Bitcoin ETFs experience significant sell-offs as BTC surges to $71,000

BTC spot ETF experienced an outflow of over $200 million.

The exchange netflow was dominated by positive flow.

After the approval of spot Bitcoin [BTC] ETFs in the US, Bitcoin has seen consistent high flows. With BTC’s price looking to surpass its all-time high, ETF flows peaked for the month.

Bitcoin spot ETF volume dominated by outflow

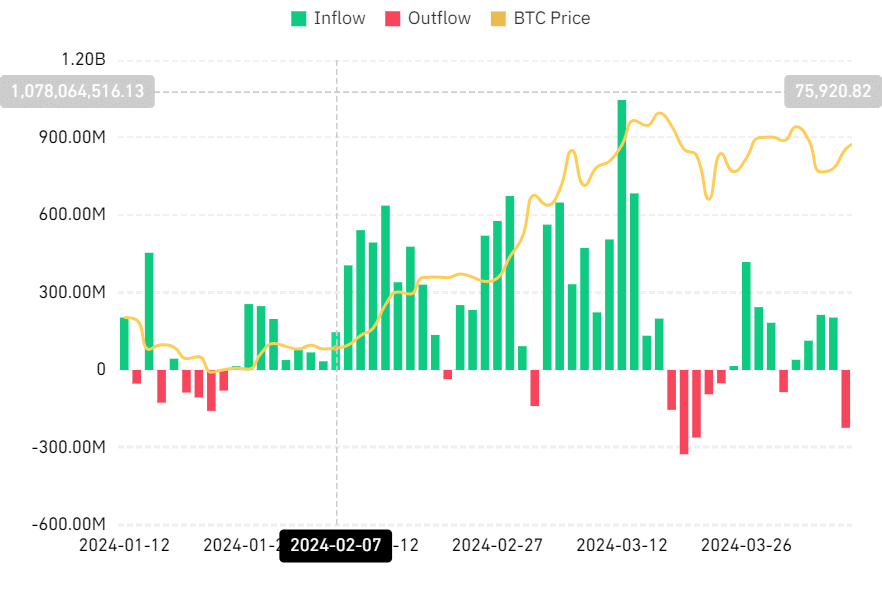

An analysis of Bitcoin spot ETF Netflow on Coinglass showed its highest flow since March 27th on April 8th. However, this flow deviated from the recent trend.

Source: Coinglass

On April 8th, there was a significant outflow, the first since March 20th. The data revealed an outflow of over $223 million worth of BTC on that day.

Interestingly, the last time such a massive outflow occurred was during a price decline, but this time, Bitcoin was rising and had crossed $71,000.

Increase in exchange inflow for Bitcoin

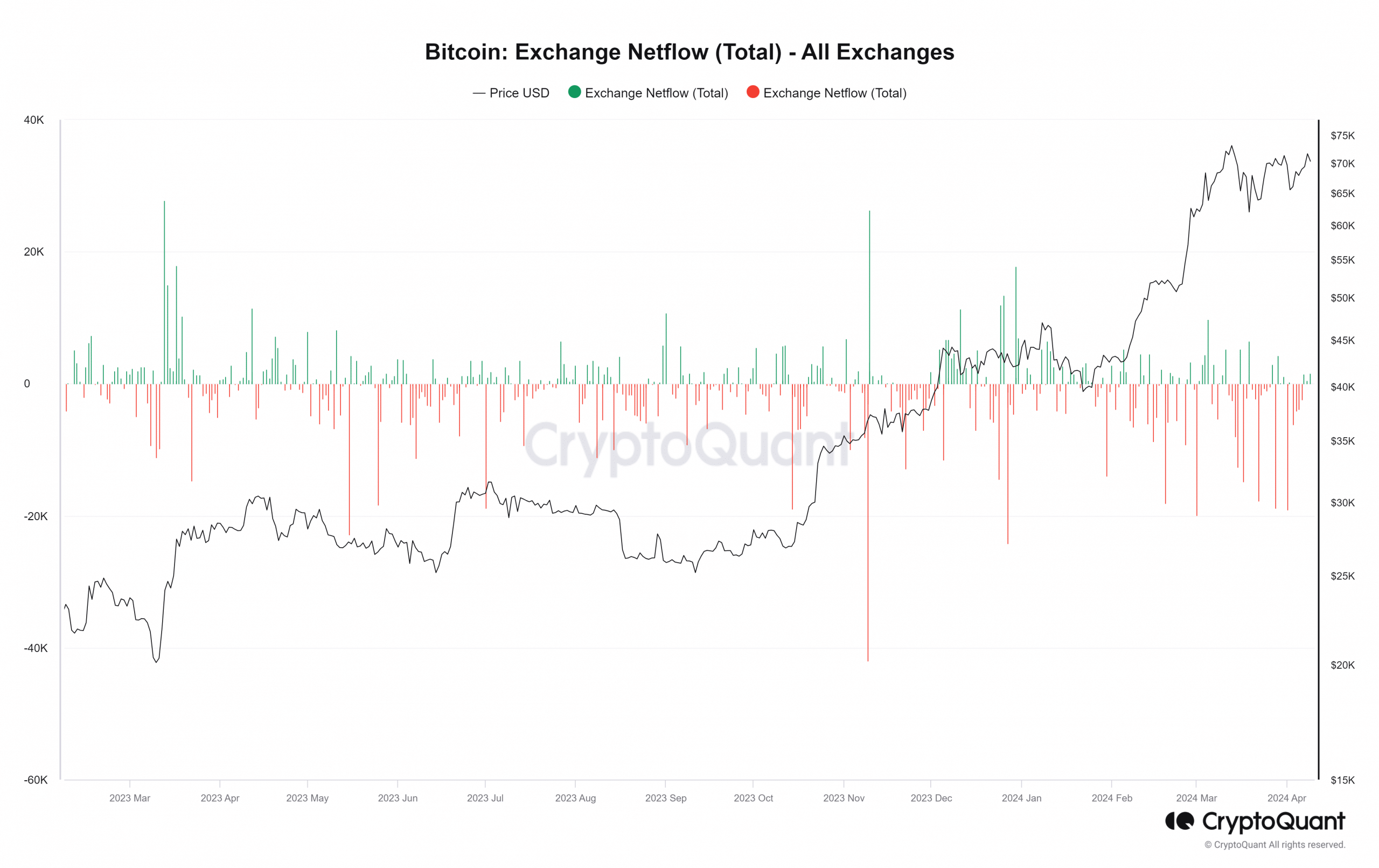

While the Bitcoin spot ETF saw a large outflow during the rise in price, the overall BTC netflow showed a dominance of inflows on April 8th. The analysis suggested that more traders were depositing their holdings into exchanges.

Source: CryptoQuant

Despite the dominance of inflows, the volume was not particularly high, with a total inflow of around 555 BTC initially. However, this has now increased to over 1,300 BTC.

Although the Bitcoin spot ETF and Exchange Netflow metrics appeared to move in opposite directions, their underlying responses were similar.

The increase in spot ETF outflow shows shareholders selling, possibly for various reasons like profit-taking. Similarly, the prevalence of inflows in exchange netflow indicates that holders are also selling to secure profits.

Both scenarios are driven by the rise in BTC price, influencing these actions.

Bitcoin price surge pauses

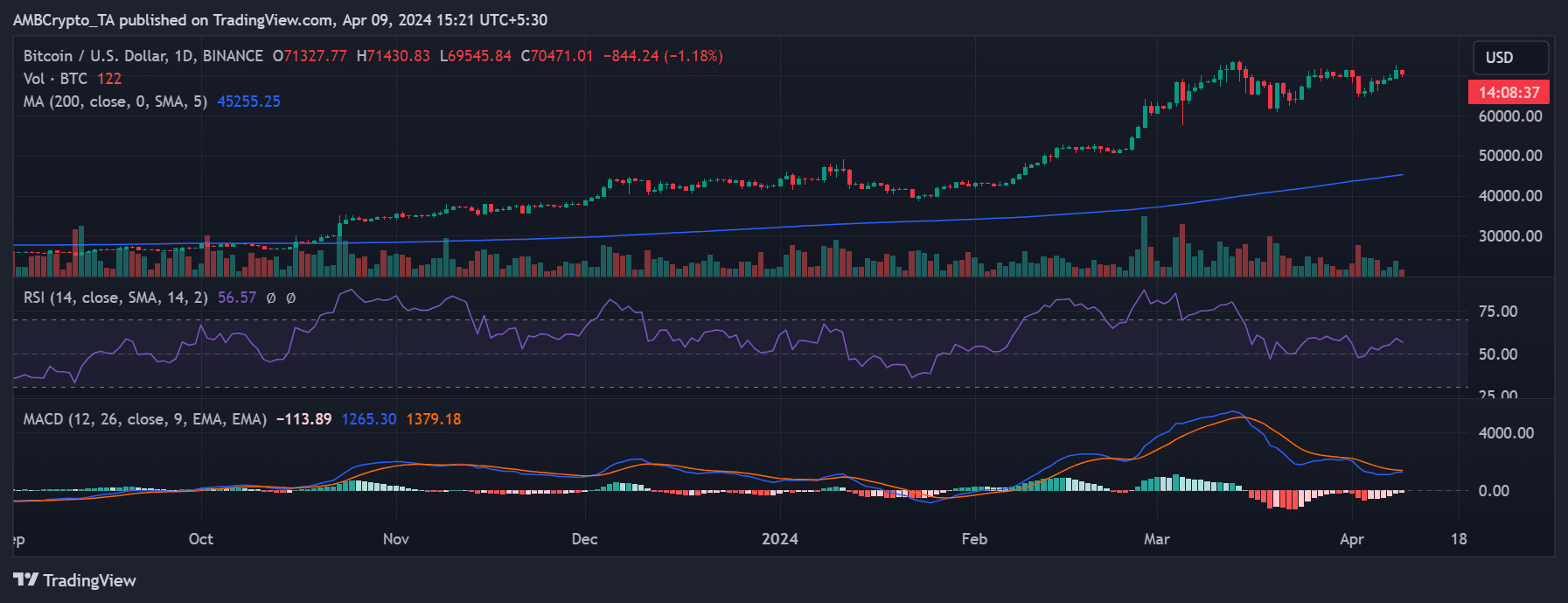

On April 8th, Bitcoin’s price surged by about 1.73%, reaching around $71,313, marking the third-highest price in its history.

Read Bitcoin (BTC) Price Prediction 2024-25

However, the price had declined by the time of writing, with BTC trading at about $70,400, reflecting a decrease of over 1%.

Despite this setback from the previous day’s rally, BTC remained within a bullish trend.

Source: TradingView

Source link

#Bitcoin #ETFs #massive #selloffs #BTC #climbs