Here’s Who Should Buy The Discount At Grayscale Bitcoin Trust

12 min read

metamorworks

Up to now week there was compelled and panic promoting of Bitcoin as a result of collapse of Sam Bankman-Fried’s FTX (FTT-USD) crypto alternate. This could be a novel alternative to purchase Bitcoin (BTC-USD) and Bitcoin-tied belongings.

The Greyscale Bitcoin Trust (OTC:GBTC), which owns Bitcoin as its underlying asset, lately traded at 42% low cost to the web asset worth. Whereas closed-end funds and trusts typically commerce at small reductions to their internet asset or liquidation worth, this can be very uncommon that any fund trades at a 42% low cost.

For sure buyers, who consider Bitcoin has a future within the monetary world, and with a excessive danger tolerance, the Grayscale Bitcoin Trust is a purchase resulting from its low cost to the present value of Bitcoin.

Background On My View Of Crypto

I feel this part is vital given the hype, dangerous data and common lack of expertise round cryptocurrencies. Please bear with me.

I first discovered of Bitcoin in 2012. I first purchased Bitcoin in 2016. I’ve traded it thrice, all profitably, promoting most of my Bitcoin in 2017, 2019 and 2021. I’ve been accumulating a brand new Bitcoin place since early summer time 2022.

Bitcoin presently makes up an equal of about 5-10% of my financial institution financial savings (relying how a lot financial savings I spend in a given interval). It has lengthy been my recommendation that individuals with extra financial institution financial savings ought to discover Bitcoin holdings as a part of a diversified foreign money strategy. Bitcoin and Ethereum (ETH-USD) mixed make up about 4% of my internet value.

I’ve not been a crypto cheerleader although. The disclaimer in a lot of my articles on crypto has been this:

The brief story is that almost all cryptocurrencies are going to zero, however there shall be survivors that rise to a lot larger value ranges. We anticipate Bitcoin and Ethereum to be among the many largest, if not the largest. The world of Blockchain is way greater than crypto although and we anticipate some huge winners there too. It is a journey of separating winners from losers.

I’ve been protecting crypto foreign money, specifically Bitcoin and Ethereum, for members of my funding letter Margin of Safety Investing since I began the service. This consists of quite a few funding webinars.

A part of a my discussion with Meb Faber in early 2021 included warning about volatility, however perception Bitcoin would have a future within the monetary world. In January 2022, I interviewed crypto and accounting skilled, Dr. Sean Stein Smith, and in that conversation said this about crypto:

(27:52) “…for somebody who’s worried that well I missed it, it’s too late to get into Bitcoin or Ether, I would still tell them buy the dips. I’d be looking for big dips 30, 40, 50 percent dips because I think that’s the kind of volatility Bitcoin is in for… (28:51) I’ll probably buy some Bitcoin if it really gets down into the 20s again, you know the 20,000 area, I think that 20 to 30,000 range is like a pretty hard floor. I know a lot of technical guys are saying 37,000 I don’t know I just wait for the momentum to be done going down and then I pick up the knife off the ground, um, yeah I might miss the first move up…

(57:11) “I feel the primary reply is Ethereum and Bitcoin and possibly a few opponents to Ethereum, are gonna do effectively. I’m on report of claiming that 99% of cryptos are going to zero…”

I would consider myself a Bitcoin “mediumist.” That’s, I feel it would have a task within the monetary world, which I will cowl in closing, however that we’ll by no means buy our pizza with it.

That made me hungry, so let’s dig into…

The Mechanics Of GBTC’s Discount

The Greyscale Bitcoin Trust is not an ETF (it wants to be), thus it does not trade based on the value of its underlying value of its holdings like an ETF would. Rather, its trust structure causes it to trade like a closed-end fund, subject to the price that investors are willing to pay for it.

In addition, for the unfamiliar, you cannot take Bitcoin out of GBTC by being an owner of GBTC units. It is not a brokerage like Coinbase (COIN).

So, while the value of the Bitcoin in the trust was worth 42% more than the trust’s trading price on the exchange the other day, that’s what investors were willing to pay, so that’s what the price was. A simple supply and demand equation.

When GBTC was only Bitcoin game in town, market demand outstripped supply, shares of GBTC was trading at a premium or for more than the underlying bitcoin it represents. This was the case for much of 2015 to 2019.

When supply outstripped demand (roughly around the time Bitcoin ETFs became available), shares of GBTC flipped to trading at a discount.

Closed-end fund agency Nuveen explains that closed-end funds commerce at reductions regularly, particularly throughout risky instances. If that’s the case, why wouldn’t you purchase a closed-end fund or belief buying and selling at a reduction? That’s really a very good query with a legit reply.

The Reasons GBTC Trades At A Discount

A CEF or trust might trade at a discount because people anticipate there is a high risk that the underlying assets could trade lower in value. In essence, this is the market partially anticipating a price decline in the underlying assets, in this case Bitcoin.

So, why did demand fall for the Grayscale Bitcoin Trust in the first place? Probably a combination of competition from ETFs, fear of falling Bitcoin prices and limited liquidity for the fund – both internally to dispose of assets and externally of having a large market to sell GBTC into should there be a volatility driven deeper dive in price.

A couple of days in the past, crypto lender BlockFi mentioned it unwound its total place in GBTC and wouldn’t take shares as collateral, earlier than strolling again the assertion hours later. Why wouldn’t it do this? Properly, if it wants liquidity, it needs an asset that’s extremely liquid and has at the very least some semblance of steady worth.

Blockfi is also a firm that suddenly announced layoffs and might be heading to bankruptcy due to its ties to FTX which filed bankruptcy last week. FTX apparently overleveraged its balance sheet and backed that leverage with its own coin which had very little real value it turns out. Now, Blockfi suddenly has a liquidity crisis.

So, you have to consider if the falling price of Bitcoin recently is part of a capitulation event caused from Sam Bankman-Fried and FTX’s Bankruptcy. This event has actually mimicked the Fed’s tightening policy by sapping crypto liquidity.

With Bitcoin falling from a high of around $69,000 to slightly under $16,000 in about the past year, it’s understandable that people are scared of a further decline in Bitcoin prices. Add a lower liquidity threshold for GBTC and it trades at a deep discount.

And, as mentioned, there is a lot of fully liquid Bitcoin ETFs available now – 18 by my count. All are currently futures based products, which is interesting to me when considering how crummy futures based commodity ETFs have treated investors over the years.

Will GBTC Close The Discount Gap?

That depends on what you think of Bitcoin, the structure of Grayscale Bitcoin Trust, and, prepare to have your noodle twisted, what the future structure of the Grayscale Bitcoin Trust might be.

We’re not going to argue about the future of Bitcoin today, but, suffice to say, if you don’t think Bitcoin has a future in the world of finance, well, then you probably won’t want to buy any GBTC at any price. That’s easy.

If you do think Bitcoin has a future in the world of finance, then you should consider GBTC in your basket of crypto investments. For if Bitcoin has a future, and it’s more optimistic than current pricing, then the pessimism and concerns that drove GBTC demand down, should reverse to at least some extent.

We know GBTC is not cheap with an expense ratio of 2% on top of trading expenses. That works against it versus ETFs and direct Bitcoin ownership.

And, as covered in Axios, “Grayscale may have misstepped and overissued shares to the market.” Simply put, there could be too much supply of GBTC units. I don’t find this particularly compelling if you think Bitcoin indeed has a role in global finance.

This is where it gets very interesting. Grayscale is trying to change the structure of the trust to be a Bitcoin physical, aka, spot, ETF. This is akin to the Sprott Physical Gold ETF (PHYS) and other physical commodity ETFs.

So far, the SEC has said no, then softened, then hardened again on allowing Bitcoin spot ETFs that hold actual Bitcoin. What you think about the future of Bitcoin spot ETFs plays a direct role in whether or not GBTC might be a good investment for you.

A Bitcoin spot ETF approval would permit Grayscale to transform its belief into an ETF, closing the hole between value and the underlying bitcoin. That’s due to the unique ETF share creation and redemption mechanism utilizing approved purchasers. The result’s that ETFs are likely to solely impression the worth of underlying belongings throughout particularly excessive quantity.

If GBTC is allowed to become an ETF, then its price should close the discount gap rather quickly via the standard ETF share creation and redemption process.

Will GBTC Become An ETF?

So, that begs the question whether GBTC will become a Bitcoin spot ETF. Nobody knows the answer yet. But, if I were to wager, I would say it is likely it will.

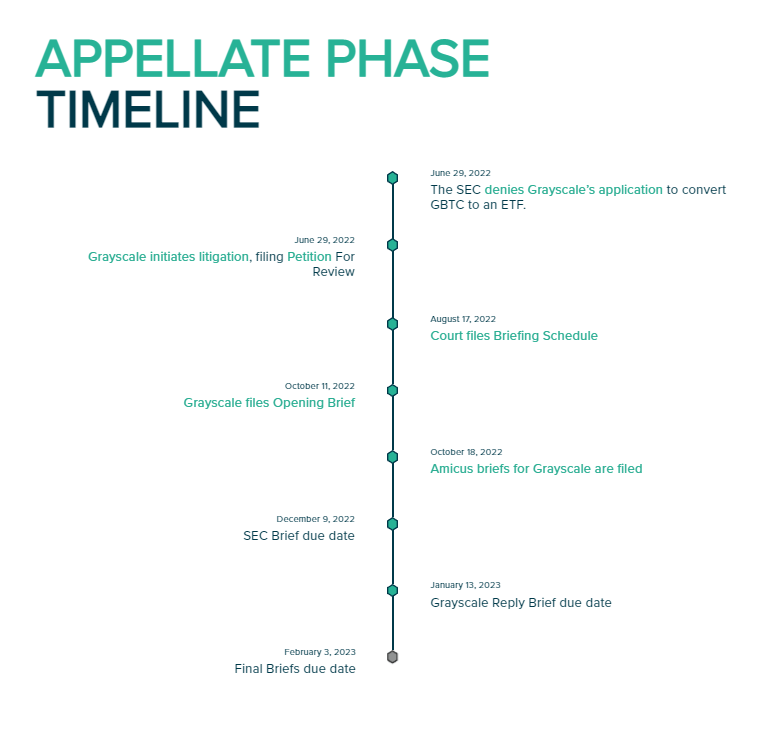

According to Michael Sonnenshein, CEO of Grayscale: “Because the SEC has disapproved the application to convert GBTC to an ETF, the next point of escalation is to go through the judicial branch.”

And that’s precisely what is occurring. Grayscale is suing the SEC to permit it to transform its belief to a Bitcoin spot ETF.

Grayscale vs SEC (Grayscale)

At this point in the process, Grayscale’s amicus briefs have been filed and the SEC is about 3 weeks away from having to file their briefs. Here is the timeline of the legal process as we know it now:

Grayscale vs SEC timeline (Grayscale)

Go here to get Grayscale’s case updates .

If Grayscale wins its case, then the futures based ETFs would now face a formidable competitor. I suspect the SEC is protecting the futures firms or trying to control volatility. But, if trying to control volatility is its aim, clearly the past year speaks loudly against its approach.

At this point, it seems as though a court decision could occur. I think it is more likely there is a settlement with the SEC that allows GBTC to become a Bitcoin spot ETF. Why?

I feel that Grayscale has convincingly argued that the SEC rejection of the Bitcoin spot ETF was arbitrary. You can read what Grayscale’s suits said here. The declare consists of that the order to reject an ETF was “arbitrary, capricious, creates unfair discrimination between . . . issuers…”

I think that is likely true. But, I think the SEC knows that. So, if they know that, why did they do it?

May it have merely been a manner for the SEC to purchase time to determine tips on how to really regulate their nook of the crypto world, which can certainly be shared with different alphabet soup companies, such because the CTFC and FTC? May they’ve been waiting for an event that got Congress involved?

I could be wrong, but if physical spot gold ETFs exist, and Bitcoin is legal, then spot Bitcoin ETFs have to be allowed to exist. The trick is how to regulate that market then.

Bitcoin’s Role In The World

I happen to believe that Bitcoin has a future in global finance, even though I don’t think it will be a common medium of exchange (one of the three functions of money). Here are my simplified core reasons:

U.S. frenemies and enemies, and maybe even the U.S., would both like to see a counter balance to the dollar’s dominance in international trade. Bitcoin can provide this in a similar way that many have described gold’s role as a provider of currency diversification and stabilization to the international trade system. Bitcoin satisfies one of the definitions of money in that it is a “store of value” due to its scarcity and that it cannot be printed like fiat currencies. If gold is a “store of value” because it is scarce and people hold it, despite gold being heavy, then why can’t Bitcoin be a store of value given it is scarce and people hold it while it is light as light? The super wealthy see Bitcoin as being akin to a golden passport. That is, because Bitcoin can be transferred quickly and securely (when done right), it acts as the ultimate way to buy freedom under many circumstances. Do not underestimate the desire of people to protect themselves even if they are good. Institutions and family offices now own 5% or more of Bitcoin and that is growing fast. If I believe in anything, it is “follow the big money.”

Under those assumptions, which you might disagree with, which means my entire thesis could be wrong, I think Bitcoin rises substantially in value from here. I will cover my back of the napkin price ranges in another article, but the range starts at $100,000 per Bitcoin and rises from there depending on how much institutional interest, wealth allocation and retail FOMO there eventually is.

A Large Potential Risk For Grayscale

The firm Genesis Global Capital is a big lender to crypto hedge funds and is facing a restructuring due to $175 million exposure to FTX. Genesis halted withdrawals from its yield product and stopped all new lending on Wednesday.

Per NYT: “Genesis is owned by Digital Currency Group, one of many largest gamers within the crypto business. Based by Barry Silbert in 2015, D.C.G. is a crypto conglomerate that owns dozens of corporations, together with the information web site CoinDesk and the asset supervisor Grayscale Investments, which runs the world’s largest crypto fund.”

CoinDesk simply posted this text:

Grayscale Business As Usual (CoinDesk )

It would seem there could be a conflict of interest there. In these moments, that is important to be aware of and scared of.

In normal circumstances, I would find it unlikely that a Grayscale does not have adequate safeguards from contagion from problems at a portfolio company of their parent.

The risk here is that FTX brings down Genesis and that brings down the entirety of Digital Currency Group. There is a vacuum of information at the moment and that means very high risk.

Here’s Who Should Buy GBTC

If you believe that Bitcoin has a role in the financial world, that Grayscale is not at some sort of contagion risk from FTX and if GBTC becomes an ETF, the discount to NAV will close fast. In fact, I think it will start to close fast on any signs of negotiations between the SEC and Grayscale.

I believe both things are true (again, if you disagree, then walk away).

I would categorize myself as a Bitcoin “mediumist” not a “maximialist.”

The Bitcoin maximalists believe Bitcoin is going to take over the financial universe, wiping out government backed fiat currencies, while bringing world peace, feeding the hungry, giving us all 80 year retirements, powering our cars and be able to fight off an alien invasion right after it deflects a killer asteroid. Or something like that.

I just think Bitcoin gains enough interest as an alternative asset, for the reasons listed above, to be around forever, or at least longer than I’m alive (and hopefully living to a ripe old age) and that the price will go higher from here.

So, for the opportunistic Bitcoin believer, with an aggressive risk tolerance, who wants some Bitcoin exposure in an IRA, who thinks GBTC will become an ETF eventually, it’s time to start buying a tiny amount of GBTC.

I think you can hold a very small single digit percentage in IRAs for the large potential upside. Non-qualified holdings should be directly in Bitcoin. Stop. Period. Non-qualified holdings should be directly in Bitcoin.

Buying GBTC, should be in addition to owning some actual Bitcoin for the equivalent of a single digit percentage of your bank savings. Owning Bitcoin directly, and having it in cold storage, is the best way to take advantage of a price dislocation, as well as, the best way to avoid counterparty and contagion risk.

On the FTX collapse and resulting fallout, I also think there are some Bitcoin, crypto and blockchain stocks worth owning. Think transparent, profitable and low leverage, aka, not FTX type companies. More to come.

Housekeeping

I will be releasing more pieces of research in coming months to help people come out of this bear market.

I also offer weekly webinars. Keep an eye on my Seeking Alpha blog for details. I look forward to discussing today’s ideas with you in the comments below.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.

Source link

#Heres #Buy #Discount #Grayscale #Bitcoin #Trust