The UAE is positioning itself as a hub for Web3 activities by aiming to establish Dubai as one of the...

```html Vladislav Sopov Nexo, a preeminent player in the cryptocurrency space, kicks off a promotional event in celebration of its...

According to Fariha Bajawrhi from Fiat Republic, the new Markets in Crypto-Assets (MiCA) regulations from the European Union offer a...

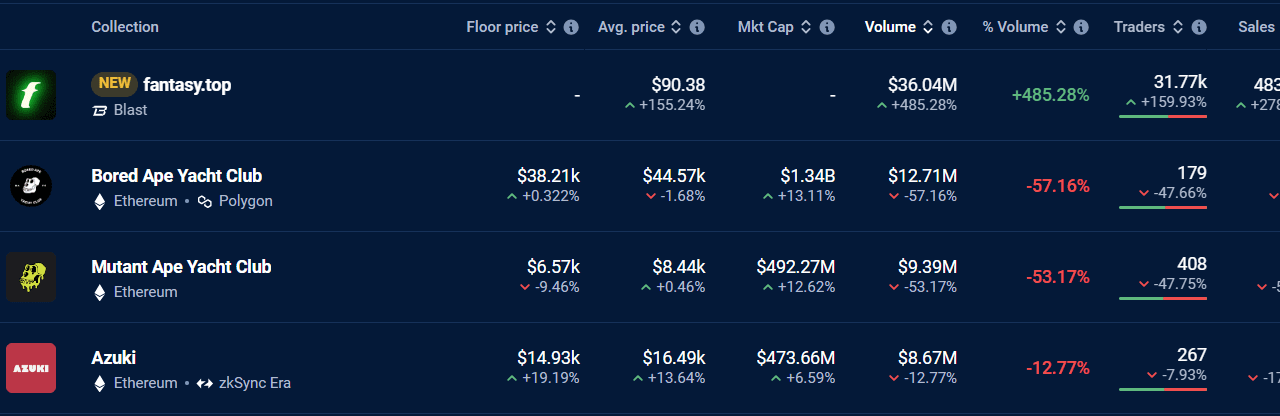

Fantasy.top, a new NFT game launched on Blast, is making waves in the NFT market. DappRadar data indicates that the...

The regulatory body in Hong Kong took action against an illegitimate virtual currency exchange that falsely claimed to be associated...

Tom Lee, co-founder of research firm Fundstrat, has ignited fresh bullish sentiment in the cryptocurrency world with his prediction of...

Dubai is aiming to attract more than 1,000 companies through its Dubai Metaverse Strategy, with the goal of creating over...

Robinhood, the popular brokerage platform, is currently facing scrutiny from the U.S. Securities and Exchange Commission (SEC) for alleged breaches...

```html Access the Editor’s Digest at no cost FT’s Editor Roula Khalaf handpicks her top stories for this weekly digest....

A Bitcoin “epic satoshi,” or a particularly rare version of the smallest denomination of BTC, was sold for 33.3 BTC...