Bitcoin Cycle Shows A Never-Before-Seen Trend, Here’s What

3 min read

On-chain information reveals a pattern within the present Bitcoin cycle that’s totally different from the sample adopted throughout the earlier epochs.

Extra Bitcoin Has Left Exchanges Throughout The Present Cycle So Far

In accordance with information from the on-chain analytics agency Glassnode, the earlier cycles noticed the steadiness on exchanges register a web improve. The “balance on exchanges” right here refers back to the complete quantity of Bitcoin that’s at present sitting within the wallets of all centralized exchanges.

When the worth of this metric goes up, it means the buyers are depositing a web variety of cash to those platforms at present. Alternatively, a decline implies that withdrawals are occurring available in the market proper now.

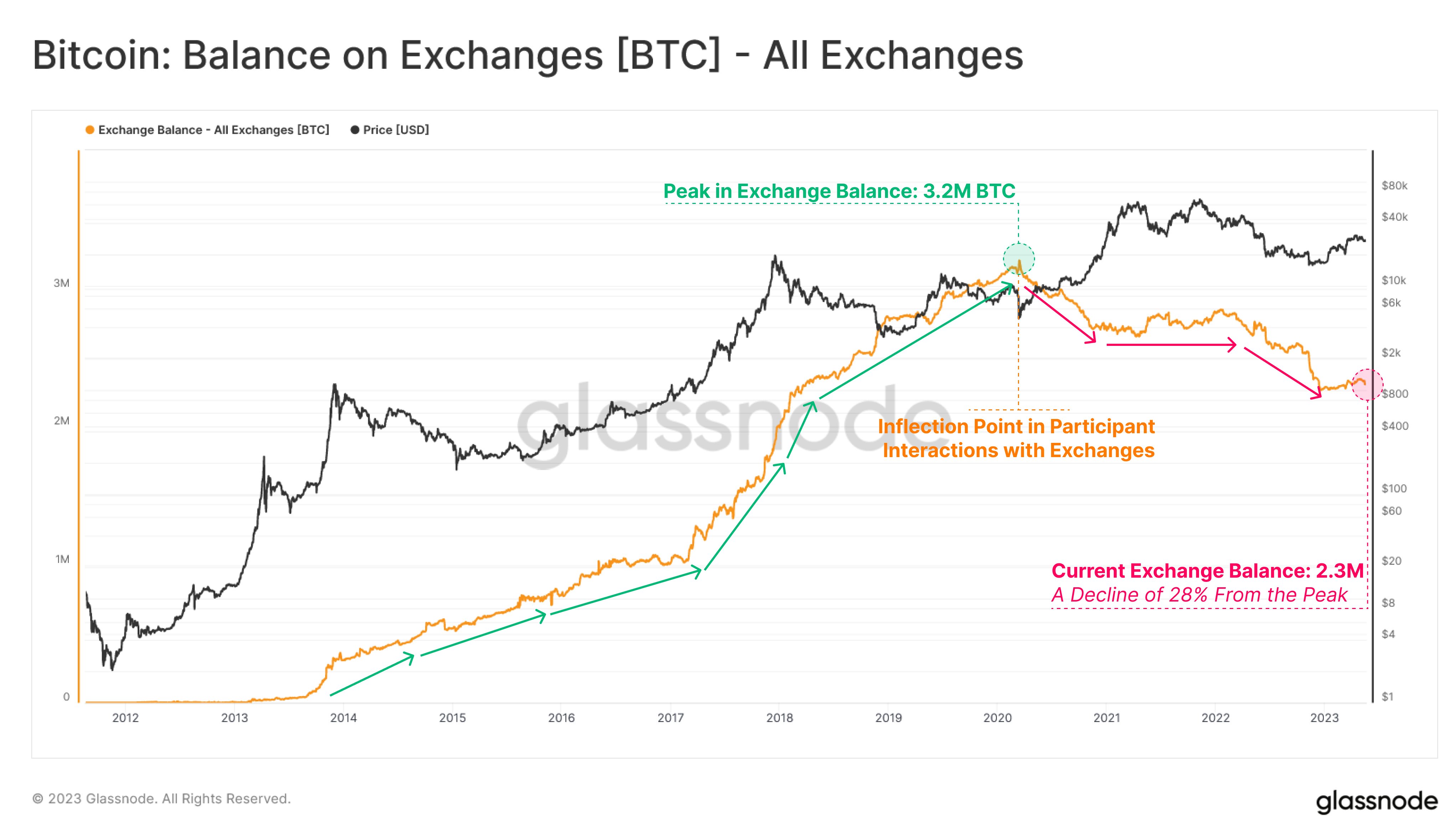

Here’s a chart that reveals how the worth of this Bitcoin indicator has modified over the past two cycles and within the present epoch thus far:

Seems to be like the present cycle is exhibiting a unique pattern than what was seen earlier than | Supply: Glassnode on Twitter

Glassnode has taken the “halvings” as the place to begin of every of the cycles or epochs right here. Halvings are periodic occasions the place the block rewards of the miners (which they obtain for fixing blocks on the community) are completely reduce in half. These happen roughly each 4 years.

These occasions have wide-reaching penalties for the economics of the cryptocurrency, because the manufacturing fee of the asset is constrained following them. This narrative behind the halvings can be so sturdy that the peak of the bull runs has at all times occurred after them.

From the above graph, it’s seen that in epoch 2, that’s, the second cycle that the asset noticed, the Bitcoin steadiness on exchanges noticed a web development of 1.02 million BTC. The following cycle, epoch 3, noticed the metric rising by 1.97 million BTC, which is nearly double what the earlier cycle registered.

Word that epoch 1 is absent right here as a result of it was the primary time ever that the asset was buying and selling, and therefore, BTC exchanges have been additionally solely a brand new existence. Which means that their provide might have solely gone up right here, because it beforehand didn’t exist in any respect.

Not like these cycles, nevertheless, the place the exchanges acquired numerous web inflows, the present epoch has seen buyers taking out round 680,000 BTC from these platforms.

The under chart highlights how this decline within the Bitcoin steadiness on exchanges has taken place.

The worth of the metric appears to have been taking place in latest months | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin steadiness on exchanges hit a peak worth of three.2 million BTC simply earlier than the COVID crash occurred again in March 2020.

“Retrospectively, the Covid Crisis appeared to be a catalyst for an inflection in participant interaction with exchanges, marking the inauguration of a macro decline in Exchange Balances,” notes Glassnode.

As we speak, the indicator’s worth stands at 2.3 million BTC, which suggests a decline of 28% from the height. This cycle is out of the peculiar by way of this metric, but it surely’s value holding in thoughts that the epoch is but to finish.

Nevertheless, it’s nonetheless unlikely {that a} reversal might happen now to maintain the present cycle consistent with the sample from the earlier cycles, as the following halving isn’t that far anymore (2024).

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,700, up 1% within the final week.

BTC has plunged up to now day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

Source link

#Bitcoin #Cycle #Shows #NeverBeforeSeen #Trend #Heres