Regulation or Transparency: The Crypto Trend Behind Exchanges

Disclaimer: The textual content beneath is an advertorial article that’s not a part of Cryptonews.com editorial content material.

2022 was a significant problem for crypto exchanges. As Warren Buffett put it, solely when the tide goes out do you uncover who’s been swimming bare. In a risky market, FTX, an change price billions of {dollars}, was immediately eradicated from the market, not to mention center and small-sized exchanges. Many traders couldn’t even get again their belongings saved on exchanges. In the meantime, the crypto neighborhood has been discussing make centralized exchanges extra regulated and clear.

Regulators launch alerts of stringent regulation

Following the FTX collapse, extra conventional monetary regulators put crypto on their radar display. Fed vice chairman, SEC chairman, U.S. Treasury Secretary, the deputy governor of the Financial institution of England, and the Worldwide Financial Fund have all proposed to impose efficient regulatory oversight on crypto; the market ought to conform to the identical guidelines as the standard monetary business to mitigate dangers.

Of the crypto exchanges on the market, Coinbase is the most important supporter of robust regulatory oversight. Coinbase CEO Brian Armstrong said that the crypto laws mentioned by lawmakers worldwide will assist them defeat rivals. Furthermore, the change additionally printed Regulating Crypto: How we move forward as an industry from here in December 2022, which describes how the business will be regulated by way of stablecoins, buying and selling platforms, and custodians.

Regulatory intervention in crypto is clearly inevitable after the autumn of FTX. That being stated, in 2022, privateness protocol Twister Money suffered OFAC sanction and led to resistance to laws within the crypto neighborhood. In any case, sanctions aren’t what we wish to see in a market that strives for decentralization. Moreover, earlier than its downfall, FTX additionally embraced regulation, nevertheless it turned out that it was merely a posture that allowed the change to hunt publicity and crush competitors.

Based mostly on the attitudes of the key exchanges, we are able to inform that crypto laws will change into extra stringent in sure nations, however many aren’t satisfied by their validity. In standard finance, it’s common that massive firms go bankrupt, and strict laws won’t eradicate all of the dangers. In the meantime, what occurred to Twister Money is at all times a reminder that laws are accompanied by sanctions. As soon as regulators begin to intervene with strict measures, many modern decentralized purposes can be strangled of their cradle, and a few traders won’t have entry to the market attributable to regulatory oversight.

The business is pursuing full transparency

After the disaster of belief because of the FTX collapse, exchanges have printed the Merkle tree and addresses of their reserve proof. As an illustration, high buying and selling platforms reminiscent of Binance, OKX, Crypto.com, Huobi, and CoinEx disclosed their reserve proofs quickly after the autumn of FTX.

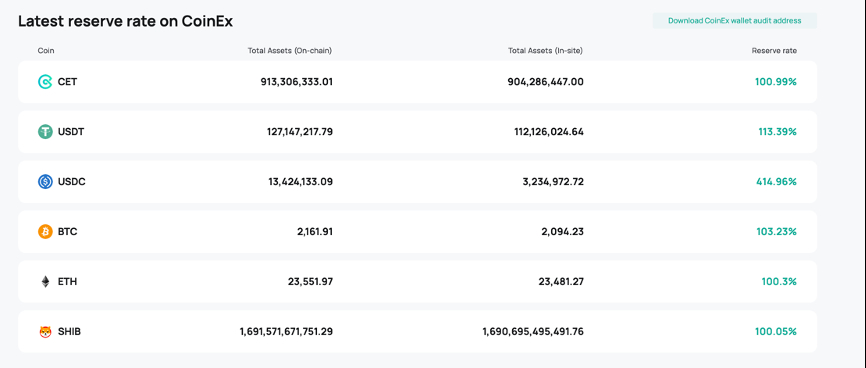

In keeping with the pockets addresses and person belongings they disclosed, these exchanges have managed to attain a 100% reserve protection of person belongings, and a few exchanges personal reserve funds that far exceed person belongings. For instance, the USDC reserve charges of Binance and CoinEx are each over 400%.

Many individuals argue that having a 100% reserve charge is nice as a result of it makes positive that customers are at all times in a position to withdraw their cryptos. Though that assertion shouldn’t be 100% correct, given the present market circumstances, reserve proofs are the easiest way to make crypto exchanges extra clear. Furthermore, the reserve belongings of an change are additionally indicative of the operation of a platform.

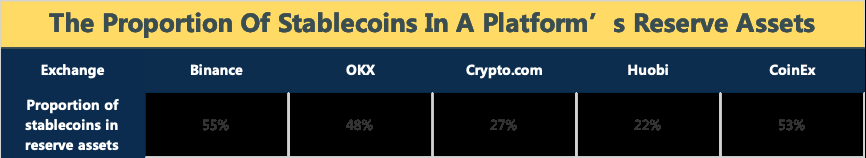

For instance, everyone knows that stablecoins should course of huge withdrawal requests when there’s a run, which signifies that the proportion of stablecoins in a platform’s reserve belongings may roughly inform us the danger resistance capability of various platforms beneath excessive situations. As will be seen from the desk beneath, on Binance and CoinEx, the proportion of stablecoins in reserve belongings is above 50%, which means that stablecoin withdrawals can at all times be processed. It needs to be famous, nonetheless, 52% of Binance’s stablecoin reserves are BUSD, a coin issued by the change itself. Though BUSD obtained the related approvals for issuance, some nonetheless fear about whether or not it might be withdrawn if Binance had been to crash. Therefore, traders should assess the dangers on their very own earlier than selecting an change.

In keeping with the said perspective of crypto exchanges, most platforms desire to earn person belief by excessive transparency. Although some crypto gamers argue that reserve belongings aren’t ironclad proof of a platform’s safety, in comparison with stringent regulation, reserve proofs are clearly extra widespread with customers. As well as, as time goes by, the applied sciences of reserve proofs will even advance in response to market calls for.

After the FTX collapse, the crypto business shifted its focus to safety and transparency, which is able to carry new growth traits. In the meantime, centralized exchanges will change into extra clear whereas facilitating transactions, and the decentralized administration of belongings on centralized platforms would possibly even achieve traction. As such, traders nonetheless must search for long-established technology-driven platforms. A very good instance is CoinEx as talked about above. Backed by a confirmed 100% reserve charge and adequate reserve belongings, CoinEx presents stable ensures by way of each asset and expertise.

Source link

#Regulation #Transparency #Crypto #Trend #Exchanges