Bitcoin, The Purchasing Power Preserver

This is an assessment article by Dan, cohost of the Blue Collar Bitcoin Podcast.

Series Contents

Part 1: Fiat Plumbing

Introduction

Busted Pipes

The Reserve Currency Complication

The Cantillon Conundrum

Part 2: The Purchasing Power Preserver

Part 3: Monetary Decomplexification

The Financial Simplifier

The Debt Disincentivizer

A “Crypto” Caution

Conclusion

A Preliminary Note To The Reader: This was initially composed as one exposition that has since been partitioned into three sections. Each segment covers unmistakable ideas, however the general postulation depends on the three areas in entirety. Section 1 attempted to feature why the ongoing fiat framework produces monetary unevenness. Section 2 and Part 3 work to exhibit how Bitcoin might act as a solution.

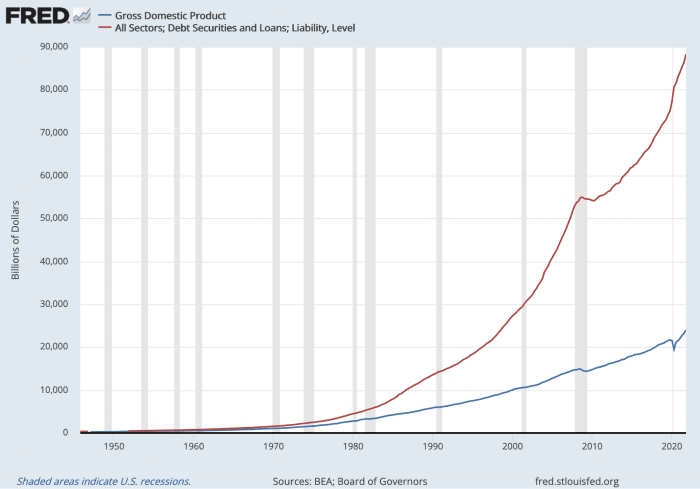

Unprecedented obligation levels that exist in the present monetary framework spell one thing over the long haul: currency debasement. The word “inflation” is thrown around habitually and carelessly nowadays. Few value its genuine significance, genuine causes or genuine ramifications. For some, expansion is just a cost at the service station or supermarket that they whine about over wine and mixed drinks. “It’s Biden’s, Obama’s or Putin’s fault!” When we zoom out and think long haul, expansion is a gigantic — and I contend unsolvable — fiat numerical question that gets increasingly tough to accommodate as many years walk on. In the present economy, efficiency slacks obligation so much that all possible techniques for compensation require battle. A vital measurement for following obligation movement is obligation partitioned by gross domestic product (obligation/GDP). Digest the diagram underneath which explicitly reflects both complete obligation and public government obligation as connects with GDP.

(Chart/Lyn Alden)

If we center around bureaucratic obligation (blue line), we see that in only 50 years we’ve gone from sub-40% obligation/GDP to 135% during the COVID-19 pandemic — the most significant levels of the last 100 years. It’s likewise important that the ongoing problem is essentially more sensational than even this graph and these numbers show since this doesn’t reflect epic unfunded entitlement liabilities (for example Government managed retirement, Medicare and Medicaid) that are expected in perpetuity.

What does this over the top obligation mean? To figure out it, how about we distil these real factors down to the person. Assume somebody piles up extravagant liabilities: two home loans well external their cost range, three vehicles they can’t bear and a boat they won’t ever utilize. Regardless of whether their pay is sizable, in the long run their obligation load arrives at a level they can’t maintain. Perhaps they stall by counting up Mastercards or applying for a new line of credit with a neighborhood credit association to support the base installments on their current obligation just. However, in the event that these propensities persevere, the camel’s back definitely breaks — they dispossess the homes; SeaRay sends somebody to reclaim the boat out of their carport; their Tesla gets repossessed; they fail. Regardless of the amount she or he felt like they “needed” or “deserved” that multitude of things, the math at last piece them in the ass. If you somehow happened to make an outline to embody this individual’s problem, you would see two lines wandering in inverse bearings. The hole between the line addressing their obligation and the line addressing their pay (or efficiency) would augment until they arrived at indebtedness. The diagram would look something like this:

(Chart/St. Louis Fed)

And indeed, this outline is genuine. It’s a refining of the United States’ total debt (in red) over total national output, or efficiency (in blue). I originally saw this diagram posted on Twitter by notable sound cash supporter and tech financial backer Lawrence Lepard. He incorporated the accompanying text above it.

“Blue line generates income to pay interest on red line. See the problem? It’s just math.”

The math is making up for lost time to sovereign country states as well, however the manner in which past events come to fruition appears to be very unique for focal legislatures than for the person in the section above, especially in nations with save cash status. At the point when an administration has its paws on both the stockpile of cash and the cost of cash (for example loan fees) as they do in the present fiat money related framework, they can endeavor to default in a lot gentler style. This kind of delicate default essentially prompts development in cash supply, since when national banks approach recently made saves (a cash printer, maybe) it’s unbelievably improbable obligation administration installments will be remembered fondly or disregarded. Rather, obligation will be adapted, meaning the public authority will get recently created money1 from the national bank as opposed to raising credible capital through expanding duties or offering securities to genuine purchasers in the economy (real homegrown or worldwide financial backers). Along these lines, cash is falsely fabricated to support liabilities. Lyn Alden puts debt levels and debt monetization in context:

“When a country starts getting to about 100% debt-to-GDP, the situation becomes nearly unrecoverable … a study by Hirschman Capital noted that out of 51 cases of government debt breaking above 130% of GDP since 1800, 50 governments have defaulted. The only exception, so far, is Japan, which is the largest creditor nation in the world. By “defaulted,” Hirschman Capital included ostensible default and significant expansions where the bondholders neglected to be taken care of overwhelmingly on an expansion changed premise … There’s no model I can find of a huge country with over 100 percent government obligation to-GDP where the national bank doesn’t claim a critical lump of that debt.”2

The exorbitant financial force of fiat national banks and depositories is an enormous supporter of the extreme influence (obligation) development in any case. Concentrated command over cash empowers policymakers to postpone monetary torment in an apparently unending way, more than once mitigating transient issues. However, regardless of whether goals are overall good, this game can’t endure forever. History shows that well meaning goals are adequately not; assuming motivating forces are inappropriately adjusted, precariousness is standing by.

Lamentably, the danger of hurtful cash corruption and expansion decisively increments as obligation levels become more impractical. During the 2020s, we are starting to feel the harming impacts of this limited fiat try. The people who apply money related influence truly do to be sure can conceal squeezing financial agony, yet over the long haul it’s my dispute that this will enhance absolute monetary obliteration, especially for the less advantaged in the public eye. As additional financial units enter the framework to ease distress, existing units lose buying influence comparative with what might have happened without such cash inclusion. Pressure at last develops in the framework so much that it should get away from some place — that get away from valve is the corrupting cash. Vocation long bond broker Greg Foss puts it like this:

“In a debt/GDP spiral, the fiat currency is the error term. That is pure mathematics. It is a spiral to which there is no mathematical escape.”3

This inflationary scene is particularly inconvenient to individuals from the center and lower classes for a few key reasons. In the first place, as we discussed over, this segment will in general hold less resources, both altogether and as a level of their total assets. As the cash dissolves, resources like stocks and land will more often than not ascent (to some degree to some degree) close by cash supply. On the other hand, development in pay rates and wages is probably going to fail to meet expectations expansion and those with less free money rapidly begin floating. (This was canvassed finally in Part 1.) Second, center and lower class individuals are, all around, obviously less monetarily educated and deft. In inflationary conditions information and access are power, and it frequently takes moving to keep up with purchasing power. Individuals from the privileged are undeniably bound to have the duty and speculation ability, as well as departure into decision monetary instruments, to hop on the existence pontoon as the boat goes down. Third, many normal workers are more dependent on characterized benefit plans, government managed retirement or customary retirement procedures. These apparatuses stand unequivocally in the extent of the inflationary terminating crew. During times of degradation, resources with payouts explicitly named in the expanding government issued money are generally defenseless. The monetary fate of many normal people is vigorously dependent on one of the following:

Nothing. They are not saving nor contributing and are hence maximally presented to cash debasement.Social security, which is the world’s biggest ponzi plot and may not exist for over 10 years or two. On the off chance that it holds up, it will be paid out in degrading fiat currency.Other characterized benefit plans, for example, pensions or annuities. Yet again the payouts of these resources are characterized in fiat terms. Furthermore, they frequently have a lot of fixed income openness (bonds) with yields designated in fiat currency.Retirement portfolios or brokerage accounts with a gamble profile that has worked throughout the previous forty years however is probably not going to work for the following forty. These asset designations frequently incorporate raising openness to securities for “safety” as financial backers age (risk parity). Tragically, this endeavor in danger relief makes these people progressively dependent on dollar-named fixed pay protections and, hence, corruption risk. The greater part of these people won’t be sufficiently deft to turn so as to hold purchasing power.

The illustration here is that the regular laborer and financial backer is needing a helpful and open device that bars the mistake term in the fiat obligation condition. I’m here to contend that nothing fills this need more superbly than bitcoin. Albeit much remaining parts obscure about this convention’s pseudonymous organizer, Satoshi Nakamoto, his inspiration for releasing this instrument was no secret. In the genesis block, the principal Bitcoin block at any point mined on January 3, 2009, Satoshi featured his scorn for concentrated financial control and control by implanting a new London Times cover story:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

The inspirations driving Bitcoin’s creation were unquestionably multi-layered, however it appears to be obvious that one of, in the event that not the, essential issue Satoshi set off to tackle was that of unchangeable money related strategy. As I compose this today, exactly a long time since the arrival of this first block, this objective has been continuously accomplished. Bitcoin remains solitary as the very first indication of persevering through computerized shortage and financial changelessness — a convention implementing a reliable stock timetable via a decentralized mint, controlled by outfitting genuine energy by means of Bitcoin mining and confirmed by an internationally disseminated, drastically decentralized organization of hubs. About 19 million BTC exist today and something like 21 million will e