Bitcoin Trading is Not Older than Fiat Currency or the US Stock Market

Bitcoin has achieved a noteworthy milestone, boasting more hours of trade than the contemporary US stock market since the pivotal moment known as the Nixon Shock. Yet, it would be an overstatement to assert that Bitcoin’s trading duration has eclipsed that of the entire US stock trading chronicle or the comprehensive history of fiat currency worldwide. A detailed scrutiny uncovers the intricate details of market persistency and the vigor of trading activities.

Within the cryptocurrency community, there’s been fervent discussion spurred by a statistic indicating Bitcoin’s amassed trading hours outpace those of the post-Nixon Shock fiat stock market, following an evaluation conducted by Cory Bates.

According to Bates, Bitcoin’s trading duration now exceeds that of the fiat stock market. It’s crucial, however, to keep in mind that this metric doesn’t include the collective history of the US stock market. Bitcoin’s trading span is certainly more extensive than that of fiat in the US, as can be concluded from this comparison, but not more so than the entirety of fiat currency trading globally.

The advent of fiat currency trading can be traced back to China’s Song Dynasty era (960–1279 CE), where the government issued paper money unanchored by tangible commodities such as gold or silver. Initially grounded in the country’s credit system, this currency attained broad acceptance for commercial transactions and tax payments.

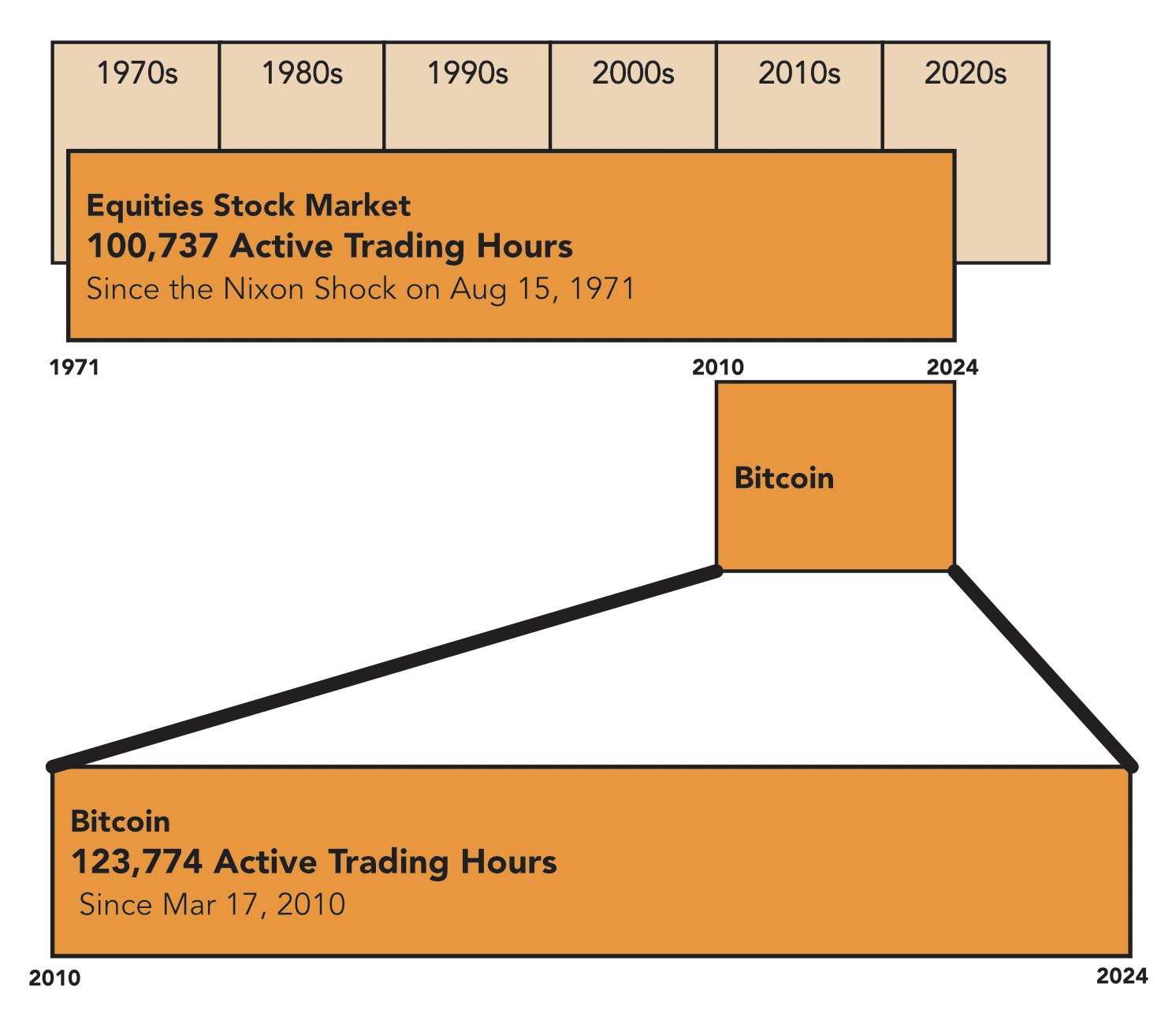

Bitcoin trading versus the US fiat stock market duration

Since its establishment in 2009, Bitcoin has recorded 123,774 hours of active trading from its first known exchange on March 17, 2010. This figure overshadows the 100,737 trading hours accumulated by the US equities markets post-August 15, 1971, known for the Nixon Shock, which steered the international monetary systems away from the gold standard.

Nonetheless, the narrative of the US stock market stretches well before 1971. With its roots dating back to 1792, the New York Stock Exchange boasts a storied existence spanning over 200 years. Once this period is taken into account, the comparison alters substantially.

An approximate calculation from the establishment of the NYSE up until September 6, 2024, presents about 380,509 hours of market operation, which substantially outstrips the count of Bitcoin, notwithstanding its uninterrupted trading capability.

Bitcoin enjoys the upper hand with its 24-hour trading availability, unlike the conventional stock market that typically opens for 6.5 hours on weekdays, not accounting for holiday closures.

Assuming the continuation of their current operating schedules without significant interruptions, predictive models suggest Bitcoin would reach parity with the total historical trading hours of the US stock market sometime around April 15, 2053.

Yet, it is essential to recognize that mere trading hours do not wholly mirror the market’s liquidity, depth, or its overall significance in the economic landscape. The US equity market, as a cornerstone of worldwide finance, holds a depth and complexity in its listing of companies and trade volumes that Bitcoin is yet to rival.

In spite of the impressive progress Bitcoin has made in the relatively limited span of its existence, the enduring impact of the centuries-long US stock market history remains a substantial benchmark.

The entire chronicle of fiat money’s trading duration

Bitcoin’s rapid expansion still lacks several decades before it could legitimately surpass the amassed trading hours of American stock markets. When discussing the duration that Bitcoin has beaten fiat trading, it’s notable that forex markets have been operational 24/5 since 1971.

Calculating the total amount of fiat’s global trading hours is complex due to the staggered adoption of fiat systems over history. While fiat money has been in use since ancient times, consistent trading hours were only established in the latter half of the 20th century, especially after the abolition of the gold standard post-Nixon Shock.

Prior to that pivotal year, trading hours were disparate, irregular, and differed from one region to another. Even as fiat money became generally accepted, trading markets worked limited hours. Post-1971, the forex market came into being, providing a concrete gauge for trading hours computation.

In present times, the forex market runs roughly 120 hours each week. Using this as a standard measure, it’s estimated that since 1971, annually there may have been around 6,240 hours of fiat trading. Multiplying this by the 53 years from 1971 to 2024, the estimated total trading hours come to about 330,720 hours for fiat in today’s global markets.

To summarize, while Bitcoin has topped the fiat equities market of the US in terms of post-1971 trading hours, the collective trading hours of fiat on a global scale, starting from the formal global forex markets, are substantially greater.

Lastly, unless the major forex markets also transition to weekend trading, Bitcoin may potentially catch up in future. However, it’s worth noting that some brokers currently allow a limited range of forex trading during weekends.

Source link

#Bitcoin #trading #older #fiat #stock #market