The collection, originally listed around $250,000, failed to solicit bids, spurring speculations about an acquisition closer to $170,000.

In July 2023, she introduced a second series ensconced in controversy. Leveraging NASA images sparked concerns over flouting its commercial use prohibition. The series posted dismal sales, with a mere 55 pieces vended in a week, generating less than $5,000 in revenue.

In contrast, Trump’s NFT venture displayed better commercial traction. The debut of “digital trading cards” (Trump Cards) in December 2022, refraining from a heavy “NFT” branding strategy. The series, characterized by illustrations portraying an idealized Trump – robust, youthful, attired as Superman or a cowboy – ventured into an out-of-touch with reality, exaggerated style.

One of Trump’s “digital trading cards” (from OpenSea)

Subsequent series escalated matters, employing Trump’s dubious registration photo as the theme, offering an “upgrade reward” mechanism. These incentives encompass snippets of the attire donned in the registration photo and even a chance to dine with him during his New York criminal trial.

Trump family’s crypto asset holding shrouded in mystery, yet actions denote connections: Interest piqued in Trump family’s crypto wealth

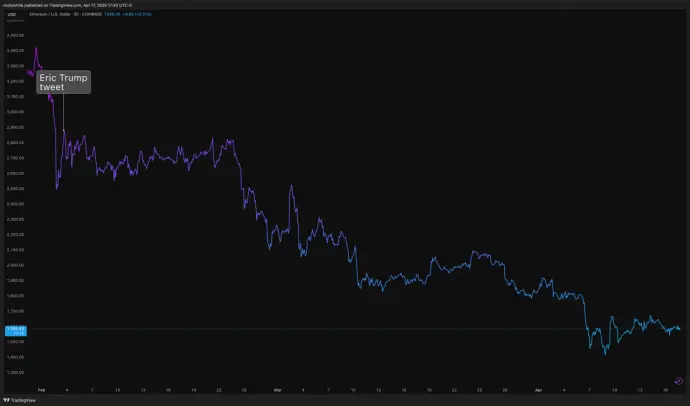

While particulars on the Trump family’s crypto asset portfolio remain undisclosed, public financial declarations and on-chain records allude to certain cues. In August 2024, Trump disclosed holdings of Ethereum (ETH) between $1 million and $5 million, aligning closely with the approximately $2.28 million worth in his wallet at the time. Since December that year, the wallet kicked off substantial ETH sales, with the majority of holdings liquidated.

Although other family members’ holdings are veiled, they evidently have opportunities to capitalize on market swings under policy influences. Some might even actively “steer the market.” For instance, in February this year, Eric Trump advised: “Now’s an opportune moment to scale up your $ETH holdings; remember to express gratitude later.” Nearly concurrently, World Liberty Financial, operated by the Trump family, transferred a hefty ETH volume to Coinbase, sparking external skepticism over potential “order coordination” attempts.

Furthermore, palpable alarm lingers over potential insider trading threats within Trump’s inner circle. Armed with insight into Trump’s modus operandi and potentially wield non-public information, Trump’s abrupt policy actions have elicited severe market perturbations.

A recent anecdote epitomizes the narrative: following Trump’s proclamation of the “Liberation Day” tariff policy, which sparked a stock market nosedive, signs pointed to some informed entities purchasing at low prices and capitalizing on the market rebound post-policy suspension for financial gains and exit. Analogous tactics could be at play in the crypto market, characterized by volatile asset prices like Bitcoin. Armed with foresight into policy trajectories, exploiting information asymmetries could pave the way for substantial returns.

The apotheosis of power monetization: From regulatory erosion to systemic jeopardy

The Trump family’s conflict of interest in the crypto realm eclipses the “emoluments clause” controversies from his earlier tenure. Via multifaceted ventures, Trump delineated an array of power-for-profit trajectories: amassing returns from tokens and companies, advocating for regulations that advance his personal investments, partaking in suspected insider trading, and affording external entities avenues to transmute “investments” into political influence – connoting these as campaign donations would breach legal edicts.

Navigating the troughs of regulatory deterrence, Trump continues to dismantle restraints on the crypto sector, exposing regular investors to fraud and manipulation risks. Conversely, he and his fiscal sponsors remain relatively shielded from substantive scrutiny.

Despite evident signs of power abuse, extant checks and balances mechanisms ring hollow. Albeit Democratic legislators prompting SEC Inspector General, senior DOJ officials, and various state attorneys general to probe Trump and affiliates’ conflicts of interest, public disclosures on tangible headway are lacking.

Even more disconcerting is the cascading regulatory unraveling fostering a high-fidelity overlap

Source link

#Trumps #Crypto #Empire #Triple #Game #Regulation #Ethics #Financial #Risks