Germany Declares Crypto Gains Tax-Free After 1 Year — Even whenever Used for Staking, Lending – Taxes Bitcoin News

3 min read

The German Ministry of Finance has distributed a letter formally affirming that the offer of crypto resources is tax-exempt following one year regardless of whether the coins are utilized for marking and lending.

How Crypto Gains Are Taxed in Germany

The German Ministry of Finance reported Wednesday that it has distributed a letter on the pay tax assessment from cryptographic money, stating:

This is whenever that there first is a cross country uniform managerial guidance on the subject.

The finance service itemized that in a conference that occurred last year, perhaps the most strongly examined question was whether the tax-exempt holding time frame for crypto loaning and marking ought to be at least 10 years.

The service noticed that collaborating with united states:

The letter currently expresses that the alleged 10-year duration doesn’t have any significant bearing to virtual currencies.

In Germany, digital money is seen as “a private asset,” and that implies “it attracts an individual income tax rather than a capital gains tax,” crypto charge firm Koinly made sense of, stressing that Germany “only taxes crypto if it’s sold within the same year it was bought.”

Koinly further detailed:

As a ‘private sale’ in Germany, crypto gains are totally charge absolved after a holding time of one year.

“In addition, profits on crypto sales up to €600 per calendar year remain tax-free,” the firm added, taking note of that already, “When it comes to cashing in on staked crypto, that tax-free holding period is a minimum of 10 years.”

Citing the letter distributed by the Ministry of Finance, crypto counsel Patrick Hansen made sense of on Twitter:

The offer of obtained crypto resources will remain tax-exempt following one year, regardless of whether utilized for marking/lending.

Parliamentary State Secretary Katja Hessel remarked: “For individuals, the sale of acquired bitcoin and ether is tax-free after one year. The period is not extended to 10 years even if, for example, bitcoin was previously used for lending or the taxpayer provided ether as a stake for someone else.”

What do you contemplate this German duty regulation? Tell us in the remarks area below.

![]()

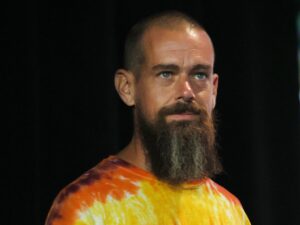

Kevin Helms

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for educational purposes as it were. It’s anything but an immediate proposition or sales of a proposal to trade, or a suggestion or support of any items, administrations, or organizations. Bitcoin.com doesn’t give venture, charge, legitimate, or bookkeeping exhortation. Neither the organization nor the writer is mindful, straightforwardly or in a roundabout way, for any harm or misfortune caused or claimed to be brought about by or regarding the utilization of or dependence on any satisfied, labor and products referenced in this article.

More Popular News

In Case You Missed It

Source link

#Germany #Declares #Crypto #Gains #TaxFree #Year #Staking #Lending #Taxes #Bitcoin #News