The Fall of Medici Bank: Lessons on Fractional Reserve Banking From fifteenth Century Italy – Featured Bitcoin News

Amid the banking chaos of the twenty first century, some are wanting again greater than 600 years in the past, to the Medici Bank — probably the most highly effective banks of its time. It established its enterprise and have become probably the most revered banks in Europe throughout its prime, and the distinguished Italian household of bankers have been early adopters of fractional reserve banking, a apply that Medici Bank clients have been unaware of, and that in the end led to the monetary establishment’s failure.

‘Nothing New’— How the Medici Bank Failure Is Nonetheless Very Related to Right now’s Trendy Banking Practices

The collapse of three main banks in mid-March 2023 has brought on individuals to scrutinize the dangers of fractional reserve banking. The apply of fractional reserve banking is actually when a monetary establishment holds solely a fraction of deposits within the financial institution, and the remaining funds are used to lend or make investments so as to acquire a yield. One of many earliest identified examples of fractional reserve banking was the Medici Bank, based in Florence, Italy, in 1397 by Giovanni di Bicci de’ Medici.

Within the first 5 years of operation, the Medici Bank grew quickly, and earlier than the monetary establishment’s demise, it established branches throughout Western Europe. Much like bankers within the early twentieth century like J.P. Morgan, Jacob Schiff, Paul Warburg, and George F. Baker, members of the Home of Medici have been extraordinarily highly effective. The Medici Bank was identified to be one of many largest enterprise enterprises in the course of the Renaissance however in the end failed after near 100 years of operation.

Philip J. Weights, the president of the Swiss Finance and Expertise Affiliation (SFTA), defined in a 2015 Linkedin post how the burden of “excessive lending” and “insufficient reserves” led to the financial institution’s final demise. Based on Raymond De Roover’s e book “The Rise and Decline of the Medici Bank (1397-1494),” printed in 1963, liquidity was a problem from the financial institution’s inception. De Roover’s e book particulars that the Medicis’ reserves held lower than 10% of deposits because of the relations’ managerial talents.

The 380-page book explains how the Medici Bank skilled a interval of decline between 1463 and 1490 as a consequence of shady and corrupt banking practices. The fraudulent schemes brought on a number of Medici branches to be liquidated and offered off to different banks. De Roover argued that regardless of being a distinguished member of the Home of Medici and a profitable banker, Francesco Sassetti “was unable to avoid the disastrous liquidation of the Bruges, London, and Milan branches.” De Roover’s e book notes that important lending was a well-liked apply that gathered high-interest charges.

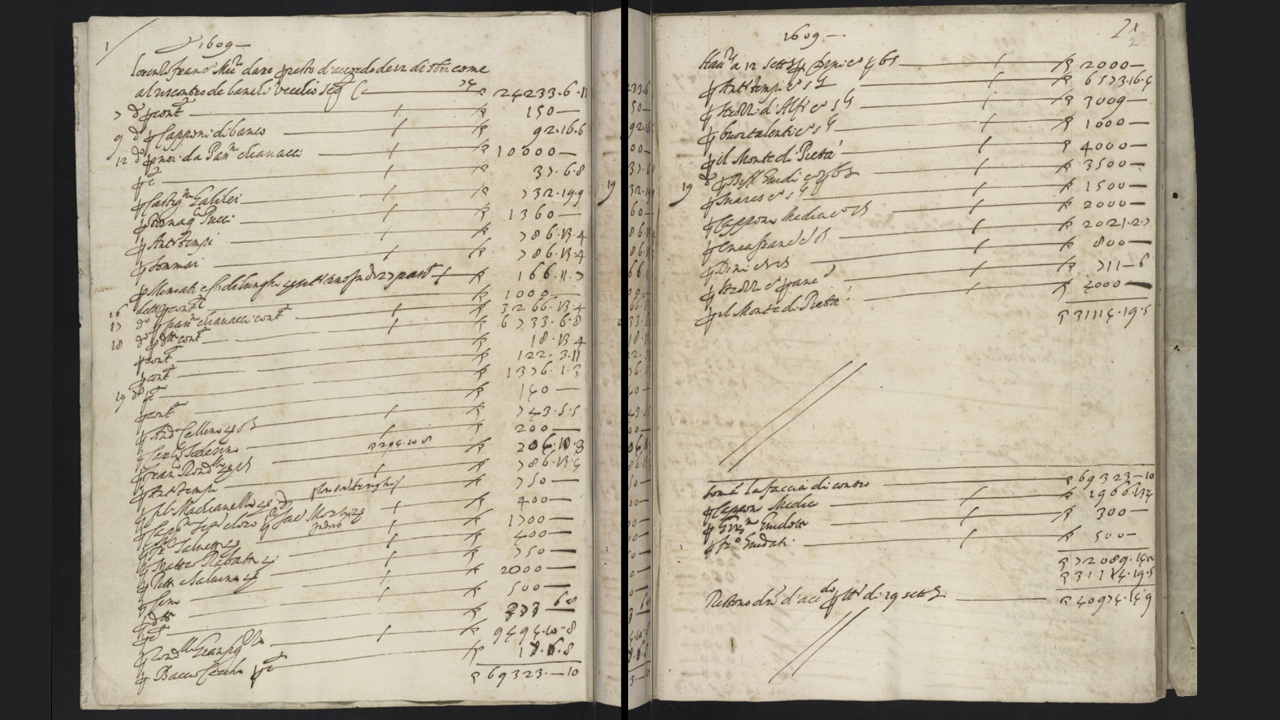

A Medici Bank ledger or double-entry bookkeeping system reveals a listing of debtors and collectors. Photograph credit score: The Penn Libraries’ Colenda Digital Repository.

A Medici Bank ledger or double-entry bookkeeping system reveals a listing of debtors and collectors. Photograph credit score: The Penn Libraries’ Colenda Digital Repository.

Florins, gold cash minted by the Republic of Florence, have been usually held on the Medici Bank steadiness sheet. Nonetheless, the dearth of reserves was a relentless supply of frustration for each Medici banking companions, and authorities officers and clients. In a 2018 editorial on bigthink.com, writer Mike Colagrossi detailed that “it was due to advancements and financial solutions like these that the Medici bank became so powerful” because the Medicis obtained excessive curiosity on loaned funds. Colagrossi notes that the downfall of the financial institution came about after the dying of Cosimo Medici in 1464, who was the financial institution’s boss on the time.

After the autumn of three main banks in 2023, Jim Bianco, president of Bianco Analysis, a agency that makes a speciality of macro evaluation for institutional traders, defined how fractional reserve banking “was invented by the Medicis in Florence in the late 15th century.” In his Twitter post, Bianco additionally mentions the “tuppence” scene within the Nineteen Sixties Disney musical movie “Mary Poppins” and the financial institution run scene from “It’s a Wonderful Life” filmed within the Nineteen Thirties, stating that “all of these are still very relevant depictions of what is happening today.”

Bianco opined:

Nothing that’s taking place is new. Our banking system is a number of hundred years previous and has always had these points.

Triple-Entry Bookkeeping — A New System of Accounting

Bianco additionally talked about that double-entry bookkeeping was the “technology” used to allow the Medici Bank’s fractional reserve banking practices. The double-entry scheme includes a ledger that data each debits and credit and continues to be used within the fashionable monetary world at the moment. On the time, the Franciscan Friar Luca Pacioli wrote a e book about double-entry accounting with help from the well-known Renaissance artist Leonardo da Vinci. Though Pacioli and da Vinci didn’t declare to invent the brand new system, their analysis led to the broader and extra structured use of double-entry bookkeeping that’s nonetheless used at the moment.

Whereas Luca Pacioli’s system was a disruptive pressure within the monetary world permitting the Medici Bank to fractionalize reserves with ease, Satoshi Nakamoto’s triple-entry bookkeeping system, launched with Bitcoin, has additionally disrupted at the moment’s monetary system.

Whereas Luca Pacioli’s system was a disruptive pressure within the monetary world permitting the Medici Bank to fractionalize reserves with ease, Satoshi Nakamoto’s triple-entry bookkeeping system, launched with Bitcoin, has additionally disrupted at the moment’s monetary system.

Quickly after the strategy was popularized, Giovanni de Medici carried out the idea into his household’s financial institution. It allowed the Home of Medici to function with lower than 10% of deposits and prolong its lending practices far and large till liquidity utterly dried up. Greater than 600 years later, an nameless individual or group released a paper that launched the idea of triple-entry bookkeeping. Along with data of each debits and credit, a 3rd part was added, which is a cryptographic receipt verified by a 3rd social gathering to validate the ledger’s entries.

Satoshi Nakamoto’s invention has produced a system the place a double-entry bookkeeping system doesn’t must be trusted now that an improved ledger accounting scheme exists. A single-entry or double-entry accounting system will be cast and manipulated, however the cryptographic assurance from a triple-entry bookkeeping system is far tougher so as to add fraudulent knowledge to. Whereas Bianco is appropriate that there’s nothing new with the way in which bankers function at the moment, in comparison with the times of Medici, Nakamoto’s invention has given the world a brand new methodology of accounting that may remodel it a terrific deal, simply because the invention of double-entry bookkeeping has finished.

Tags on this story

developments, financial institution run scene, Banking Disaster, Bankruptcy, Bianco Analysis, bigthink.com, Bitcoin, Bitcoin (BTC), Corruption, Cosimo Medici, Prospects, Monetary Establishments, monetary options, Fractional-reserve banking, Francesco Sassetti, fraudulent schemes, Giovanni de Medici, gold cash, authorities officers, Home of Medici, institutional traders, rates of interest, It is a Fantastic Life, J.P. Morgan, Jim Bianco, lending, Leonardo da Vinci, Liquidity, Luca Pacioli, macro evaluation, Mary Poppins, Medici Bank, Mike Colagrossi, Paul Warburg, Philip J. Weights, energy, Raymond De Roover, Renaissance, Republic of Florence, reserves, Satoshi, Satoshi Nakamoto, tuppence scene, Western Europe

What classes will be realized from the autumn of the Medici Bank? Share your ideas within the feedback part under.

![]()

Jamie Redman

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or companies talked about on this article.

Extra Fashionable News

In Case You Missed It

Source link

#Fall #Medici #Bank #Lessons #Fractional #Reserve #Banking #fifteenth #Century #Italy #Featured #Bitcoin #News