Experts Discuss the Future of Crypto in Europe: MiCA Predictions for 2025 – Brave New Coin

2025 is set to be a crucial year for the cryptocurrency industry in Europe as the Markets in Crypto-Assets (MiCA) regulation is fully implemented, ushering in a new era of regulatory oversight.

Designed to establish a unified framework for crypto-assets across the European Union, MiCA aims to tackle persistent challenges in the sector, including investor protection, market integrity, and financial stability.

This milestone not only marks a significant change in how crypto businesses operate within the EU but also raises questions about its impact on global crypto adoption and innovation. Experts are analyzing the profound changes these regulations could bring to the rapidly evolving digital asset ecosystem.

MiCA’s Promised Reforms and Market Impact

MiCA introduces a standardized regulatory framework for crypto-assets across the EU, covering assets not previously addressed by financial laws. A key aspect of the regulation is “license passportization,” allowing firms licensed in one EU country to operate across the bloc. Marina Markezic, Co-Founder of the European Crypto Initiative (EUCI), highlighted the significant implications this could have as countries like Germany, France, and Portugal may become new hubs by offering favorable regulatory environments.

Source: X

The regulation is already affecting market dynamics. For example, big stablecoin players like Tether have exited the European market due to compliance issues, reducing diversity and potentially impacting liquidity. The recent surge of Bitcoin over $100,000 underscores the growing interest in digital assets, further fueled by the consumer protection and anti-market abuse measures introduced by MiCA.

Opportunities and Obstacles for Businesses

Erald Ghoos, OKX Europe General Manager, described 2025 as a “transformative year” for the crypto market, predicting that MiCA will bring increased stability and security for investors. However, compliance requirements will be challenging, especially for smaller players. Issuers of ARTs and EMTs are now obligated to create detailed whitepapers and adhere to strict AML and CTF regulations, potentially creating barriers to entry and operational costs for newcomers.

Critics suggest that MiCA’s stringent requirements could unintentionally stifle innovation. Markezic noted that a lack of clarity from regulators on DeFi and NFTs could lead to challenges, along with the possibility of differing interpretations of MiCA among the EU’s 27 member states.

The Strategic Shift in Europe’s Crypto Policy

As MiCA is rolled out, discussions on Europe’s broader crypto strategy are intensifying. European lawmaker Sarah Knafo recently proposed establishing a strategic Bitcoin reserve, echoing similar proposals in the U.S. However, Markezic warned that such a move would require careful consideration of Bitcoin’s volatility and strategic importance.

Source: X

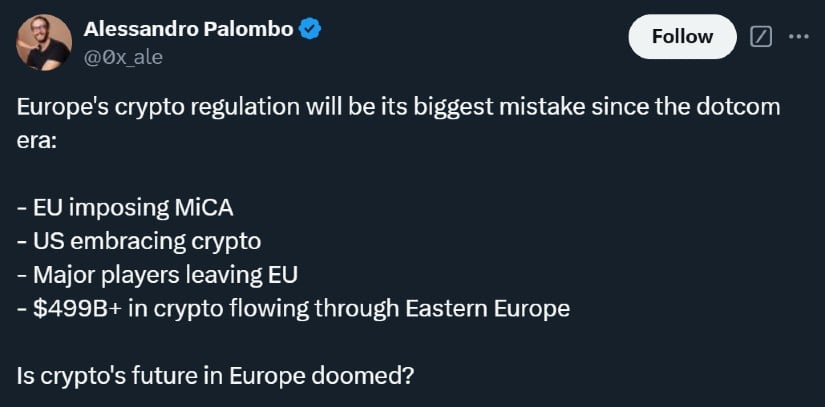

MiCA’s impact goes beyond market structure, representing a significant change in the EU’s approach to digital finance that could set a global benchmark. However, with regulatory developments in the U.S., Europe’s appeal to crypto firms may face challenges if the U.S. adopts a more crypto-friendly stance under the new administration.

The Road Ahead

As MiCA comes into full force, attention will turn to its real-world implications. Businesses will need to navigate complex compliance landscapes while balancing innovation and risk management. Institutionalization and consolidation are expected to increase, with more mergers between traditional finance and crypto-native firms becoming common.

While MiCA is a significant step towards regulatory clarity, its stringent requirements highlight the importance of a collaborative approach between regulators and industry players. As the crypto industry evolves, Europe’s ability to nurture innovation while maintaining robust safeguards will determine its role in the global digital economy.

Source link

#Future #Crypto #Europe #Experts #MiCA #Brave #Coin