Buffett’s company makes $1 billion bet on cryptocurrency stock despite his personal stance on Bitcoin ownership

Warren Buffett has voiced his dislike for Bitcoin multiple times. In 2018, he remarked that “In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending,” when Bitcoin was around $15,000.

Despite Bitcoin’s current value soaring above $50,000, Buffett’s opinion remains unchanged. Even if offered all the Bitcoin in the world for $25, he said he wouldn’t accept it. “Because what would I do with it?” he asked. “I’ll have to sell it back to you one way or another. It isn’t going to do anything.”

While Buffett may not like Bitcoin, his holding company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), appears to hold a different stance.

Berkshire, now with a market cap of almost $900 billion, has advisors who have made a $1 billion bet on a stock heavily exposed to the rise of cryptocurrencies, including Bitcoin.

Riding the Bitcoin wave

Following the strategy of profiting from the crypto wave, Nu Holdings (NYSE: NU) began its conquest of the Latin American banking industry in 2013 as Nubank, offering low-cost financial products for smartphone or computer users.

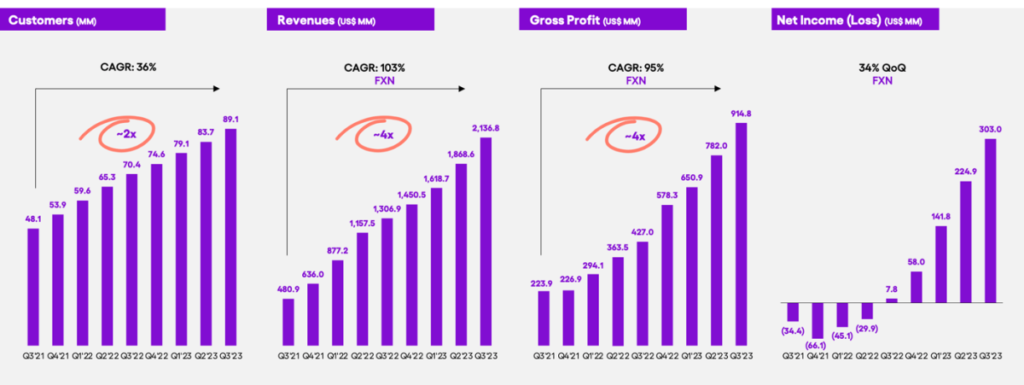

Nubank captured a significant share of the market, with over 90 million customers by 2023, a number that continues to grow. Their crypto product, Nucripto, introduced in 2022, boasts over 1 million active users in its first month of operation.

While Nubank still holds a leading position in the Latin American crypto market, most of the company’s revenue still comes from other financial products. However, with more than 1 million active users, the company’s crypto platform continues to strengthen.

Furthermore, Nubank is not only tapping into the crypto market but is also introducing its digital currency and expanding its lineup with new cryptocurrencies like Polkadot and Avalanche.

A classic Buffett stock?

Even though Buffett historically steered clear of technology stocks, Nubank has a close resemblance to a classic Buffett stock. Founded by an experienced former venture capitalist and offering a strong economic moat, it benefits from a digital-first position, giving it a significant competitive edge over traditional industry players.

While Nubank’s shares may not be cheap due to their strong performance in 2023, investors like Buffett recognize the value of early investment in consistent growth stocks.

Source: Nu Holdings.

Citigroup, Bank of America, and Wells Fargo are advertising partners of The Ascent, a Motley Fool company. The Motley Fool has positions in and recommends Avalanche, Bank of America, Berkshire Hathaway, Bitcoin, and Ethereum. The Motley Fool recommends Nu.

Warren Buffett Doesn’t Own Bitcoin, but His Company Is Betting $1 Billion on This Crypto Stock was originally published by The Motley Fool

Source link

#Warren #Buffett #Doesnt #Bitcoin #Company #Betting #Billion #Crypto #Stock