Reasons Behind Steve Christie’s Comeback to Binance, the Cryptocurrency Platform

“`html

In a notable return, Steve Christie, who previously held the role of Senior Vice President of Compliance at Binance, has been reinstated as the cryptocurrency exchange’s Deputy Chief Compliance Officer (DCCO).

Christie’s comeback is seen as a strategic move in light of Binance’s recent encounters with regulatory scrutiny—most notably, a hefty $4.3 billion settlement with US authorities over alleged infractions.

The Return of Steve Christie to Binance

Christie has voiced his approval of Binance’s approach in tackling the regulatory pressures imposed by the U.S. Securities and Exchange Commission (SEC) and the Department of Justice (DoJ).

“The strides Binance has made in compliance since my departure are commendable and reinforce my decision to return.”

Christie is set to work in tandem with Binance’s Chief Compliance Officer, Noah Perlman. Together, they plan to enhance the exchange’s adherence to global compliance standards.

Furthermore, they aim to proactively seek fresh avenues for Binance to uphold its pioneering status amidst the dynamic nature of the cryptocurrency market.

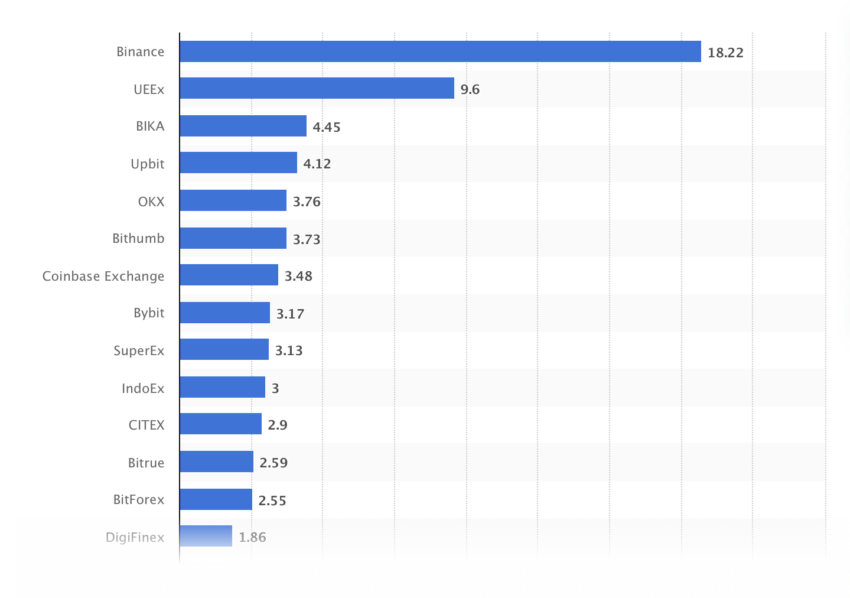

Recent figures from Statista place Binance at the apex of the list for 24-hour trading volume across international cryptocurrency exchanges, with an impressive volume of 18.22 billion USD as of January 9th.

Discover more: Top 7 Binance.US Alternatives for USD Withdrawal Options

The Recent Regulatory Hurdles Faced by Binance

BeInCrypto had reported in December 2023 that the court had found Changpeng “CZ” Zhao and Binance to allegedly infringe upon the Commodity Exchange Act alongside regulations set by the CFTC, resulting in a $150 million civil monetary penalty directly levied on Zhao.

Gain insight: Explore 7 Leading Binance Card Alternatives in Europe

In November 2023, an agreement between Binance, CZ, and the US Department of Justice led to a penalty settlement of $4.3 billion. This consisted of a $3.4 billion fine from the US Treasury’s Financial Crimes Enforcement Network with an additional $968 million from the Office of Foreign Assets Control.

However, Binance’s legal confrontation with the US Securities and Exchange Commission (SEC) is still in motion.

In June 2023, the SEC leveled a lawsuit against Binance Holdings Ltd., its US-based operation BAM Trading Services Inc., and the platform’s founder, Changpeng Zhao, citing numerous infractions.

On January 19th, Binance made a legal request for the dismissal of the SEC lawsuit.

More recently, a request made by CZ to return to the United Arab Emirates was denied, compelling him to remain stateside pending his sentencing date later in the month.

Disclaimer

All reporting by BeInCrypto follows the Trust Project protocols for objective and transparent journalism. This news piece is meant to relay accurate and current information, but it is recommended that readers verify facts for themselves and seek professional advice before making any decisions based on this content. Updates to our Terms and Conditions, Privacy Policy, and Disclaimers are available for review.

“`

Please note some of the duplicate target=”_blank” attributes were omitted since they are redundant. It is standard practice to include each attribute only once per element.

Source link

#Steve #Christie #Return #Crypto #Exchange #Binance