Bitcoin: Is It A Buy, Sell, Or Hold After Biden’s Executive Order On Cryptocurrency?

5 min read

Eoneren/E+ by means of Getty Images

What Is Biden’s Cryptocurrency Executive Order?

The Biden Administration gave an executive order on March ninth framing their goals for the mindful advancement of cryptographic money. Brookings depicted the request as “non-controversial“. In any case, 5 years prior, it wasn’t sure if Western states would even endure computerized resources. Today, they predominantly permit them, dependent upon the very duty and legitimate system that property is. While the request shouldn’t make any sensational changes crypto, it shows how far the world has arrived in a brief timeframe. Indeed, even professional athletics associations are getting in on the action, focusing on ways of giving their own cryptocurrencies.

The Treasury probably had a legitimate an open door to burden crypto as a collectible (at a higher 28% rate) as they accomplish for gold and craftsmanship, yet they didn’t. In school, a teacher of mine showed us how the media and mainstream society would in general acclimatize novel thoughts that were a danger to it, as did the public authority. Hate individuals in power? Incredible, we have a few stone collections and shirts you can purchase for $19.99 a pop!

Bitcoin (BTC-USD) was imagined by a portion of early allies as a device could totally upswing the political framework. The political foundation has managed Bitcoin not by prohibiting it, however by permitting directed trades where individuals can estimate on the cost and pay gigantic measures of momentary capital additions duty to the public authority. I think this is really a sensible methodology I couldn’t say whether I would need to live in the anarcho-capitalist world that some early Bitcoin allies imagined. What Bitcoin really does incredibly well is take into consideration a store of abundance that will not be impacted by the horrible political choices of different focal bankers.

How Will The Executive Order Affect Bitcoin?

The key important point from the Biden Administration’s chief request is that crypto is digging in for the long haul. The Feds don’t need individuals laundering drug cash with crypto, they don’t need oligarchs sidestepping sanctions with it, and they need the expense circumstance for homegrown financial backers to be equivalent to other resource classes, worse or more regrettable. The request likewise guided the Fed to investigate a national bank computerized cash, yet I’ve yet to see any convincing use for one, so exploring is presumably everything they’ll do.

Biden’s leader request on crypto is intriguing considering the continuous mission to get the Grayscale Bitcoin Trust (OTC:GBTC) endorsement to change over to an ETF. The SEC requested comments last month from the public on the ETF change. More than 2600 individuals have written in, with by far most in help (I wrote in as well, here’s mine). There are still issues that could should be managed before the primary ETF endorsement, however with the help of the general population, I’d envision that it’s an issue of “when”, not “if,” and that the administrative structure will grow so individuals can put effectively in Bitcoin with trade exchanged items unafraid of losing their keys or getting hacked.

Abroad likewise, there are intriguing new advancements, for example, El Salvador’s push to sell Bitcoin-connected bonds (a gimmick but it’s smart). Additionally, both sides of the war in Ukraine have utilized Bitcoin to help their endeavors I see no genuine negatives with Bitcoin here other than that it’s a nonpartisan store of significant worth a great deal like the dollar regarding moving cash all through fighting nations. It’s not exactly ideal for individuals to consume coal to mine BTC either, yet the world is already taking steps to address this.

Will Bitcoin Go Back Up In 2022?

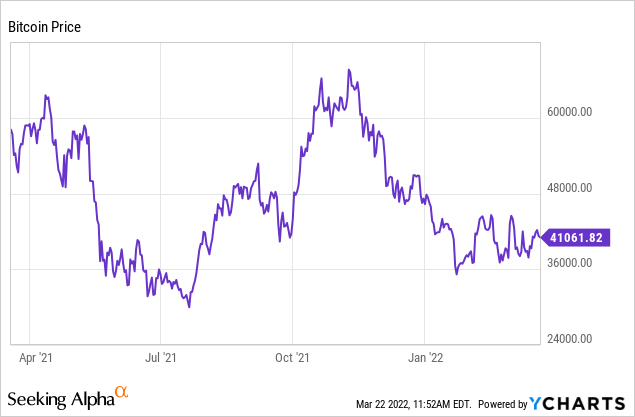

Data by YCharts

Data by YCharts

2022 has shown that Bitcoin is obviously a gamble resource, and it isn’t safe to the changing gamble cravings of brokers. Going ahead, I would expect crypto to be more related with stocks than it was previously. Over the long haul, the essentials for Bitcoin stay sound with expanding reception and almost unending potential for individuals in emerging nations to place their reserve funds in something that will not lose esteem because of the activities of their focal banks.

I’m negative on the NASDAQ (QQQ) and available in everyday right now because of the loosening up of improvement and what I accept are ridiculous profit assumptions. Whether this stays an adjustment or forms into a bear market is yet to be seen, however Bitcoin is probably going to see some transient tension. I in all actuality do anticipate that Bitcoin should challenge its untouched high this year, however the value markets falling could dial this cycle back to a creep. Bitcoin has been range-bound between generally $30,000 and $60,000 for the last year.

Is Bitcoin A Buy, Sell, Or Hold Now?

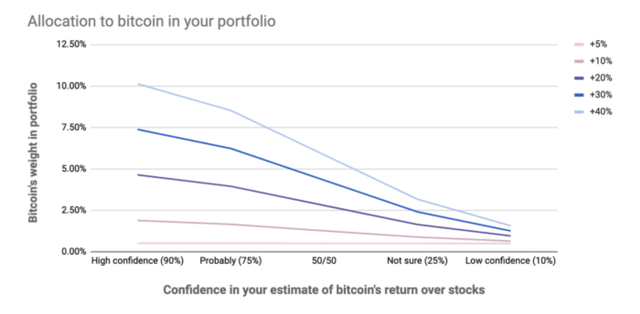

One perspective about resource classes was created in the Black-Litterman model by the late Fischer Black (who likewise made the Black-Scholes model) and Robert Litterman, then quant tacticians at Goldman Sachs. The thought is to match the worldwide market-cap weight of resources as a beginning stage, and afterward increment or reduction your designations in view of your assessments of what is probably going to return well.

Bitcoin presently addresses somewhere in the range of 0.5% and 1% of worldwide resources, so that is the beginning stage under this model. Then there are charts that let you know the amount to contribute in view of your return assumptions.

Ideal Allocation to Bitcoin? (Kiplinger)

The chart proposes a distribution somewhere close to 0.5% and 10% in view of how hopeful you are on BTC. It’s not on this diagram, but rather additionally note that the model idea is likewise to rebalance a portion of your benefits into other resource classes if crypto skyrockets. You could likewise unquestionably clutch the BTC and not rebalance, but rather you would rather not be holding nothing back on one resource class. It’s a first-world issue to have when you’ve become gathered in one resource since it’s gone up so much, yet it’s not numerically ideal from a gamble the board angle. I’ve seen the two methodologies with individuals who got into crypto somewhat early and made a lot of cash however would incline toward enhancing at this point.

I’d say on the off chance that you don’t possess it, Bitcoin is a purchase, and assuming you really do claim a few BTC in the suggested range and your position coordinates with the return assumptions above then I’d hold it. GBTC is my #1 vehicle for possessing Bitcoin at the moment.

#Bitcoin #Buy #Sell #Hold #Bidens #Executive #Order #Cryptocurrency