Central Banks Continue to Show Strong Demand for Gold in 2023, Says World Gold Council Report – Economics Bitcoin News

4 min read

Central banks present continued demand for gold in 2023, as per a latest report from the World Gold Council (WGC), which famous that the world’s central banks gathered 31 tons of the dear steel in January. Turkey was the most important gold purchaser, including 23 tons to its central financial institution’s stash, whereas the Individuals’s Financial institution of China additionally bought 15 tons of gold.

Central Financial institution Gold Purchases Stay Regular Regardless of Potential Challenges in 2023

On the time of writing, a troy ounce of high quality .999 gold is $1,857.50 per unit, up 1.12% over the previous day. Gold prices have been down since Jan. 31, 2023, when the value per ounce reached $1,950 per unit in opposition to the U.S. greenback. On March 2, the World Gold Council (WGC) printed a report titled “No Dry January for Central Bank Gold Buying,” which discusses how Jan. 2023 data present that the world’s central banks have maintained the demand registered on the finish of 2022.

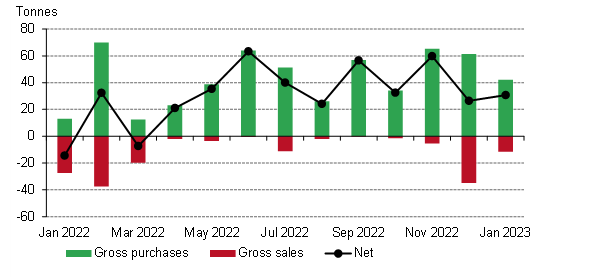

In accordance with Krishan Gopaul, the writer of the report, many purchases got here from Turkey, China, and Kazakhstan. “In January, central banks collectively added a net 31 tonnes (t) to global gold reserves (+16% m-o-m),” Gopaul wrote. “This was also comfortably within the 20-60t range of reported purchases which has been in place over the last 10 consecutive months of net buying.”

Central financial institution purchases and gross sales accounted for 44 tons in Jan. 2023, with one central financial institution offsetting its stash by promoting 12 tons. The biggest gold purchaser was the Central Financial institution of Türkiye (Turkey), which acquired roughly 23 tons throughout the month. In accordance with the nation’s data, Turkey now holds 565 tons of gold.

China got here in second, with the Individuals’s Financial institution of China buying 15 tons throughout the identical timeframe, as Gopaul detailed. “The National Bank of Kazakhstan increased its gold reserves by a modest 4 tons in January, taking its gold reserves to 356 tons,” the WGC writer explains. The report notes that the information relies on Worldwide Financial Fund (IMF) data, and among the information could also be revised throughout the subsequent WGC month-to-month report.

Along with Turkey, China, and Kazakhstan, the WGC writer particulars that the European Central Financial institution (ECB) acquired two tons as a result of Croatia joined the eurozone, and the nation was required to switch its reserve belongings to the ECB. The vendor of the 12-ton sale of gold in January 2023 was the Central Financial institution of Uzbekistan, and the nation now holds roughly 384 tons.

The WGC report concludes that the group has little doubt that central banks worldwide will proceed to buy gold throughout the remainder of 2023. Nonetheless, the WGC writer stresses that the gold shopping for this 12 months could not match the data set in 2022. “It is also reasonable to believe that central bank demand in 2023 may struggle to reach the level it did last year,” the report notes.

Tags on this story

2023, Belongings, purchaser, Central Banks, China, Demand, ECB, economics, Financial system, European Central Financial institution, Eurozone, monetary, World, gold, holdings, IMF, Worldwide Financial Fund, funding, january, Kazakhstan, Krishan Gopaul, Markets, Steel, web shopping for, treasured steel, Worth, Purchases, Information, reserves, gross sales, vendor, troy ounce, Turkey, U.S. greenback, Uzbekistan, WGC, World Gold Council

What do you assume the long run holds for central financial institution gold demand? Will it proceed to rise or will it lower within the coming months and years? Share your ideas within the feedback part beneath.

![]()

Jamie Redman

Picture Credit: Shutterstock, Pixabay, Wiki Commons, World Gold Council, Tradingview

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

Extra In style News

In Case You Missed It

Source link

#Central #Banks #Continue #Show #Strong #Demand #Gold #World #Gold #Council #Report #Economics #Bitcoin #News