4 Bitcoin Only Exchanges Reducing Risks With Securities Regulations

6 min read

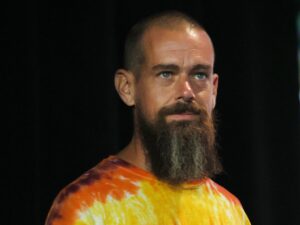

on stage throughout Bitcoin Convention 2023 at Miami Seaside Conference Middle on Might 19, 2023 in Miami Seaside, Florida. (Photograph by Jason Koerner/Getty Pictures for Bitcoin Journal)Getty Pictures for Bitcoin Journal

The SEC has taken various enforcement actions towards crypto exchanges in recent times. Some specialists consider that the SEC is overstepping its authority and that the enforcement actions are stifling innovation within the crypto area. Others consider that the SEC is true to crack down on crypto exchanges that aren’t complying with the regulation.

BitcoinBTC has been categorised as a commodity by the Commodity Futures Buying and selling Fee, making it completely different than the tokens usually bought on crypto exchanges. Numerous exchanges have capitalized on this clarification by focusing solely on bitcoin. Whereas crypto exchanges initiated mass layoffs throughout the bear market, many bitcoin solely exchanges continued to develop, making them an more and more well-liked selection as buyers search out safer choices.

The SEC’s enforcement actions and the expansion of bitcoin solely exchanges are prone to play a major function in shaping the business’s future. The next exchanges deal with bitcoin solely and will function a hedge towards regulatory uncertainty for buyers.

Strike

Jack Mallers is the Founder and CEO of Strike, a digital pockets constructed on bitcoin’s lightning community that gives peer to see and cross border funds much like Venmo or PayPal. He has spent the final decade within the bitcoin area, pioneering efforts in distributed programs infrastructure and utility growth as one of many first lightning community utility builders. Although Strike has grown into a well-liked app for buying bitcoin, changing into an change was by no means the corporate’s intention.

The concept for Strike got here from Mallers’ experimentation with the lightning community. “With lightning, the money is in the message and the message is the money,” Mallers instructed me in our interview, evaluating the lightning community to an immediate messaging protocol. The lightning community is a second layer community constructed on prime of bitcoin that permits people to ship bitcoin immediately and with very low charges.

“Payments are promises of future settlement,” Mallers mentioned in our interview, referring to the time wanted within the present monetary system for cost finality. He sees the lightning community as a way to get rid of settlement time, in flip lowering counterparty threat, the necessity for intermediaries, and in the end transaction charges.

Strike leverages the lightning community by changing prospects’ currencies into bitcoin and transferring that cash immediately over the lightning community. On the receiving finish, the bitcoin is transformed again into the native foreign money. The pace of the transaction eliminates bitcoin’s volatility threat, reworking the lightning community into a brand new cost rail like ACH or wire transfers.

Mallers instructed me that their mission is best cash, superior funds, and entry to bitcoin for all. Their mission seems to be going nicely, having lately closed an $80 million funding spherical and increasing their enterprise into 65 international locations. Strike estimates that its whole addressable market is now 3 billion individuals.

Swan

Cory Klippsten is the CEO of Bitcoin the monetary companies agency Swan.com. Earlier than bitcoin, Klippsten labored for GoogleGOOG, McKinsey, MicrosoftMSFT and Morgan StanleyMS, after incomes an MBA from the College of Chicago.

Swan options automated financial savings plans and withdrawals for retail prospects, with specialised companies for high-net-worth people and establishments as nicely. This 12 months, Swan additionally began providing an in-house IRA product, permitting prospects to carry precise bitcoin in a tax-advantaged method, lowering the necessity for top payment change traded merchandise.

Swan’s dedication to schooling makes it distinctive amongst different exchanges. “We believe Bitcoin will change the world for the better, and we’re dedicated to helping the world understand why,” Klippsten mentioned in our interview in regards to the intent behind their manufacturing efforts.

Swan’s academic commitments grew additional in 2022 with the beginning of their annual Pacific Bitcoin Festival in Los Angeles. This 12 months’s competition begins on October fifth and is predicted to host over 2,000 attendees. Regardless of their rising reputation, Swan claims to spend a minimal amount of cash on advertising campaigns. Klippsten concluded that “when people understand the truth about Bitcoin, they tend to get on board, so education is the only marketing we need.”

River

Alexander Leishman is the CEO and Founding father of River, a bitcoin monetary companies firm. “My goal was to create my own commodity-backed currency that the government couldn’t inflate, but never quite figured out how to make that a viable business,” Leishman mentioned about his journey main as much as bitcoin. Due to this, he was in a position to perceive bitcoin comparatively shortly, realizing that it might change the function served by a commodity backed foreign money.

“The post-bitcoin cryptocurrencies never quite appealed to me because there was no obvious problem they were solving,” Leishman recalled about his bitcoin solely focus. He quickly acknowledged the chance to construct a monetary establishment primarily based on bitcoin, in the end resulting in River’s creation.

River differentiates itself by having full management over their custody infrastructure. In doing so, River states that they’ve a better high quality of service with stronger ensures for his or her prospects than different corporations. River gives companies to people, establishments, and the lighting community infrastructure powering bitcoin functions like El Salvador’s Chivo pockets. The Salvadoran authorities launched the Chivo Pockets as an answer to onboard residents when it adopted bitcoin as authorized tender in 2021.

River additionally provides a mining product, permitting prospects to buy hosted bitcoin miners instantly within the app, akin to a turnkey rental property service. “We are always thinking about which products to build next, but we are very conservative and tend to avoid complex financial products,” Leishman mentioned about River, contrasting the corporate with the current failures within the crypto area. River lately closed a $35 million funding spherical, a testomony to their energy within the midst of a bear market.

Relai

Julian Liniger is CEO and Co-Founding father of the European bitcoin app, Relai. He studied psychology and enterprise administration in Switzerland earlier than changing into an entrepreneur. Lininger credit a good friend along with his introduction to bitcoin in 2015, however mentioned it took him till 2017 to totally grasp the financial implications. Relai is now the highest bitcoin on-ramp in Europe, with over 200,000 downloads, 65,000 energetic customers, and over €10 million in month-to-month buying and selling quantity.

“[Crypto] can be categorized as high risk, speculative venture investments. Bitcoin, on the other hand, is for long-term saving,” Liniger mentioned in our interview in regards to the firm’s bitcoin solely focus. He says their mission is to assist individuals save their cash and buying energy in the long term, contrasting their objectives with the large crypto exchanges usually used for buying and selling.

Relai permits prospects to purchase bitcoin shortly and with out registration, 24 hours a day, and ship the bought bitcoin straight into the shoppers’ self-custodial wallets. Relai mentioned this technique is meant to get rid of counterparty dangers current with custodial constructions.

Liniger instructed me in our interview that “despite the market turmoil… and crypto exchanges failing, we have doubled our volumes and revenues,” talking to the success of Relai’s technique. In line with Liniger, prospects have continued to purchase bitcoin at rising charges whatever the worth motion.

No matter your selection, bitcoin solely exchanges are a great possibility for these in search of to start their journeys with simplicity. With automated financial savings plans and decreased regulatory dangers, bitcoin centric exchanges are rising from the bear market largely unscathed. Their recurring successes in fund elevating and accountable development methods are indicative of their potential for longevity. These firms stay optimistic that they are going to proceed to onboard newcomers for a very long time into the longer term.

Observe me on Twitter or LinkedIn.

I’m a contract author exploring the bitcoin ecosystem. My work has been revealed by Bitcoin Journal and Bitcoin Information. I’m personally invested in bitcoin and am fascinated by the rising bitcoin economic system.

Learn ExtraLearn Much less

Source link

#Bitcoin #Exchanges #Reducing #Risks #Securities #Regulations