Crypto Crisis Wipes Out 298,239 Traders, With Losses Surpassing $1 Billion

2 min read

“`html

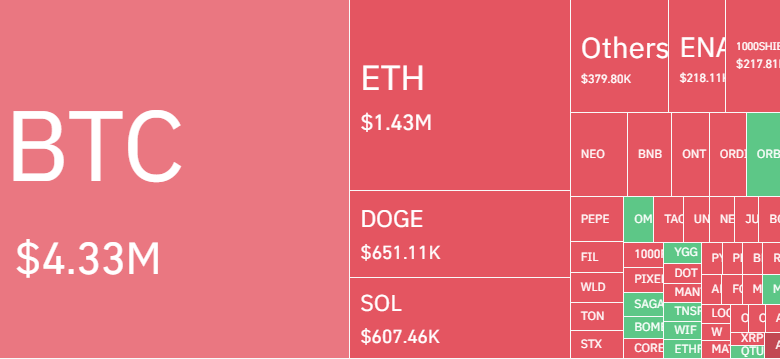

In the last 24 hours, the cryptocurrency market—including prominent currencies like Bitcoin and Ethereum—has experienced a sharp downturn, with liquidations amounting to approximately $1 billion.

A staggering number of 298,239 investors have seen their positions liquidated, totaling a loss of $935.43 million.

The largest single liquidation order, which was placed on the OKX ETH-USD-SWAP and amounted to $7.19 million, primarily consisted of long positions that were unexpectedly hit by the drastic market drop, anticipating an increase in value.

Long contracts are crypto derivatives that allow an investor to bet on the appreciation of an asset. When a long bet is liquidated, this indicates that the investor’s speculative position is involuntarily closed due to the loss.

The sentiment towards cryptocurrency has somewhat soured as the fear pervading traditional markets, spurred by growing geopolitical tensions, infiltrated the digital asset space on Friday.

Bitcoin Price Movements

During the U.S. trading hours, Bitcoin (BTC) experienced a steep decline, plummeting below the $66,000 mark shortly after it had touched the $71,000 level. At the time of this report, Bitcoin had recovered slightly to $66,700, following more than a 5% fall within the last day.

Current data preceding this publication reveals Bitcoin’s price hovering just under $67,000; this reflects a decline of over 2.5% within a day and a significant retraction from its peak of $73,737 in March.

Bitcoin (BTC) has been consolidating within a specific price range for the past several weeks. This pattern could lead to considerable liquidations across bulls and bears before the market determines a clear trend. Despite current market volatility and potential short-term downward movements, there are still optimistic projections for Bitcoin’s trajectory in the long term, especially with the upcoming halving event.

On the other hand, Ethereum’s price has also decreased by more than 5%, now trading around $3,215.

Other major cryptocurrencies have also seen sharp decreases; for instance, Solana has dropped close to 12%, and Dogwifhat, which had gained traction recently, has shed over 5% of its value.

As investors turned to traditionally stable assets amidst market turmoil, gold surged past $2,400 to a new high before paring its gains, while oil exhibited a 1% increase. Treasury bonds and the U.S. dollar index (DXY) also rose, reflecting a flight to safety.

This sudden shift in market dynamics sharply contrasts with the preceding bullish surge, part of which hinged upon the anticipation of Bitcoin’s forthcoming halving—an event set to alter the supply dynamics of the cryptocurrency significantly.

Despite the recent wave of liquidations within the cryptocurrency market, Bitcoin has maintained a substantial year-to-date growth, climbing close to 60%.

“`

Source link

#Crypto #quake #hit #traders #billion #lost