U.S. Congress to handle stablecoin regulation with this new invoice, particulars inside

3 min read

– The U.S. proposed a invoice to manage stablecoins, with fines and jail sentences for non-compliance.

– Circle CEO endorses the proposed invoice, whereas Tether and different stablecoins dominate the market with a complete capitalization of over $131 billion.

The US has moved in the direction of regulating cryptocurrencies, starting with a give attention to stablecoins. Regardless of earlier issues concerning the ambiguous nature of crypto laws, the U.S. is taking a proactive step in regulation.

In addition they appear to be beginning with the bridge between digital currencies and conventional fiat cash.

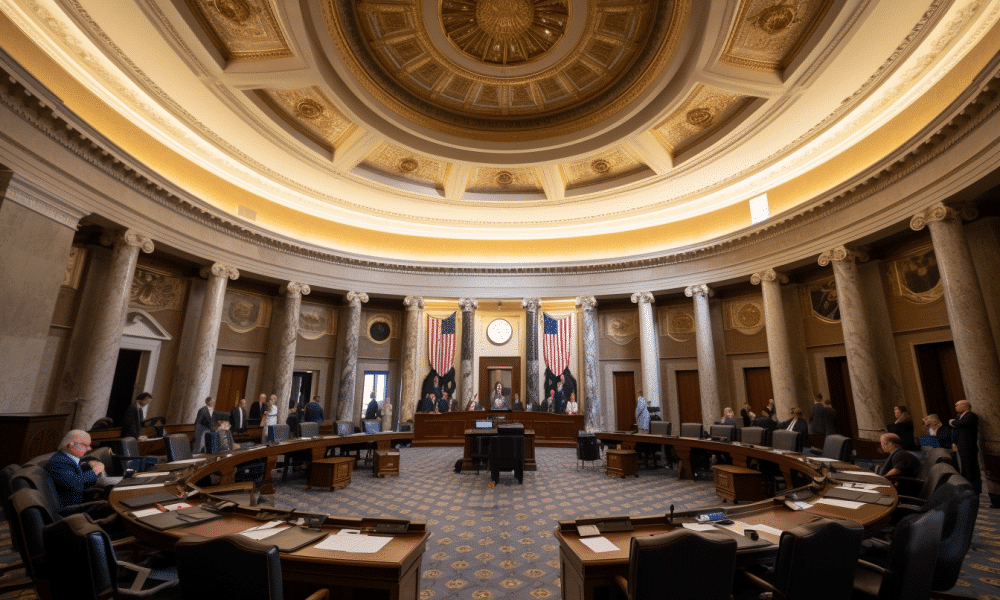

Stablecoin invoice draft surfaces in U.S HOR repository

A draft document dated 14 April, which surfaced in america Home of Representatives’ repository, confirmed steps towards regulation. The proposal said that insured depository establishments looking for to introduce stablecoins can be topic to oversight by the related companies.

In distinction, non-bank establishments would come below Federal Reserve scrutiny. Non-compliance might end in a penalty of as much as $1 million and a jail sentence of as much as 5 years. International issuers would additionally must register to conduct enterprise throughout the U.S.

Approval of stablecoin issuance would rely upon varied elements, together with the applicant’s functionality to take care of enough reserves to assist the stablecoins. The reserves should be U.S. {dollars}, Federal Reserve notes, or Treasury payments with a maturity interval of 90 days or much less.

Moreover, repurchase agreements with maturities of seven days or much less, supported by Treasury payments with maturities of 90 days or much less, in addition to central financial institution reserve deposits, can also be used to meet the reserve requirement.

Circle onboard with the invoice draft?

On 15 April, the CEO and co-founder of Circle [USDC], Jeremy Allaire, appeared to endorse the proposed invoice in a tweet.

See extra

2/ It is a rare second for the way forward for the greenback on the planet, and the way forward for forex on the web. There’s clearly the necessity for deep, bi-partisan assist for legal guidelines that be sure that digital {dollars} on the web are safely issued, backed and operated.

— Jeremy Allaire (@jerallaire) April 15, 2023

He emphasised the second’s significance for the greenback’s future and the position of digital currencies on the web. He additionally burdened the necessity for sturdy, bipartisan backing of laws that assure safe issuance, assist, and operation of digital {dollars} on the web.

If the invoice is handed, initiatives resembling Tether [USDT] shall be required to reveal the backing of their stablecoin. It might assist alleviate issues raised prior to now concerning the lack of transparency round Tether’s reserves.

Tether has confronted criticism over its means to show its backing prior to now. These criticisms have prompted Concern Uncertainty and Doubt (FUD) across the stablecoin.

The present state of stablecoins

In line with knowledge from CoinMarketCap, as of this writing, the market capitalization of stablecoins stood at over $131 billion. The buying and selling quantity was over $30 billion, though it had decreased by over 30% within the final 24 hours.

Supply: CoinMarketCap

Tether continued to dominate the market with a quantity of over $80.9 billion, representing the very best proportion of the entire market cap. Its 24-hour buying and selling quantity stood at over $22 billion.

Circle’s USDC remained in second place with a market cap of over $31 billion, however a a lot decrease 24-hour quantity of over $3.5 billion. Different stablecoins within the prime 5 included Binance USD [BUSD], Maker [DAI], and True [TUSD].

The proposed stablecoin invoice continues to be a draft, and a listening to is about for 19 April to additional focus on the specifics of the invoice.

Source link

#U.S #Congress #handle #stablecoin #regulation #invoice #particulars