Bitget’s Trading Volume Skyrockets in Q1 Amidst Cryptocurrency Surge

“`html

The initial three months of 2024 observed a significant boost in the uptake of intricate crypto offerings, spurred by the thriving crypto bull market as indicated by various exchange reports.

The first-quarter report from Bitget reveals a doubling in the volume of transactions for both spot and futures trading, reaching a monumental $1.4 trillion and $160 billion, respectively.

This surge signifies a marked progression from the previous year’s $658 billion in futures trading volume and $59 billion in spot trading volume.

Bitget Trading Volume and Crypto Market Surge

Bitget’s user base expanded to over 25 million in the first quarter, courtesy of its web3 wallet and trading platform.

“The market witnessed a vigorous comeback in February with Bitcoin reaching new record levels,” according to the Bitget report. The excitement surrounding Solana and advancements in AI technology highlight the market’s ever-changing landscape.”

Bitget listed 186 novel tokens during the first quarter, such as the Solana-inspired meme coin Dogwifhat (WIF) and the rollup utility token Altayler (ALT), both of which saw remarkable post-listing gains of over 1,000%.

Bitget Transparency Report: Q1 2024.

Now serving 25 million users globally, Bitget’s futures trading volume spiked by 146% to US$1.4 trillion, and spot trading also rose by 100% in the first quarter of 2024.

Bitget noted the most significant increase in derivatives market share, growing 2.4% in March. pic.twitter.com/D2482dj4Ve

— Ukashat Bala Sarki CCII.BC (@UkashatBalaCCII) April 11, 2024

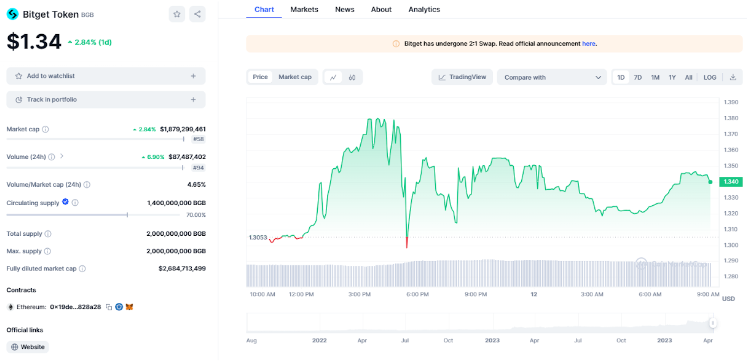

Meanwhile, the exchange’s proprietary token, BGB, holds a market capitalization valued at $2.6 billion.

Per the study, “Binance continues to lead the pack among the top 12 derivatives exchanges with a 47.0% market share of total volumes in March.”

OKX came in second with a 21.8% market share, while Bitget claimed 12.8% of the total market.

Effect of the Crypto Rally on Centralized Exchanges

CCData’s analysis highlighted an uptick in open interest for derivatives and futures contracts, with Binance at 37.7%, Bitget at 34.7%, and OKX at 10.4%.

CCData also recognized that derivatives market share expanded by 2.5% in March, marking the highest ascension among other centralized exchanges (CEX).

Concurrently, Bitget’s native BGB token has seen a 5.51% increase in value over the last 24 hours, with the current trading price at $1.34. This token has skyrocketed by 434% since the onset of 2024, thereby eclipsing Bitcoin’s growth and leading the crypto market.

“`

Source link

#Bitget #Trading #Volume #Soars #Crypto #Rally