Bitcoin Bullish: Exchange Netflow Registers Negative Spike

On-chain knowledge exhibits the Bitcoin alternate netflow has registered a adverse spike lately, an indication that could be bullish for the value.

Bitcoin Exchange Netflow Has Plunged In Current Days

As identified by an analyst in a CryptoQuant post, a big adverse spike within the netflow came about simply yesterday. The “exchange netflow” is an indicator that measures the web quantity of Bitcoin that’s coming into into or exiting the wallets of all centralized exchanges. Its worth is of course calculated because the inflows minus the outflows.

When the worth of this metric is constructive, it means a internet quantity of BTC is coming into the wallets of those platforms proper now. Since one of many most important explanation why traders would deposit their cash to the exchanges is for selling-related functions, this type of pattern can have bearish implications for the asset’s worth.

However, adverse values of the indicator suggest that outflows are overwhelming the inflows presently. Such a pattern, when extended, is usually a signal of accumulation from the holders, and therefore, will be bullish for the value of the cryptocurrency.

Now, here’s a chart that exhibits the pattern within the Bitcoin alternate netflow over the previous couple of months:

The worth of the metric appears to have been fairly adverse in current days | Supply: CryptoQuant

As proven within the above graph, the Bitcoin alternate netflow noticed an enormous adverse spike lately. Which means that the traders have withdrawn a lot of cash from these platforms.

A few massive adverse spikes have been additionally noticed earlier within the month. The primary of those got here simply after the asset’s worth had slipped beneath the $28,000 degree, whereas the second got here when the coin was wobbling across the $27,000 mark.

Each of those spikes might have been indicators of some whales attempting to catch the underside in the course of the decline. The newest plunge within the indicator has additionally come after the cryptocurrency has plummeted; this time in direction of the $26,000 degree.

This new internet outflow spike is the second largest that the indicator has registered this yr, with solely the withdrawals in the course of the consolidation across the $27,000 degree being better in scale.

Naturally, even when these outflows are an indication of shopping for stress available in the market, it’s unlikely that they’ll flip the value round on their very own; identical to how the earlier two spikes additionally failed.

Nevertheless, it’s a constructive signal for the cryptocurrency nonetheless, because it exhibits that a minimum of some whales suppose that it’s price shopping for the asset on the present costs. Whereas maybe not instantly, this will definitely assist the value hit a backside ultimately.

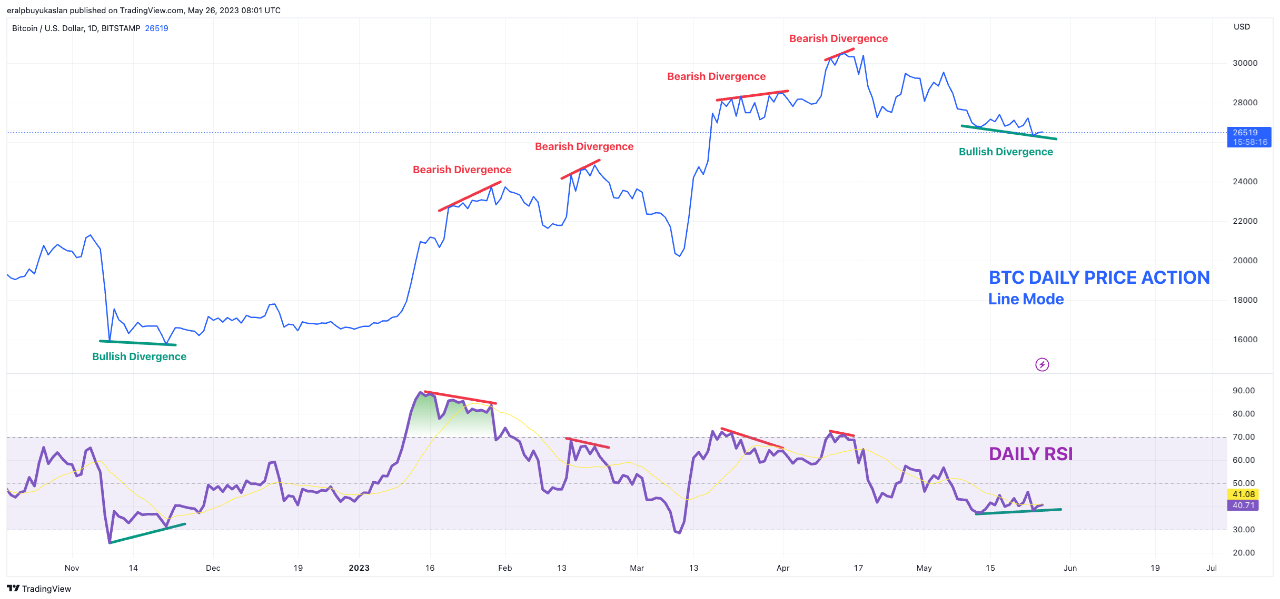

The quant has additionally famous that the day by day Relative Power Index (RSI) of Bitcoin has additionally shaped a doable bullish divergence lately, which can even be one other issue to contemplate.

Seems to be like the value and the RSI have gone reverse methods lately | Supply: CryptoQuant

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,800, up 1% within the final week.

BTC has been consolidating lately | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, CryptoQuant.com

Source link

#Bitcoin #Bullish #Exchange #Netflow #Registers #Negative #Spike